As of Friday, January 30, 2026, the crypto market is undergoing a major $9.7 billion options expiry on the Deribit exchange, leading to a sharp spike in realized volatility and localized "gamma decay". Bitcoin has recently slumped to a two-month low near $81,000 as market participants react to geopolitical tensions and speculation regarding future Federal Reserve leadership.

Key Data for January 30, 2026 Expiry

The current expiration event is the largest of 2026 so far, creating significant "pinning" pressure near key strike prices.

Total Expiry Value: $8.5 billion in Bitcoin (BTC) options and $1.2 billion in Ethereum (ETH) options.

BTC Max Pain Price: Currently sits at $90,000. This level has acted as a "gravity well," though the recent drop to $81,000 indicates that spot selling pressure has overwhelmed the typical pinning effect.

ETH Max Pain Price: Positioned at $3,200, while the asset trades closer to $2,900, representing a deep "short gamma" environment for dealers.

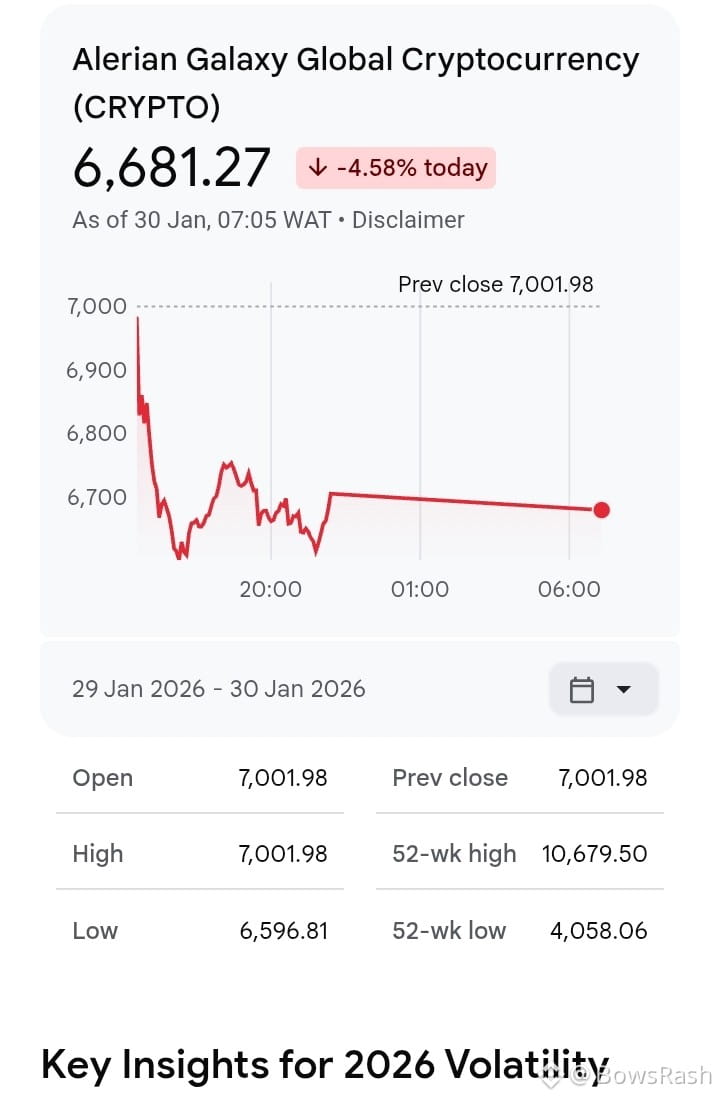

Put/Call Ratio: 0.54 for BTC, showing that while traders are long-term bullish, there has been a recent surge in "crash protection" (puts) to hedge against the current downside  move. Key Insights for 2026 Volatility

move. Key Insights for 2026 Volatility

Gamma Shift: Analyst data shows Bitcoin's gamma at $88,000 recently flipped from "Long" to "Short," meaning that as the price fell below this level, market makers were forced to sell aggressively to hedge their positions, accelerating the downward move.

Four-Month Losing Streak: Bitcoin is currently at risk of marking its first four-month losing streak since 2018, a rare psychological threshold that has historically preceded deeper corrections.

Institutional Overhang: Unlike previous cycles, current volatility is driven heavily by ETF flows and institutional "gamma ceilings" rather than just retail speculation. Major outflows from spot ETFs like IBIT have added to the selling pressure leading into today's expiry.

The "Vortex" Effect: With the $100,000 strike still holding the highest notional value for future expiries, many analysts view the current "gamma decay" as a necessary flush of leverage before a potential relief rally later in Q1 2026.