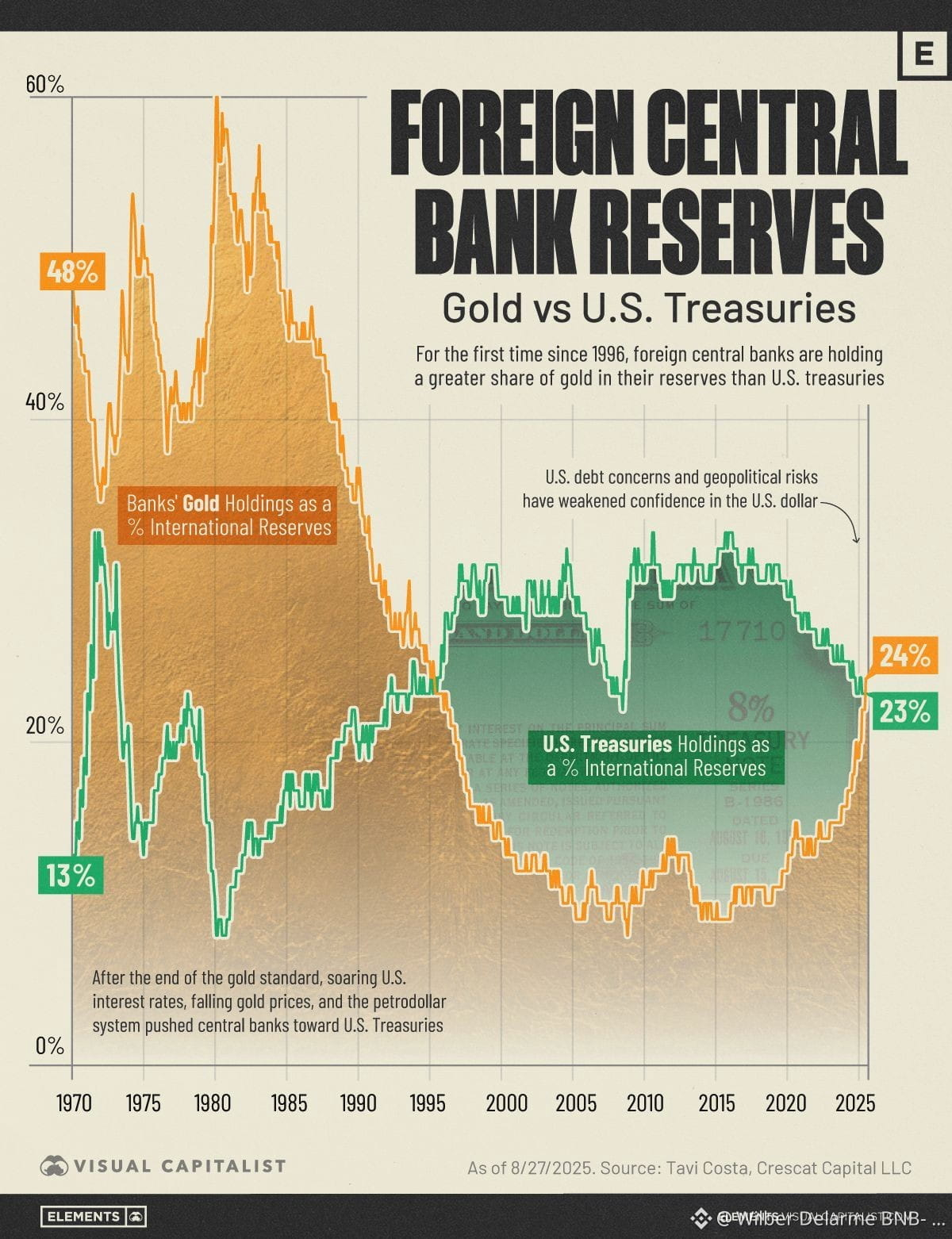

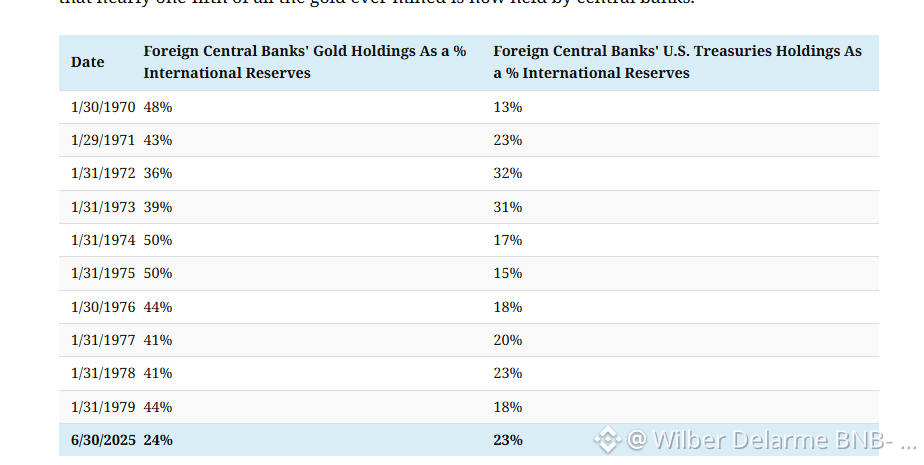

For the first time since 1996, foreign central banks hold more gold than U.S. Treasuries in their reserves.

That’s a historic shift.

Why it’s happening:

• Record gold buying in 2022 (1,136 tonnes)

• Continued heavy accumulation in 2023–2024

• Rising U.S. debt concerns

• Growing geopolitical risk

• Gradual “de-dollarization”

this signals:

Central banks are prioritizing durability, neutrality, and safety over yield.

Gold’s share of global reserves has climbed to ~18% (2024), up sharply from the mid-2010s.

Notably, China, Russia, and Türkiye have been the biggest buyers over the past decade.

In October 2025, gold even broke $4,000/oz for the first time — a price move backed by real policy behavior, not just speculation.

Simple takeaway:

The world is slowly rebalancing away from dollars and toward hard assets.

Big question for markets:

If central banks are stacking gold… what should investors be stacking?