🚀 Why is $CYBER Pumping? | Detailed Analysis

1. Institutional Accumulation (The "Enlightify" Effect)

One of the strongest long-term drivers for $CYBER in 2026 is the $20M treasury commitment from Enlightify Inc. (NYSE: ENFY).

What’s happening: They are utilizing a Dollar-Cost Averaging (DCA) strategy to acquire CYBER over a 12-month period.

Impact: This provides a consistent "buy wall" and reduces circulating supply, signaling massive institutional confidence in CyberConnect’s Web3 social infrastructure.

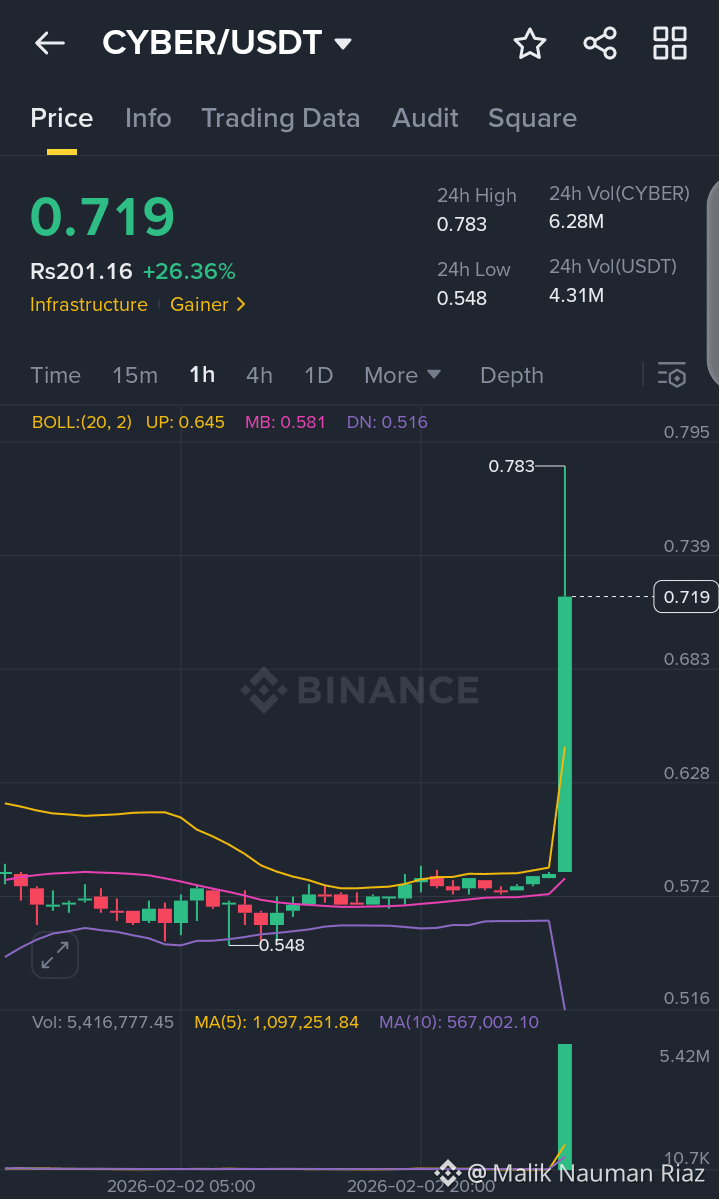

2. Technical Breakout & Momentum

On the charts, $CYBER has recently shown strong recovery signals:

MA Alignment: Price has successfully crossed above the MA7, MA25, and MA99 on shorter timeframes, confirming a shift from bearish to bullish momentum.

Support Bounce: Strong demand has been identified around the $0.75 – $0.80 zone, where "smart money" appears to be accumulating.

RSI Health: The Relative Strength Index (RSI) is hovering in the 50–60 range, suggesting there is still plenty of "room to run" before the asset becomes overbought.

3. SocialFi Ecosystem Growth

CYBER isn't just a token; it's a Layer 2 social network.

Grants & Staking: The team recently deployed $2M in developer grants to attract new dApps.

Staking Rewards: Over 2.6M CYBER has been staked for governance, further locking up supply and rewarding long-term holders with revenue sharing.

4. Market Sentiment & "Dip Buying"

As Bitcoin stabilizes around the $78k – $80k mark, capital is beginning to rotate back into high-utility altcoins. CYBER, with its low market cap (currently around $40M–$50M) relative to its utility, is a prime target for traders looking for high-beta gains.

📊 Key Levels to Watch

Level Type Price Target (USD) Significance

Immediate Resistance $0.85 – $0.90 Breakthrough here confirms the next leg up.

Major Goal $1.20 Historical resistance and psychological barrier.

Critical Support $0.74 Must hold this level to maintain the bullish structure.

💡 Pro Tip for Square: Always remind your followers that while the technicals look "creative" (bullish), high volatility is expected. Mention that DWF Labs has been known to be active in CYBER liquidity, which often precedes rapid price movements.