Headline

Fetch.ai Gains Attention as AI‑Blockchain Use Cases Expand and Ecosystem Grows

Short Intro

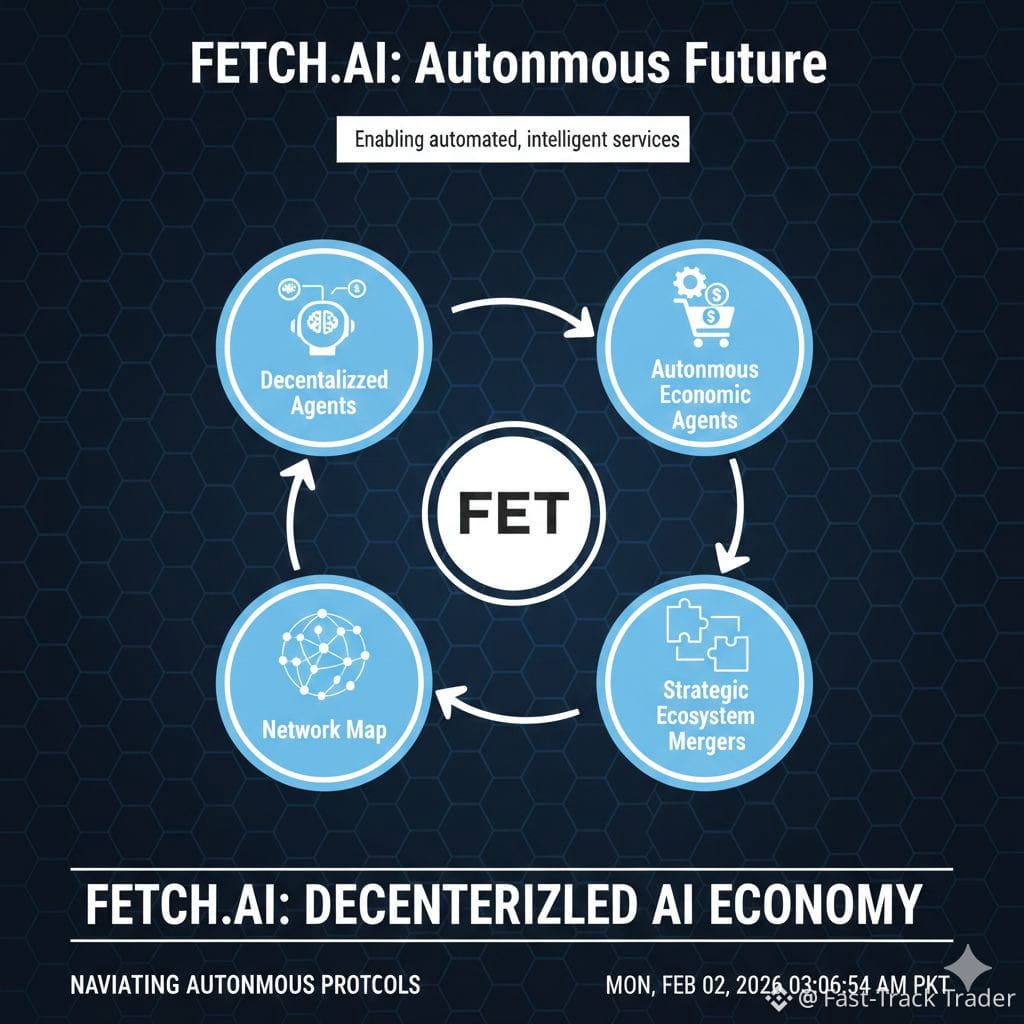

Fetch.ai (ticker FET) — a blockchain project that merges artificial intelligence with decentralized technology — is capturing community interest thanks to increasing on‑chain utility, ecosystem growth, and strategic developments that link it with other AI crypto initiatives. Market conversations around FET highlight its transition toward a broader AI‑based infrastructure narrative.

What Happened

Recent data shows that FET remains one of the most talked‑about altcoins, particularly among AI‑related protocols, as crypto discussions around artificial intelligence tokens heat up. The token is frequently mentioned alongside other trending assets in market sentiment reports, suggesting heightened community engagement and curiosity.

Fetcher.ai’s network statistics also point to strong on‑chain growth with millions of transactions processed and increasing developer contributions, indicating rising adoption and practical use cases beyond speculation.

FET’s ecosystem has evolved significantly with the Artificial Superintelligence (ASI) Alliance merger, where Fetch.ai joined with other AI‑centric projects like SingularityNET and Ocean Protocol to build a larger decentralized AI framework — although the token still trades under the FET ticker as the native asset in many listings.

In addition, strategic moves such as a $50 million token buyback announced by the Fetch.ai Foundation aim to strengthen the token’s market position and support its future roadmap ahead of further ASI developments.

Why It Matters

Fetch.ai’s growth highlights an important trend in crypto: the expansion of utility beyond simple store‑of‑value tokens to systems that enable real‑world automation and decentralized services. FET’s value proposition lies in powering autonomous economic agents — software entities that can perform tasks like market optimization, data analysis, mobility services, or predictive machine learning in a decentralized environment.

Additionally, community and ecosystem metrics — such as rising transactions, active developers, and enterprise partner engagement — show that Fetch.ai is building functional infrastructure rather than focusing only on price narratives. The ASI Alliance, collaborative AI token ecosystem approach further signals that projects aiming at decentralized AI solutions could form a significant niche in the broader blockchain space.

For beginners especially, this means that the technical adoption and underlying utility of a token often influence its long‑term relevance — and in the case of FET, that utility centers around AI‑linked automation and decentralized computing.

Key Takeaways

Community interest in FET is rising, with Fetch.ai among trending AI crypto tokens in market sentiment.

TradingView

Network activity and developer growth continue solidly, indicating rising utility on chain.

The ASI Alliance merger unites Fetch.ai with other AI‑focused blockchain projects, expanding ecosystem reach.

Fetch.ai Foundation’s $50 M buyback is a strategic move to support token stability and confidence before further integration phases.

FET’s core value lies in autonomous economic agents, decentralized AI tooling, and network participation — not only price speculation.

#FetchAI #AIBlockchain #AutonomousAgents #DecentralizedAI $FET