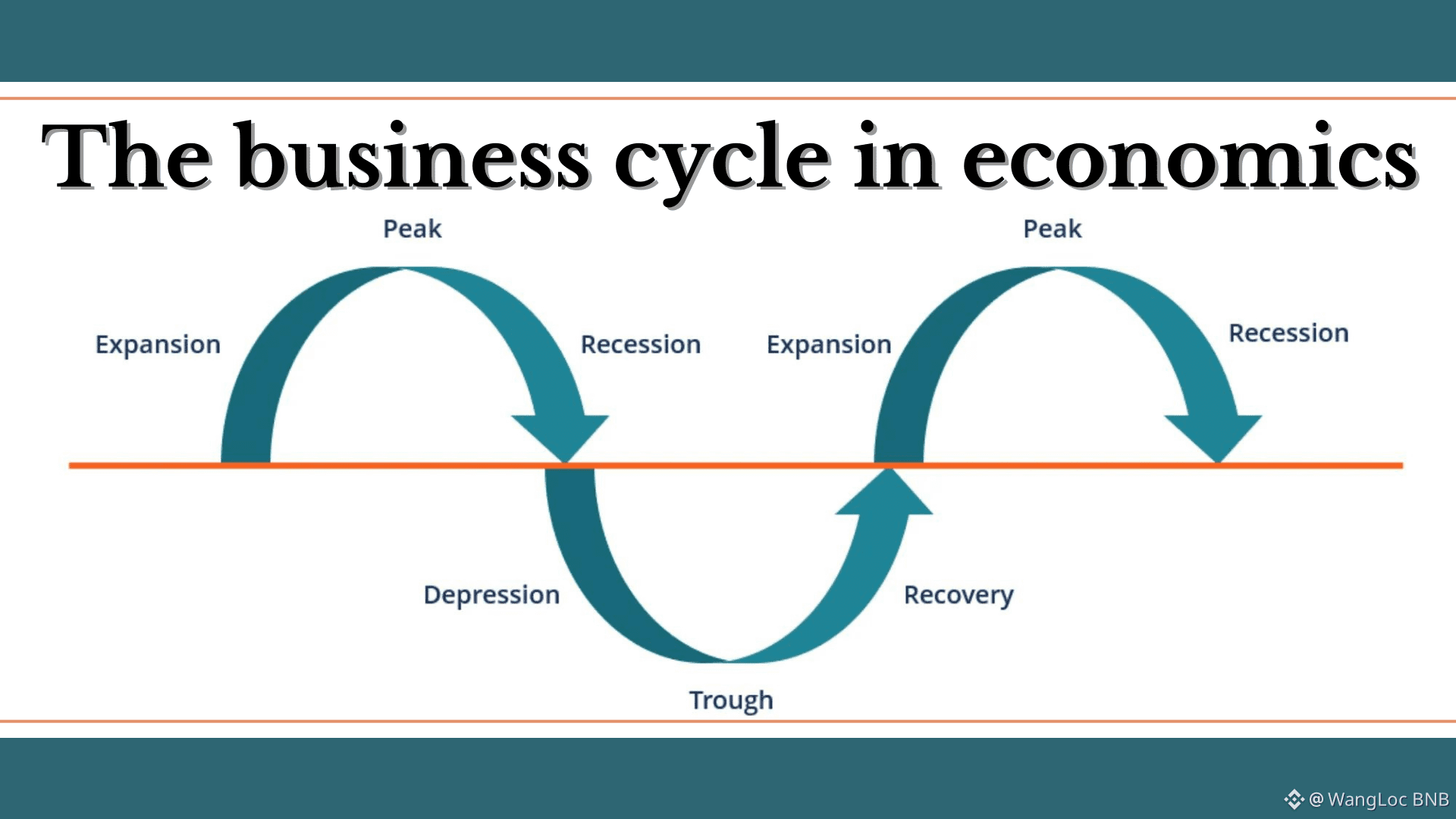

Crypto market expansions are not random events. They are a direct consequence of the business cycle and the liquidity conditions that define it.

Every major parabolic phase in crypto has emerged during periods of monetary transition not during economic strength, but at the point where policy begins to shift from restriction to accommodation.

Quantitative tightening has effectively reached its end. Rate cuts are now being priced into the market, and historically, this sequence is followed by a return to easing conditions. These moments mark structural turning points, not short-term trades.

Bitcoin has recently interacted with what can be described as the natural low of the business cycle a phase characterized by compressed liquidity, risk aversion, and widespread capitulation. While sentiment at these levels is typically pessimistic, history shows they have consistently preceded the most aggressive expansion phases across crypto markets.

Previous cycle resets tell a clear story. During the 2012–13 cycle,

Bitcoin advanced over 5,000%, followed by altcoin expansions of 10–50x.

The 2016–17 cycle produced Bitcoin gains exceeding 6,500%, with select altcoins delivering 20–100x returns.

Even in the more mature 2020–21 cycle, Bitcoin still appreciated over 1,700%, while altcoins achieved 10–40x moves. The magnitude changes, but the structure remains consistent.

The business cycle does not end it resets. These resets occur precisely when conviction is weakest and participation thins out, just before liquidity conditions begin to improve and risk assets reprice accordingly. This is not an argument for complacency or blind optimism, but a reminder that macro-driven expansions are built during periods of doubt, not euphoria.

Positioning during these phases is less about prediction and more about discipline. Understanding where we are in the cycle matters far more than reacting to short-term volatility.

#CYCLE #business #MarketCorrection $BTC