Market Signals Can Conflict And That’s Where Real Insight Begins

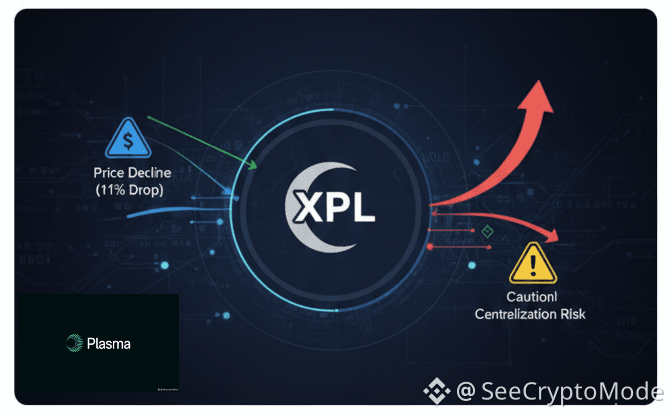

Crypto markets rarely move in straight lines, and the most informative moments often arrive when price action and capital flows tell different stories. Plasma ($XPL ) is currently in one of those moments. Short-term charts may show weakness and drawdowns, while ecosystem metrics and capital activity suggest growing structural interest.

For experienced market participants, this is not a contradiction it is a signal to look deeper.

When price declines occur alongside measurable capital inflows, infrastructure integrations, and token model adjustments, it often indicates a transition phase rather than a simple trend continuation. These phases are where narratives are rewritten, positions are built quietly, and long-term theses are tested against real adoption.

Understanding XPL right now requires separating three layers: price behavior, ecosystem mechanics, and infrastructure utility.

Price Action vs Capital Movement Why They Don’t Always Agree

Many traders assume price and capital move together. In reality, this often fails, especially in emerging infrastructure projects.

Price is driven by marginal buyers and sellers in the short term. Capital flows represent broader positioning, liquidity allocation, and ecosystem participation. The two operate on different time horizons.

A token can decline in price while still attracting capital into its ecosystem through:

• Liquidity provisioning

• Protocol integrations

• Institutional testing

• Strategic partnerships

• Infrastructure usage growth

In these cases, price reflects short-term sentiment, while capital flow reflects medium-term conviction or experimentation. #Plasma

For XPL, the conversation is increasingly shifting from pure price movement to ecosystem behavior, and that’s a more durable metric set.

Infrastructure Adoption Is a Slower but Stronger Signal

Speculative attention moves fast. Infrastructure adoption moves more slowly but tends to be more reliable once established.

When a protocol becomes useful plumbing rather than a trending topic, its growth curve changes shape. It becomes less explosive but more durable. Activity becomes less retail-driven and more system driven.

Key infrastructure adoption signals typically include:

• Integration with major DeFi protocols

• Liquidity routing usage

• Stable transfer volume

• Settlement layer utilization

• Reduced friction for specific transaction classes

In Plasma’s case, the discussion around zero-fee or lowfee stablecoin transfers is strategically important. Payments infrastructure is one of the most competitive and valuable layers in blockchain ecosystems. If a network meaningfully reduces friction there, it earns attention beyond speculation.

Infrastructure that makes financial movement cheaper and faster tends to find users even if the token price takes time to reflect that utility.#Plasma

Token Emission Changes Why Supply Design Matters More Than Hype

Token emissions are one of the most under-appreciated drivers of medium-term price behavior.

High emissions can suppress prices even during ecosystem growth. Reduced emissions can support price stability, but only if demand exists or develops. Emission cuts alone do not create value, but they can remove structural selling pressure.

When emission schedules are adjusted downward, it often signals a shift from growth-at-all-costs toward sustainability design. That is generally a positive maturity indicator, though markets may take time to price it properly.

For analysts, the key is not simply whether emissions are reduced but why and how:

• Is usage growing enough to support lower emissions?

• Is liquidity deep enough to absorb volatility?

• Is the token tied to a real network utility?

• Are incentives being redesigned or simply cut?

Emission policy is not marketing it is monetary architecture.

Integration Effects Why Partnerships Matter Only When They Drive Usage

Protocol integrations are frequently over marketed and under analyzed. Not all integrations are equal.

A meaningful integration changes behavior. A superficial integration changes headlines.

When evaluating integration impact, professionals look for:

• Liquidity migration

• Volume routing changes

• Borrow/lend activity shifts

• Collateral acceptance

• Cross-protocol transaction flow

If integration with a major protocol leads to measurable ecosystem usage, it becomes structurally relevant. If it produces only announcement-driven spikes, it is marketing noise.

The difference shows up in data, not tweets.

The Stablecoin Transfer Thesis Quiet but Powerful

Stablecoin movement is one of the most economically important transaction classes in crypto. It represents settlement, payments, treasury movement, and cross-border value flow.

Networks that optimize stablecoin transfers are not chasing hype they are targeting utility.

Low-cost or zero-fee stablecoin transfers create advantages in:

• Cross-border payments

• Exchange settlement

• Treasury rebalancing

• Merchant flows

• Remittance rails

These flows are less visible than meme cycles but far more economically meaningful. @Plasma

If Plasma continues positioning itself as an efficient stablecoin transfer layer, its long-term relevance depends more on throughput consistency and reliability than short-term token volatility.

Centralization Concerns Why They Should Be Analyzed, Not Ignored

Every infrastructure project faces the decentralization trade-off. Performance optimizations often introduce centralization vectors. Governance speed can reduce validator diversity. Operational efficiency can concentrate control.

Professional analysis does not dismiss centralization concerns it measures them.

Important questions include:

• Who controls upgrades?

• How distributed is validation?

• How transparent is governance?

• Can participants verify operations independently?

• Is decentralization improving over time or declining?

Centralization risk is not binary it is directional. The trend matters as much as the snapshot.

Markets reward transparency and credible decentralization roadmaps more than empty decentralization claims.

Volatility Phases Are Information Phases

Sharp moves both up and down are information events. They reveal liquidity structure, participant behavior, and conviction distribution.

During volatility phases, smart observers track:

• Who is buying dips

• Whether liquidity thickens or thins

• If volume confirms direction

• How quickly price stabilizes

• Whether ecosystem metrics change

Volatility is not just risk it is data.

For infrastructure tokens, volatility often precedes repricing toward a more accurate utility narrative either higher or lower.

Separating Trading Narratives from Infrastructure Narratives

One of the most common analytical errors is mixing trading narratives with infrastructure narratives.

Trading narrative asks:

“What will price do next?”

Infrastructure narrative asks:

“Will this system be used next year?”

They are different questions requiring different frameworks.

Short-term traders focus on momentum, structure, and liquidity. Infrastructure investors focus on adoption, integrations, and economic design.

Confusion happens when one framework is applied to the other.

What Professional Watchers Track Next

Experienced market participants watching XPL will likely monitor:

• Transfer volume trends

• Stablecoin flow metrics

• Protocol integration usage

• Liquidity persistence

• Governance evolution

• Emission sustainability

• Validator or operator decentralization

These metrics matter more than single-day price moves.

Final Perspective Signal Lives Below the Surface

Moments where price weakness coexists with ecosystem strengthening are analytically rich. They force deeper evaluation and discourage lazy momentum thinking.

XPL’s current phase appears to be one where surface level volatility and deeper infrastructure signals are diverging. That does not guarantee an outcome, but it does justify attention.

The most valuable insights in crypto rarely come from obvious trends. They come from structural shifts happening quietly while attention is elsewhere.

In summary, XPL’s current divergence between price and ecosystem fundamentals calls for deeper analysis rather than surface-level conclusions. Key takeaways: Separate price from capital flow signals, focus on infrastructure and adoption metrics, assess emission and integration impacts by their effects, not announcements, and prioritize decentralization and transparency trends. Prudent monitoring of these areas will yield stronger insights. As always, disciplined research, independent verification, and risk awareness remain essential. Markets reward preparation more than prediction.