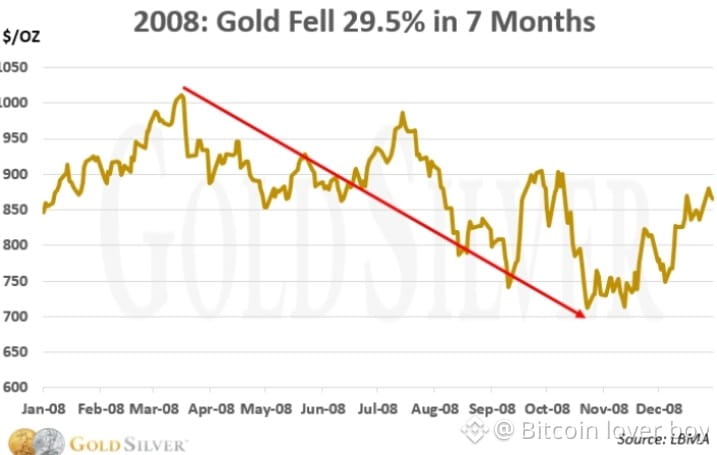

$VANRY Gold just suffered a historic shock. Prices plunged nearly 12% in a single session, marking the metal’s worst one-day collapse since the early 1980s. Spot gold briefly touched $4,682 per ounce, as a brutal wave of selling ripped through the precious metals market and caught even seasoned traders off guard.

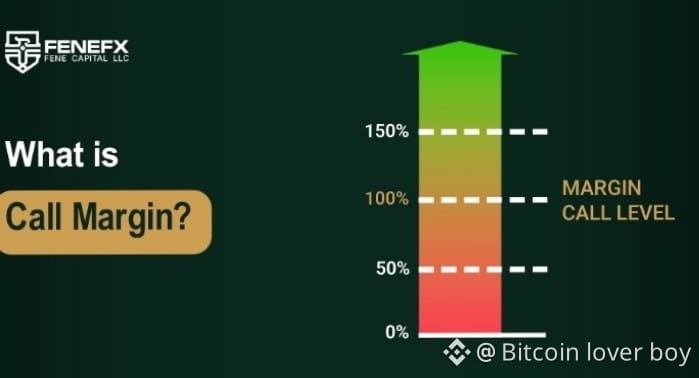

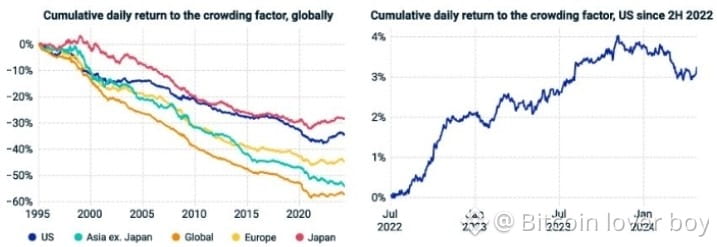

The sell-off appears to be driven by a toxic mix of forced liquidations, overcrowded long positions, and shifting macro expectations. With global liquidity tightening and risk assets showing renewed strength, gold’s role as a short-term safe haven was suddenly questioned. Rising real yields and a stronger dollar added fuel to the fire, triggering margin calls and cascading stop-losses across futures and ETFs.#Vanrychain

What makes this move especially striking is the context: gold had been riding strong geopolitical and inflation narratives for months. This crash doesn’t erase gold’s long-term relevance—but it does expose how fragile consensus trades can become when positioning gets extreme.$ETH

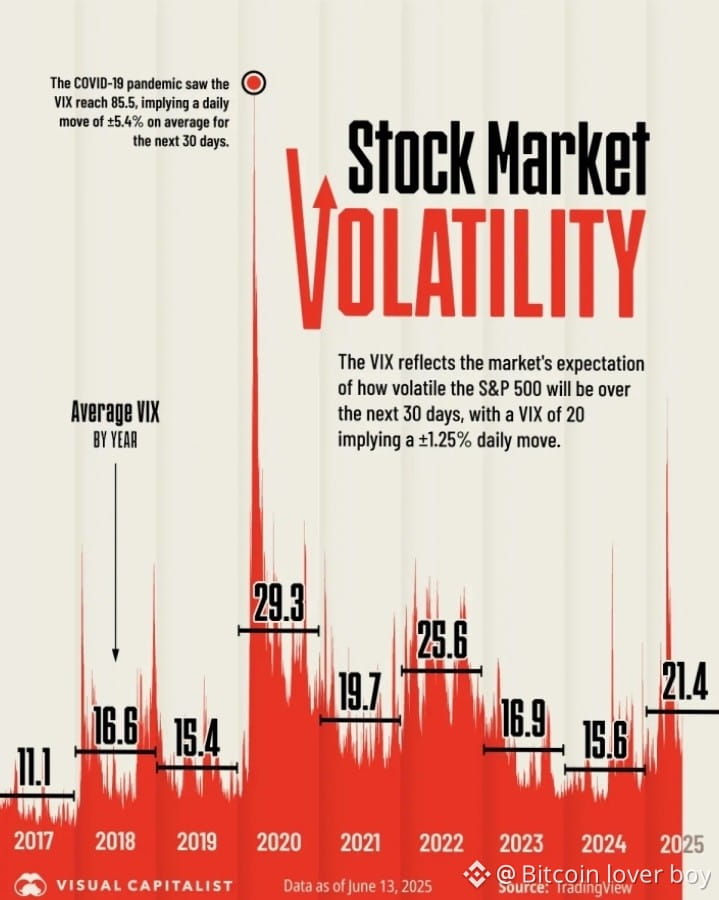

History reminds us that moments like this often reshape market psychology. Whether this is a temporary flush or the start of a deeper repricing, one thing is clear: volatility is back, and complacency just got punished—hard.$SOL