In the high-stakes arena of digital assets, few names evoke as much polarized emotion as Changpeng Zhao, widely known as "CZ." As the founder of Binance, the world’s largest cryptocurrency exchange, he has become the industry’s de facto lightning rod. While his influence is undeniable, he remains the preferred target for critics, competitors, and disgruntled investors alike.

But what lies behind this persistent scrutiny?

1. The Scapegoat for Individual Missteps

In a market defined by extreme volatility, human psychology often seeks an external culprit for financial losses. Many retail investors enter the crypto space driven by FOMO (Fear Of Missing Out), often bypassing essential due diligence.

When a trade goes south or a portfolio is liquidated due to poor risk management, it is psychologically easier to blame the platform’s architect than to accept personal accountability. CZ, as the face of the largest gateway to the markets, becomes the personification of "the house," making him the convenient villain for those struggling with the harsh realities of trading.

2. A Cutthroat Ecosystem: The Reality of Organized Sabotage

The crypto industry is far from a "care-free" utopia; it is an intensely competitive battlefield. Behind the scenes, the fight for liquidity and user dominance often involves tactics that border on psychological warfare.

Coordinated FUD: Fear, Uncertainty, and Doubt (FUD) are frequently weaponized.

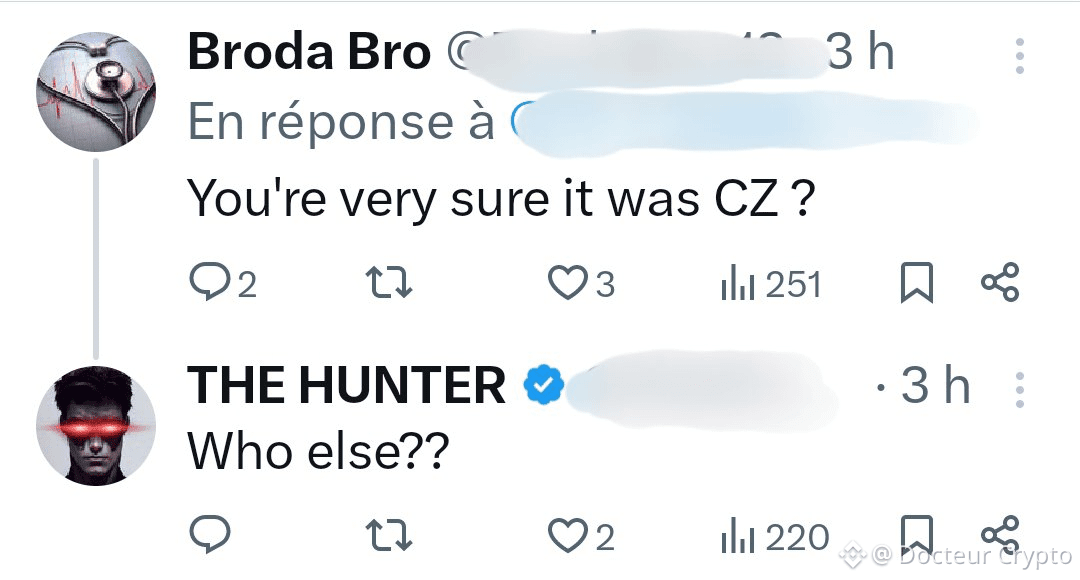

Reputation Mercenaries: It is an open secret in the industry that some actors fund coordinated "hit pieces" or social media campaigns to tarnish a competitor's reputation.

Strategic Destabilization: By paying individuals to amplify negative narratives, competitors hope to trigger mass withdrawals (bank runs) to weaken Binance’s foothold. In this environment, attacking the leader isn't just personal—it’s a calculated business strategy.

3. The Dark Side of Success

Grandeur naturally invites scrutiny. When you build the most dominant platform in a global industry, you inherit a permanent bullseye. This is the "tax" on success:

Regulatory Magnet: Being the biggest makes you the first point of contact—and friction—for global regulators.

The Tall Poppy Syndrome: There is an inherent cultural tendency to criticize those who achieve unprecedented wealth and influence.

Every tweet, policy change, or technical update from CZ is dissected under a microscope. At this level of success, nuance is often lost, and every move is interpreted through a lens of suspicion by those who view his market share as a threat to decentralization or their own interests.

Conclusion: A Builder’s Perspective

CZ will likely never achieve universal consensus. His leadership style and Binance’s dominance will continue to spark debate. However, one must look at the incentives: CZ would never jeopardize the survival of his "baby," Binance, for the sake of a few million dollars. For a founder who has spent years navigating existential regulatory hurdles to build a multi-billion-dollar empire, long-term stability is the only currency that matters. While critics focus on short-term conspiracies, the reality remains that CZ’s interests are fundamentally aligned with the platform's longevity. He is a builder who understands that in the world of global finance, trust is the hardest asset to earn and the easiest to lose.