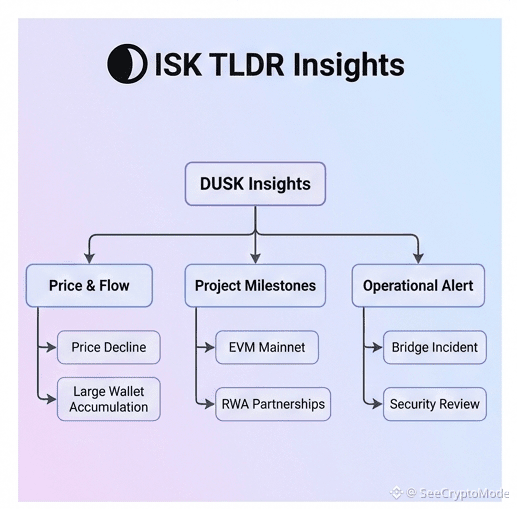

When Price Drops but Development Accelerates

In crypto markets, price often dominates attention while infrastructure progress quietly builds underneath. DUSK is currently in one of those divergence phases, short-term price weakness paired with meaningful project milestones, ecosystem expansion in Real World Assets (RWA), and deeper regulatory-aligned infrastructure development.

These moments are not unusual in infrastructure-heavy protocols. In fact, they are common. Markets tend to price narratives first and architecture later. Traders react to volatility. Builders focus on foundations. Serious observers study both.

DUSK’s recent cycle EVM mainnet launch, RWA partnerships, large wallet accumulation, and a temporary operational pause due to a bridge security review represent a textbook example of a network transitioning from roadmap to reality. That transition is rarely smooth. But it is often revealing.

The key question is not whether volatility exists. The key question is what kind of system is being built beneath it.

RWA Tokenization Is Moving from Theory to Infrastructure

For years, tokenization of real-world assets was discussed more than it was implemented. Concepts circulated widely, including tokenized securities, regulated on-chain trading, and compliant asset issuance, but production-grade infrastructure remained limited.

That is changing.

The RWA narrative is no longer about possibility. It is about execution. Institutional-grade tokenization requires more than smart contracts. It requires:

• Regulatory alignment

• Identity frameworks

• Privacy controls

• Auditability

• Compliance enforcement

• Controlled disclosure

• Secure settlement layers

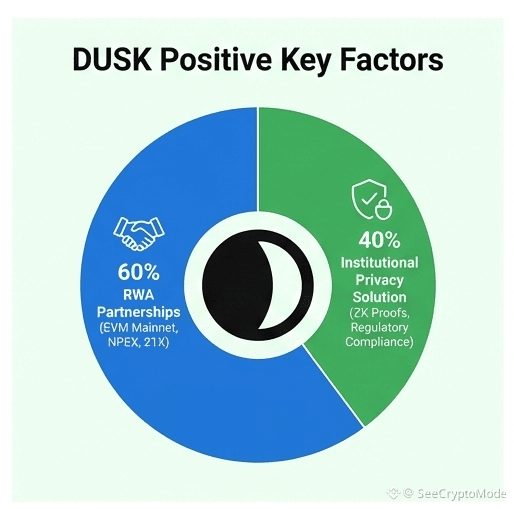

DUSK’s positioning within RWA infrastructure signals a move toward regulated tokenization rails rather than speculative asset layers. This matters because institutional adoption does not arrive through hype cycles it arrives through compliant infrastructure. $DUSK

Tokenized securities cannot run on experimental rails alone. They require environments designed for oversight, reporting, and controlled transparency.

EVM Mainnet Launch Compatibility as a Strategic Decision

Launching an EVM-compatible mainnet is not just a technical milestone; it is a strategic adoption decision.

EVM compatibility reduces friction for:

• Developers

• Smart contract deployment

• Tooling reuse

• Wallet integration

• Cross-chain composability

Instead of forcing developers to learn a new stack from scratch, EVM compatibility allows ecosystems to grow faster by leveraging existing knowledge and tooling. @Dusk

But compatibility alone is not differentiation. Its value depends on what is built on top of it.

For DUSK, EVM serves as an access layer, not the core thesis. The deeper thesis lies in compliant RWA rails, privacy-preserving auditability, and institutional-grade transaction models.

Compatibility opens the door. Specialized infrastructure defines the purpose.

Institutional Privacy: The Most Misunderstood Requirement in Crypto

Privacy in crypto is often misunderstood as secrecy. Institutional privacy is different. It is selective disclosure with verifiable compliance.

Institutions do not need invisibility. They need controlled visibility.

This includes:

• Confidential transaction details

• Selective regulator access

• Audit trails

• Proof-based verification

• Disclosure on demand

• Data minimization

DUSK’s “auditable privacy” model, typically enabled through zero-knowledge proofs and dual transaction frameworks, aligns with this institutional requirement set.

This model allows transactions to remain confidential publicly while remaining provable privately to authorized parties. That is fundamentally different from anonymous systems.

Institutional adoption does not scale with anonymity. It scales on verifiable confidentiality.

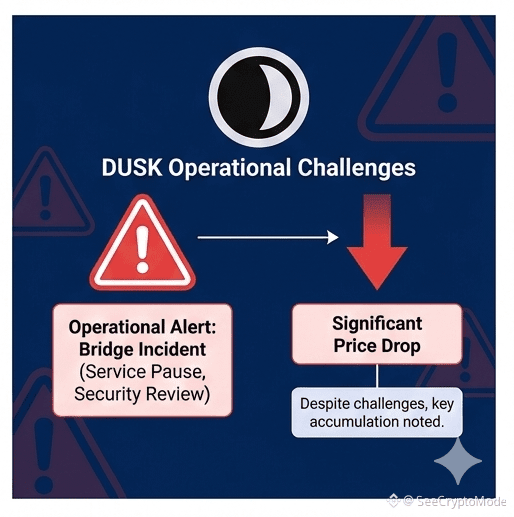

Price Decline with Large Wallet Accumulation: A Classic Structural Signal

When price declines while large wallets accumulate, analysts pay attentionnot because it guarantees reversal, but because it changes the distribution structure.

Large wallet behavior often reflects:

• Strategic positioning

• Long-term conviction

• Infrastructure thesis alignment

• Liquidity absorption

• Risk-tolerant capital

Retail flows typically chase momentum. Large capital often builds during uncertainty.

However, accumulation alone is not enough to form a thesis. It must be evaluated alongside:

• Development milestones

• Ecosystem usage

• Partnership depth

• Governance direction

• Security posture

In DUSK’s case, accumulation occurring alongside infrastructure expansion and RWA positioning creates a more complex and more interesting analytical picture.

Operational Incidents Stress Tests, Not Just Setbacks

Bridge incidents and service pauses are never positive headlines, but they are revealing events.

Infrastructure maturity is not measured by the absence of stress, but rather by the response to stress.

Key evaluation questions include:

• Was the issue detected quickly?

• Was the response transparent?

• Was user safety prioritized?

• Were services paused responsibly?

• Was a security review initiated immediately?

• Were communication channels active?

Security-first pauses may create short-term market fear, but they can strengthen long-term trust if handled correctly.

Institutional infrastructure cannot afford silent failures. It must demonstrate operational discipline under pressure.

Regulated Trading Platforms: The Missing Middle Layer

One of the biggest gaps in tokenization has been regulated trading infrastructure. Issuing tokenized assets is only half the system. Trading them compliantly is the other half.

Regulated token trading requires:

• Licensed exchange partnerships

• Compliance workflows

• Identity-linked settlement

• Transfer restrictions where required

• Reporting pipelines

• Legal enforceability

Platforms aligned with regulated exchanges and compliant trading models fill the missing middle layer between blockchain issuance and institutional participation.

Without this layer, tokenized securities remain technically impressive but commercially limited.

Why RWA Infrastructure Moves Slower and That’s Good

RWA infrastructure does not move at meme speed and it shouldn’t.

It moves more slowly because it must satisfy:

• Legal frameworks

• Regulatory reviews

• Custody requirements

• Audit standards

• Operational risk controls

• Identity verification layers

This slower pace is not a weakness. It is a structural necessity.

Markets often underestimate slow-building infrastructure because it lacks viral moments. But durable systems rarely launch through hype; they launch through compliance and reliability.

The Shift from Speculative Chains to Purpose-Built Networks

Early crypto networks aimed to be general purpose platforms. The new generation increasingly aims to be purpose built.

Purpose-built networks optimize for:

• Specific asset classes

• Specific compliance needs

• Specific transaction types

• Specific user groups

• Specific regulatory contexts

#dusk 's specialization around RWA and compliant finance infrastructure reflects this broader industry shift from universal platforms toward specialized rails.

Specialization increases relevance even if it reduces general hype.

Risk, Reward, and Infrastructure Cycles

Infrastructure tokens behave differently from narrative tokens.

Narrative tokens move fast with sentiment. Infrastructure tokens move more slowly with milestones. Narrative tokens spike in attention. Infrastructure tokens reprice on adoption.

This difference creates mismatched expectations in markets dominated by short-term traders.

Infrastructure cycles often look like:

Development → Silence → Milestone → Volatility → Integration → Repricing → Adoption

Understanding where a project sits in this cycle matters more than reacting to isolated price moves.

What Professional Observers Will Track Next

Serious analysts watching DUSK’s trajectory will focus on measurable indicators, including:

• RWA issuance volume

• Regulated partner onboarding

• Network usage metrics

• Compliance integrations

• Privacy model adoption

• Institutional pilot programs

• Security audit transparency

• Governance evolution

These metrics provide stronger forward signals than price candles alone.

Market Maturity Requires Regulated Rails

Crypto’s next growth phase is unlikely to come from faster speculation; it will come from deeper integration with regulated financial systems.

That integration requires:

• Regulated trading infrastructure

• Compliant token standards

• Privacy-preserving auditability

• Institutional settlement rails

• Legal enforceability

Networks building in this direction are not chasing cycles; they are building bridges between systems.

Final Perspective Infrastructure Is Being Valued Differently Now

The market is gradually shifting from valuing promises to valuing infrastructure readiness. From whitepapers to operational systems. From speed claims to compliance capability.

DUSK’s current phase, combining price volatility, milestone launches, RWA partnerships, institutional privacy frameworks, and operational stress tests, reflects a network moving through real-world validation rather than theoretical positioning. $DUSK

That process is rarely smooth. But it is where durable infrastructure is forged.

As always, independent research, risk discipline, and critical evaluation remain essential. Infrastructure stories reward patience and punish assumptions. Binance Square readers who focus on structure instead of noise will consistently make better long-term decisions.