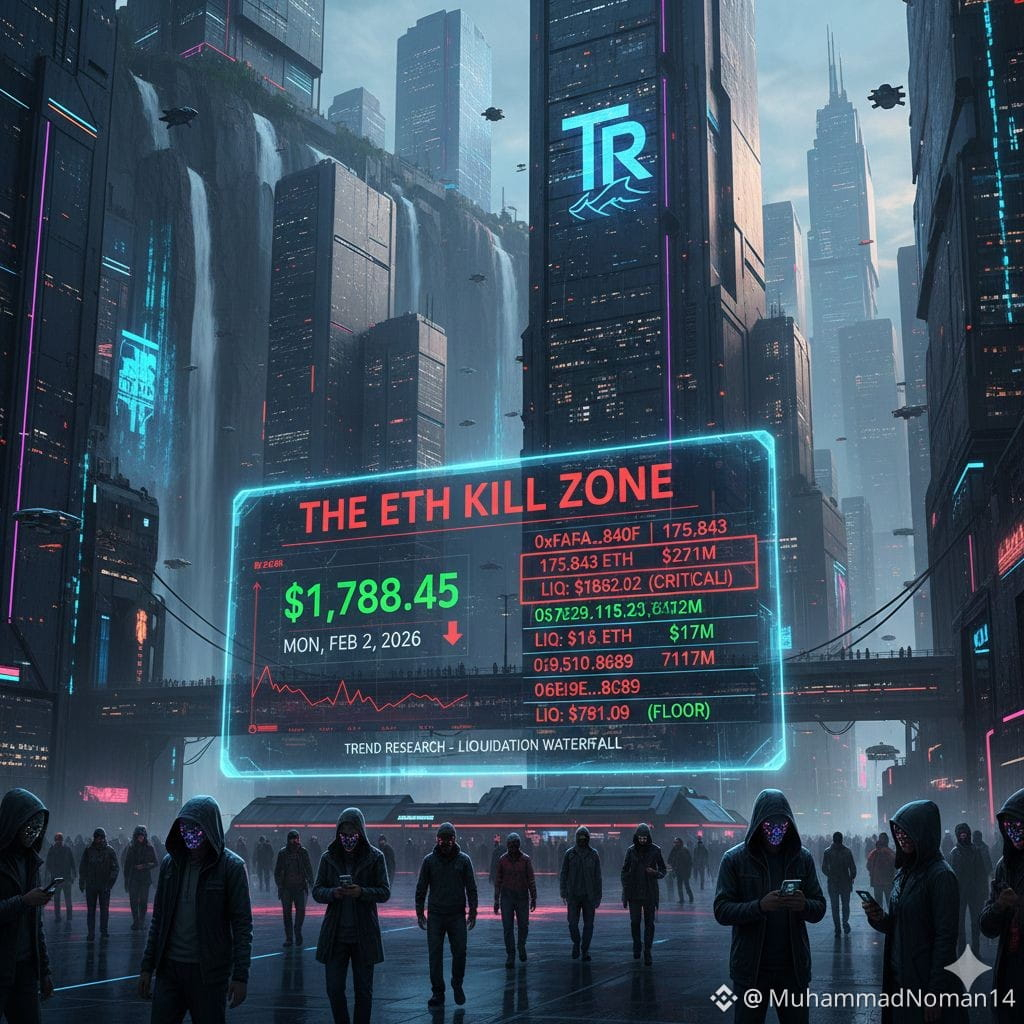

The ETH "Kill Zone": Mapping the Whale’s Edge

Ethereum is drifting into dangerous waters. This isn't just about "bearish sentiment"—it’s about cold, hard math. We are approaching a specific liquidation band where the market’s biggest player, Trend Research, could be forced into automatic selling.

The $1.33 Billion Burden

Trend Research is currently juggling 618,245 ETH across six strategic wallets. With roughly $939M in stablecoin debt, the structure isn't a single wall—it’s a staircase of pain. If ETH slips into the $1,781 – $1,862 range, the "manageable" becomes "automatic."

The Liquidation Roadmap

Here is exactly where the pressure points lie:

Wallet Address ETH Collateral Borrowed Liquidation Price

0xfaf1...840f 175,843 ETH $271M $1,862.02

0xb855...1e8a 41,034 ETH $63.23M $1,856.57

0x8fdc...7f43 43,025 ETH $66.25M $1,855.18

0xe5c2...4e4c 169,891 ETH $258M $1,833.84

0x85e0...eec8 108,743 ETH $163M $1,808.05

0x6e9e...8c89 79,510 ETH $117M $1,781.09

The Bottom Line

This isn't a single cliff; it’s a series of trapdoors. ETH doesn’t need a black swan event to crash—it just needs to keep drifting. Once the price enters that top band at $1,862, the smart contracts won't care about "whale status" or "market reputation." They will simply execute.

The question is: Does Trend Research have the dry powder to deleverage, or are we watching a slow-motion wreck?

Would you like me to create a summary table focusing specifically on the "risk levels" (High, Medium, Low) for these addresses based on the current ETH price?

#WhenWillBTCRebound #PreciousMetalsTurbulence #Ethereum #ETHETFsApproved