$F surprised many traders today with a sudden bullish move, gaining strong momentum after a period of consolidation. Let’s break down why this pump happened and what traders should watch next.

1️⃣ Accumulation Phase Confirmed

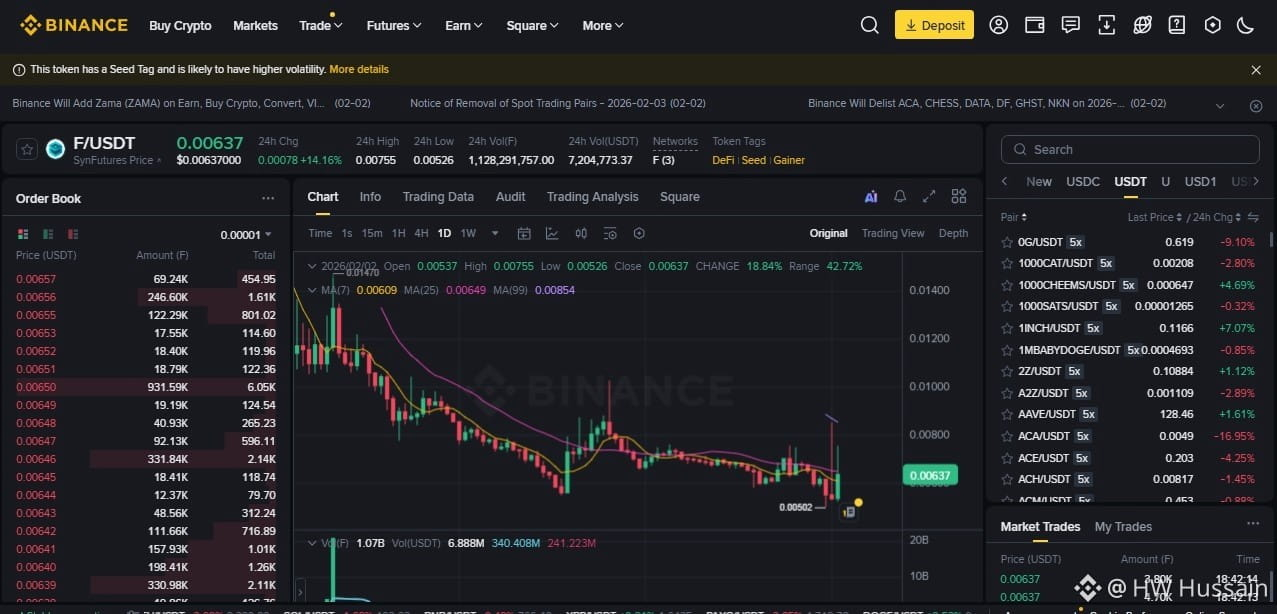

For several sessions, F/USDT traded in a tight range near the 0.0050 support zone. This type of sideways movement often signals quiet accumulation by larger players before a move.

2️⃣ Volume Expansion

The breakout was confirmed by a sharp increase in trading volume, which validates the price move. Breakouts without volume usually fail—this one didn’t.

3️⃣ Technical Breakout

Price pushed above key short-term moving averages (MA7 & MA25), flipping them into support. This triggered:

Momentum traders

Short-covering

Algo-based buy signals

4️⃣ Seed Tag Effect

Because F carries a Seed tag, liquidity is thinner and volatility is higher. Once buyers step in, price can move aggressively in a short time.

5️⃣ Market Psychology

After a long downtrend, even a modest breakout can create:

FOMO entries

Rapid momentum candles

Overextension in the short term

This explains the fast spike rather than a slow grind up.

📌 What to Watch Next

Support: 0.0056 – 0.0058

Resistance: 0.0070 – 0.0075

Invalidation: Breakdown below 0.0052

⚠️ Risk Note

Seed tokens can dump as fast as they pump. Always wait for confirmation and avoid emotional entries.

Conclusion:

The pump was driven by technical breakout + volume + volatility, not randomness. Smart traders now watch how price reacts at resistance.