INTRODUCTION

Markets often try to force a verdict on a network before the network has finished becoming itself. That mismatch creates false negatives and false positives. In a project like XPL, where the core promise is infrastructure for high frequency stablecoin movement, the early data that matters is rarely price action. The higher value evidence sits elsewhere: whether the chain can keep finality stable under load, whether developer tooling reduces friction, whether distribution choices create durable incentives, and whether adoption is driven by repeat usage rather than one off campaigns. Patience, in this context, is not passive optimism. It is a deliberate choice to wait for higher quality signals that arrive only after the system is exposed to real constraints.

This article lays out a step by step framework for reading XPL through the lens of fundamentals. It focuses on ecosystem updates, technical foundations, adoption signals, developer trends, economic design, challenges, and a grounded outlook.

ANALYTICAL METHOD

A useful way to analyze a payments first chain is to separate what is easy to claim from what is hard to fake.

Step one: verify architecture intent

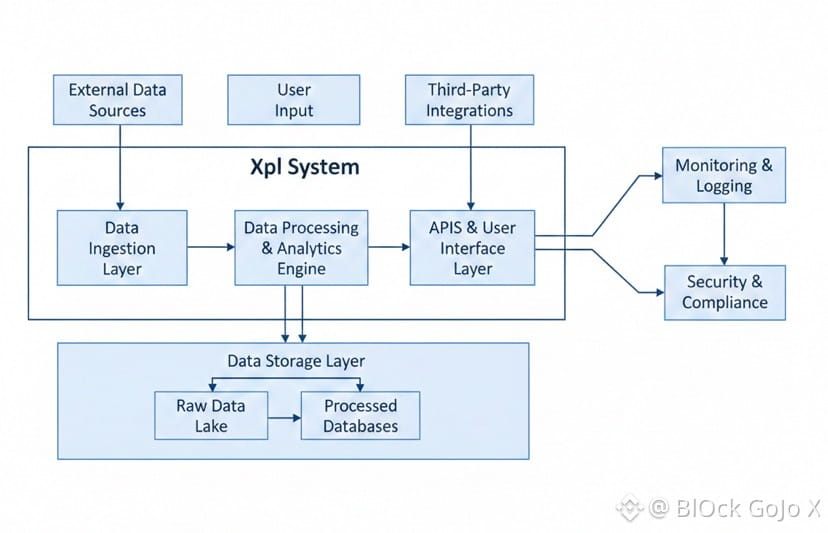

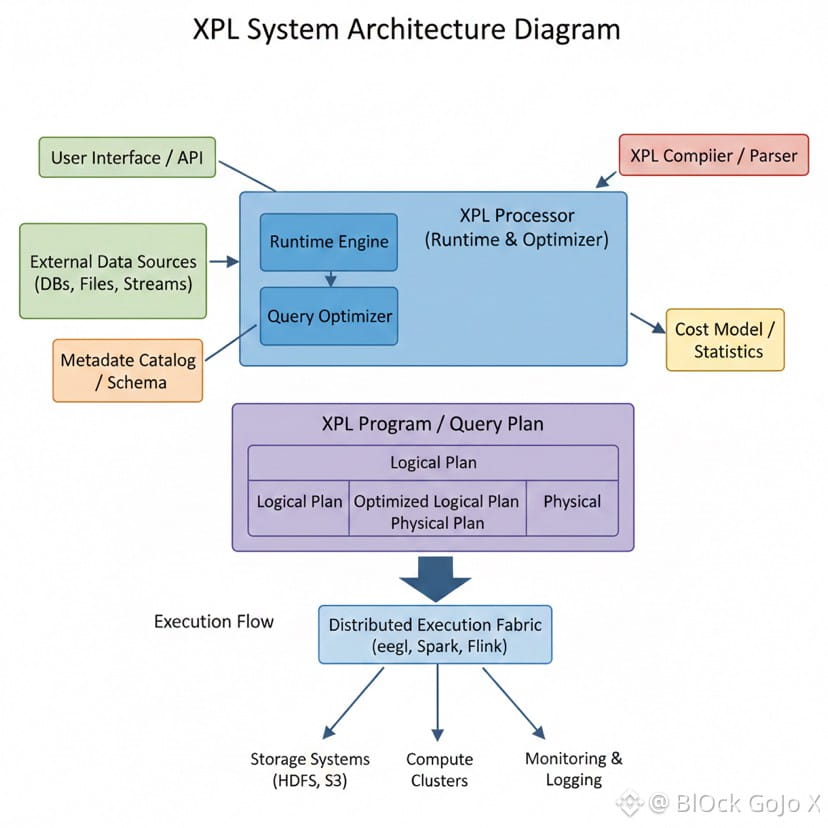

A payments chain should optimize for throughput, predictable finality, and operational simplicity for end users. Claims are cheap. Documentation and node level design choices are harder to fabricate and easier to validate. XPL positions itself as stablecoin first infrastructure with design elements that reduce user friction, including fee sponsorship for certain transfers and compatibility with existing contract tooling.

Step two: confirm implementation path

If execution and consensus are modular and documented, you can reason about performance and failure modes. XPL documents a split where the consensus component handles sequencing and finality while the execution component handles state transition and contract execution.

Step three: track adoption quality, not just quantity

For payments, the best early proof is repeat usage from integrators and the gradual appearance of infrastructure primitives: wallets, SDKs, node operators, explorers, and stablecoin liquidity routes. Volume spikes without repeat behavior are weaker.

Step four: test incentive alignment

Token design should reward security provision and ecosystem build out without creating a short horizon extraction game. XPL publishes a distribution and unlock structure that can be evaluated against that goal.

This method is why patience is diagnostic. Many meaningful signals only appear after integration cycles complete and after incentives move from announcement to execution.

ECOSYSTEM UPDATES THAT MATTER

Ecosystem updates can be categorized into two types.

The first type is capability shipping. This includes mainnet beta readiness, node operation guides, execution layer details, and architecture documentation. These updates matter because they reduce integration uncertainty. XPL provides documentation describing an execution layer built for compatibility with the dominant smart contract environment and a consensus layer designed for fast finality, which is directionally consistent with stablecoin payments as the primary use case.

The second type is distribution and growth machinery. This includes how the ecosystem funds are structured, what portion is immediately available for early programs, and how quickly the remainder unlocks. These choices shape the long run trajectory more than short run announcements. XPL outlines a sizable allocation intended for ecosystem and growth with a portion unlocked at launch and the remainder unlocking over time.

The practical takeaway is that the most informative updates are the ones that reduce friction for builders and users, or the ones that clarify how incentives will be deployed over multiple years.

TECHNICAL FOUNDATIONS

XPLs technical story is best understood as a system engineered around one dominant workload: stablecoin movement at scale.

Execution environment and compatibility

A stablecoin ecosystem already has extensive tooling and contract code built for a specific virtual machine and developer workflow. XPL leans into that reality by aiming for compatibility rather than forcing a new developer stack. Its documentation describes an execution layer powered by a high performance client that is widely used in the broader ecosystem for efficient state execution.

Consensus and finality

Payments need fast confirmation and low variance. XPL describes a dedicated consensus layer responsible for block sequencing and finality. The architectural separation between consensus and execution helps reason about performance tuning, upgrades, and incident containment, because each layer can be improved without rewriting the entire stack.

Gas policy and user experience

A key barrier to mainstream stablecoin payments is the need for users to hold a native token just to move a stablecoin. XPL highlights a model where certain stablecoin transfers can be sponsored, reducing onboarding friction and making the stablecoin behave more like a simple digital cash instrument.

Bridge and settlement anchoring

A payments chain that expects significant stablecoin flow must treat bridging and settlement assurances as first order risks. XPL positions itself as anchored to an external settlement layer via a bridge design intended to reduce trust assumptions. Even without going deep into cryptographic details, the strategic point is clear: the network is trying to borrow security properties from a highly hardened settlement environment rather than inventing them from scratch.

ADOPTION SIGNALS

Adoption analysis should distinguish between surface level metrics and structural indicators.

Structural indicator one: integration gravity

When a chain is truly reducing friction, integrations appear in predictable layers: wallet support, SDKs, node operator participation, and developer documentation maturity. XPL has documentation covering node setup for non validators and core architecture, which is a prerequisite for independent infrastructure participation.

Structural indicator two: stablecoin first product fit

A stablecoin first chain should show evidence that its design is tailored to stablecoin workflows, not generic throughput marketing. XPL emphasizes zero fee stablecoin transfers, custom gas options, and optional privacy oriented capabilities for payments. These are coherent with payment adoption pathways: merchants, remittance corridors, payroll flows, and exchange settlement where cost predictability matters.

Structural indicator three: liquidity readiness

Even for simple transfers, liquidity depth matters because it enables onchain treasury management, lending, and routing. Third party dashboards have reported significant early liquidity numbers around launch. These figures can be noisy and are sometimes inflated by incentive structures, so the correct patient approach is to watch whether liquidity persists after incentives normalize.

A patient read of adoption focuses on whether usage becomes routine and whether integrators stick around after the initial promotional window.

DEVELOPER TRENDS

Developer adoption is rarely instantaneous. It follows tooling familiarity, deployment ease, and operational predictability.

Familiar tooling lowers switching costs

By supporting the dominant smart contract environment and standard developer workflows, XPL reduces migration effort. This matters because stablecoin infrastructure teams are often conservative: they prefer shipping on known stacks with minimal new risk. Documentation explicitly positions the chain as compatible with existing contracts and tooling, which suggests a strategy aimed at minimizing developer retraining and code rewrites.

Operational clarity improves iteration speed

Node documentation and architectural transparency help teams estimate operational burden. A chain can have good technology but still fail to attract builders if running reliable infrastructure is unclear. XPL publishes specific node setup pathways that indicate an intent to support external operators, not just a closed validator set.

What patience looks like in developer data

The cleanest developer signal is not social engagement. It is a rising count of independent deployments, sustained activity in tooling repositories, and increasing diversity of applications beyond incentive farming. Those signals usually appear months after launch because integrations run on business timelines. If you evaluate too early, you over weight noise.

ECONOMIC DESIGN AND INCENTIVE ALIGNMENT

XPLs token design can be assessed with a simple question: does the token coordinate security and growth without turning into a short horizon subsidy instrument.

Supply and distribution logic

XPL documentation states an initial supply of ten billion units at mainnet beta, with distribution across public sale, ecosystem and growth, team, and investor aligned buckets.

From an incentive perspective, three details matter.

First, ecosystem allocation size and unlock pace

A large ecosystem allocation can either bootstrap real usage or become a constant sell pressure overhang, depending on how it is deployed. The published structure includes an immediately unlocked portion for early programs and a multi year unlock for the remainder. That design can support sustained incentives, but it also creates an accountability requirement: the ecosystem spend must translate into retention, not just temporary liquidity.

Second, staking and validator economics

The token is positioned as the security asset that validators stake to secure the network. This is standard in proof of stake designs, but the key is the parameterization: reward rates, slashing conditions, and decentralization of stake distribution. A patient analyst watches whether stake concentrates or disperses over time, because concentration is a hidden risk for payments infrastructure.

Third, fee model and value capture

If stablecoin transfers are sponsored, then the chain must still finance security and operations. That can come from smart contract activity, from alternative fee markets, from inflation, or from ecosystem subsidies. The sustainable path is a gradual transition where real usage pays for security, while subsidies are used only as a bridge to reach that steady state.

In this context, patience is the act of waiting to see whether the economics migrate from incentives to organic fees and security participation.

KEY CHALLENGES

XPLs design choices create clear benefits, but they also introduce specific risks.

Paymaster sustainability

If a large share of transfers are subsidized, the network must ensure that the subsidy does not become a permanent fiscal burden. The risk is a loop where adoption is real but financially dependent on continued token emissions or treasury spend. The mitigation is a phased policy: subsidize onboarding, then shift value added transactions to fee paying flows.

Bridge risk and settlement assumptions

Any system that connects to an external settlement layer inherits a new class of security concerns: bridge correctness, monitoring, and incident response. Trust minimized designs reduce risk but do not eliminate it. The patient approach is to monitor whether audits, formal verification efforts, and incident drills become visible over time.

Centralization pressures

Payments infrastructure attracts regulatory scrutiny and requires reliability. Those pressures can push networks toward centralized validator sets, permissioned components, or heavily curated application layers. XPL will need to balance operational stability with credible decentralization, especially if it targets large scale financial flows.

Liquidity and incentive distortions

Early liquidity can be incentive driven. If incentives are too generous, they can attract mercenary capital that leaves quickly, harming long run credibility. The right signal is not peak liquidity, but retained liquidity after incentives normalize.

Competition and differentiation

Stablecoin rails are a crowded arena. Differentiation must be measurable: lower friction, better reliability, faster settlement, cheaper operations, or superior integration tooling. XPLs differentiator is the stablecoin first design and gas sponsorship mechanics, but it must prove that those features remain robust at scale.

FUTURE OUTLOOK

A grounded outlook should be framed as a set of measurable milestones rather than predictions.

Milestone one: reliability under real payment load

The project will be judged on finality variance, uptime, and operational clarity for integrators. This is where patience pays off because reliability evidence accumulates slowly through months of continuous operation.

Milestone two: expansion from transfers to full financial workflows

Stablecoin transfers are the entry point. The larger opportunity is stablecoin treasury management, credit, merchant settlement, payroll flows, and cross border routing. Progress here will show up as a more diverse application set and deeper liquidity primitives.

Milestone three: privacy aligned payment features

XPL documentation references support for confidential payments as part of its stablecoin focused feature set. If implemented well, privacy features can unlock enterprise use cases, but they also raise compliance and policy considerations. The key is careful design and clear guardrails.

Milestone four: incentive maturation

Over time, the ideal trajectory is reduced dependence on subsidies, increased fee paying activity in value dense transactions, and a staking economy that is decentralized enough to support a credible security claim.

CONCLUSION

Patience in XPL analysis is a discipline of signal selection. The true direction of the project will be revealed less by market narratives and more by the slow accumulation of operational evidence: architecture choices that support payments, tooling that reduces developer friction, adoption that persists beyond incentives, and economic design that funds security without permanent subsidy dependence. The projects most likely to endure are the ones whose early promises harden into boring reliability. That is a slow process by nature, and it is precisely why patience is informative rather than passive.