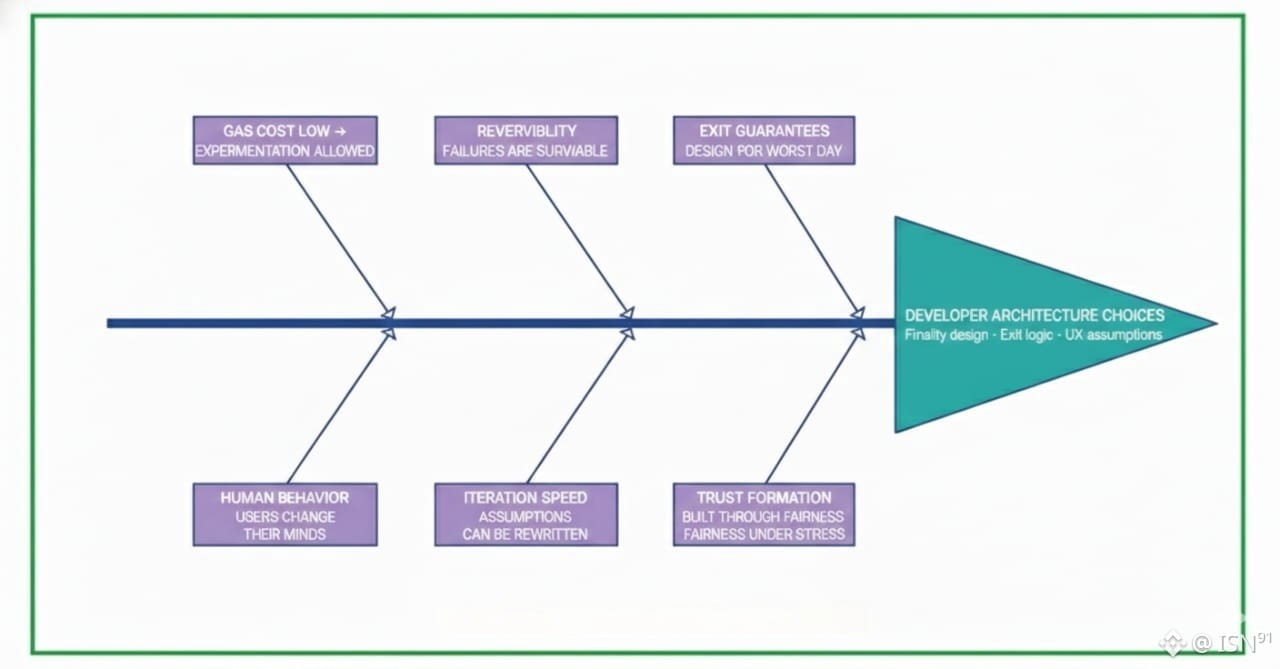

Plasma doesn't just move execution off-chain. It changes how developers feel about building. When gas stops punishing curiosity and reversibility is part of the design, architecture becomes less defensive and more honest.

I remember reviewing a Plasma prototype where finality was deliberately delayed. Not because the system was slow, but because the developer wanted users to have a short, explicit window to change their mind and exit. On most chains, that would be framed as a risk. Here, it was the entire point.That shift matters more than people realize.

Why Constraints Shape Everything At a technical level, Plasma exists to scale without discarding security. Execution happens off-chain while guarantees stay anchored to a base layer. But the more interesting effect is cultural. On expensive, congested chains, developers learn to minimize change. They ship once, touch state carefully, and avoid rethinking fundamentals. Eventually, that caution becomes habit.

Plasma removes the penalty. Iteration becomes cheaper. Rewriting assumptions becomes acceptable.

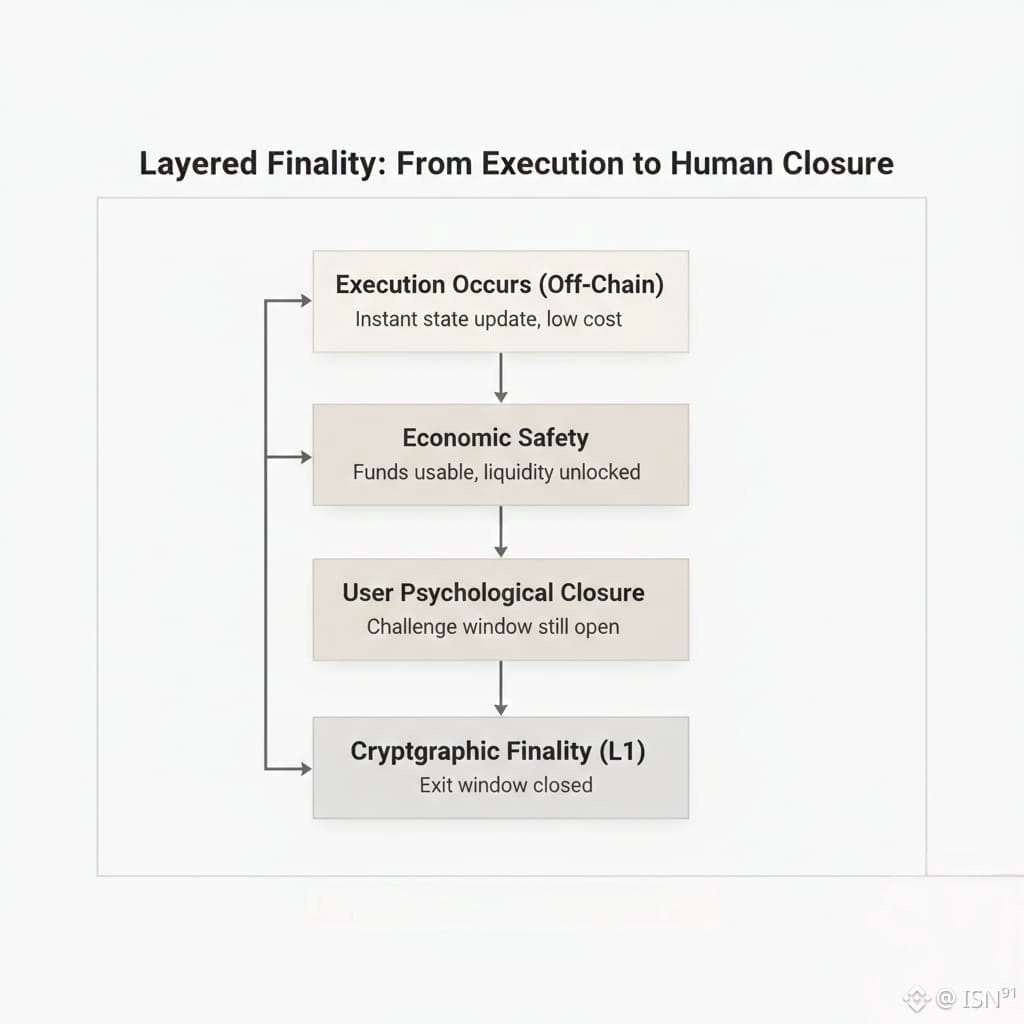

Rethinking Finality One of the most unconventional patterns emerging is how developers treat finality. Instead of a binary switch, it's broken into layers: when funds are economically safe, when users feel done, and when cryptographic closure occurs.

Rethinking Finality One of the most unconventional patterns emerging is how developers treat finality. Instead of a binary switch, it's broken into layers: when funds are economically safe, when users feel done, and when cryptographic closure occurs.

Consider a marketplace dispute. On Ethereum, you'd lock funds until resolution—expensive and rigid. On Plasma, a seller can receive payment instantly while a buyer retains a 24-hour challenge window. Both sides experience the outcome they care about: the seller has liquidity, the buyer has recourse. Finality becomes contextual, not absolute. This enables systems that feel instant while remaining safely reversible for a bounded time... especially useful in payments, recurring subscriptions, and any flow where humans change their minds.

Design Patterns You Don't See Elsewhere

Financial logic gets more nuanced when gas doesn't constrain every decision. Developers aren't just writing contracts that execute; they're modeling behavior. Fees respond to usage stress. Exit incentives shift with liquidity conditions. Treasury flows reflect risk, not ideology.

A few teams are building payment rails where transaction costs drop as volume stabilizes rewarding consistency instead of charging flat rates. Another project dynamically adjusts exit queue priority based on how long funds have been deposited, preventing newer users from being penalized during stress events. The inspiration here comes less from crypto and more from economics, operations research, and traditional finance.

Plasma also rewards attention to problems most people ignore. Stablecoin transfers. Payroll. Merchant settlement. These aren't exciting demos, but they are where users feel the pain first. On Plasma, developers optimize for something rare in Web3: boring reliability. When it works well, users don't even realize a blockchain is involved.

Tools That Match the Mindset Tooling has started to follow. Because off-chain state and exits matter, some teams build visual debuggers, state timelines, and exit simulations. These tools don't look impressive in screenshots, but they change how developers reason about systems under stress. You can trace exactly when a user could have exited, what they would have recovered, and whether the system behaved fairly during a cascade failure. One developer described it as "designing for the worst day, not the demo day."

Tools That Match the Mindset Tooling has started to follow. Because off-chain state and exits matter, some teams build visual debuggers, state timelines, and exit simulations. These tools don't look impressive in screenshots, but they change how developers reason about systems under stress. You can trace exactly when a user could have exited, what they would have recovered, and whether the system behaved fairly during a cascade failure. One developer described it as "designing for the worst day, not the demo day."

The Trade-offs Are Real Of course, this freedom comes with costs. Plasma designs are harder to explain, easier to get wrong, and slower to earn trust. Flexibility increases cognitive load, and abstraction only helps if it holds under adversarial conditions.

Still, this tension may be Plasma's most important contribution. It forces developers to design for failure, reversibility, and human behavior–conditions most chains quietly pretend won't happen.

If Plasma's flexibility is taken seriously, the future of on-chain finance may look less flashy on the surface and far more dependable underneath.

The Real Question

Speed and gas are no longer your constraints. So which parts of your architecture exist only because Ethereum was expensive last year?