The rapid evolution of blockchain finance has resulted in the tokenization of Real-World Assets (RWAs) being one of the most exciting opportunities within this new market. Dusk Network, the leading provider of this service within regulated European markets, is using its Layer-1 blockchain to progress from bold ideas to an existing resource for institutional level usage. This transformational journey is being driven by an agreement with NPEX, who are developing the first of their kind, blockchain based, regulated securities exchange in Europe, with an operational mainnet already hosting over €300 million’s worth of tokenised securities, creating a new benchmark for compliant, private finance.

This is not just a trial, but the active development of Europe’s first securities exchange run through a blockchain system in partnership with NPEX (a regulated MTF exchange based in the Netherlands) supports Dusk’s proposition it has developed as its central theme: institutional investment flows to the blockchain cannot happen unless infrastructure is built first to comply with current regulations, and secondarily, to achieve this ambition.

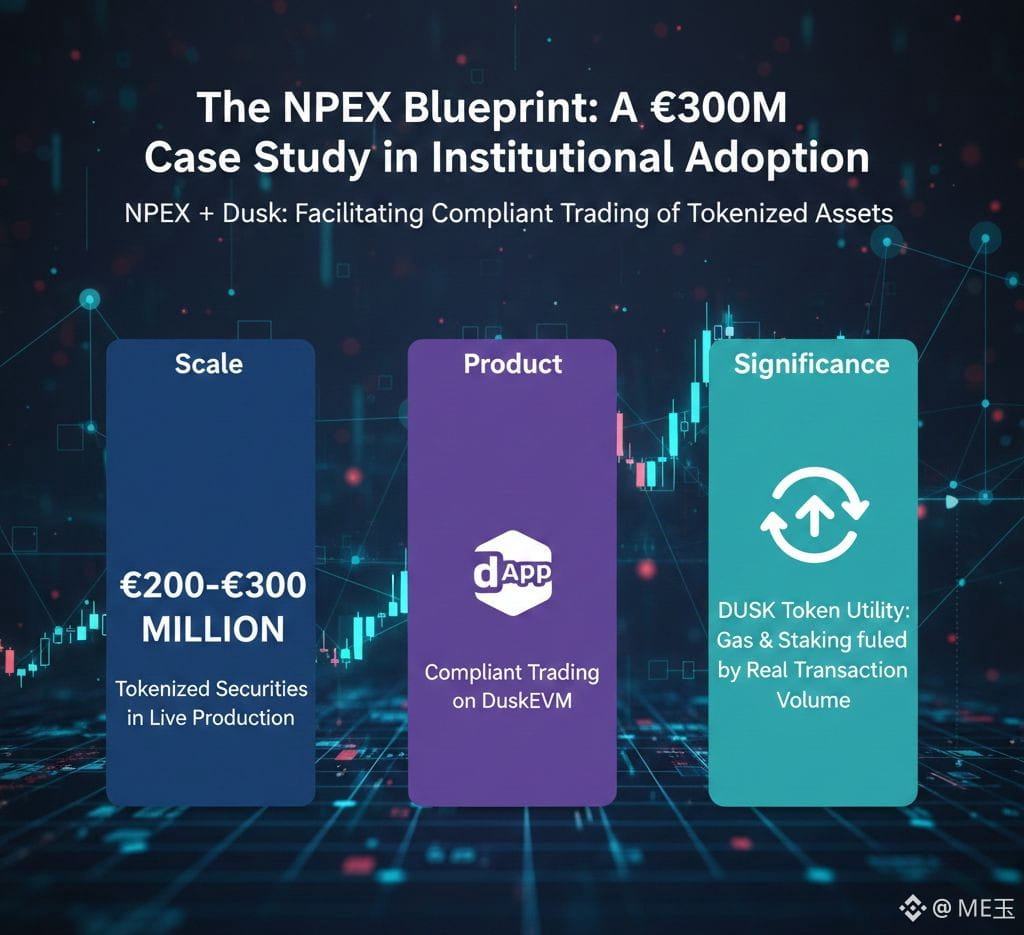

The NPEX Blueprint: A €300M Case Study in Institutional Adoption

NPEX's partnership with Dusk presents Dusk's most persuasive proof of concept. This partnership seeks to create a marketplace that facilitates the compliant trading of tokenized equities, fixed income, and fund products through an existing broker network and regulatory licenses from NPEX while providing the technological infrastructure for the new financial market.

Scale: The NPEX-Dusk partnership has progressed beyond the conceptual stage, with active management of tokenized securities valued between €200-$300 million in live production.

Product: NPEX has a dedicated dApp that will be deployed on the DuskEVM to enable compliant trading of tokenized securities directly on the blockchain.

Significance: Dusk provides a compelling reason to use the DUSK token as a gas and staking mechanism because real asset value creation generates real transaction volumes and demand for the DUSK token. This creates a strong feedback loop that ties the DUSK token value to measurable economic activity.

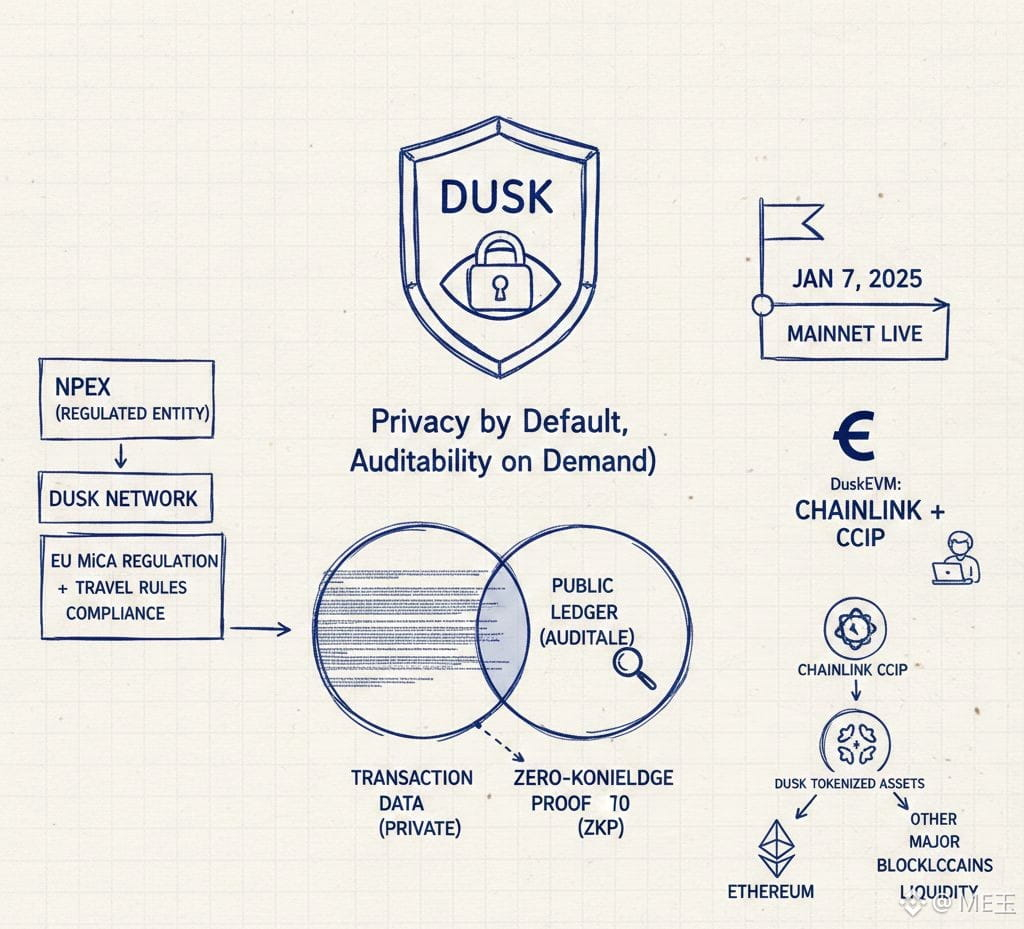

Auditable Privacy": The Regulatory Superpower

Why did a regulated entity like NPEX choose Dusk as its partner? Because of its unique "privacy by default, auditability on demand" model.

Dusk provides a level of privacy for transactions that other crypto coins do not. The utilization of a technology called zero-knowledge proof (ZKP) means that Dusk can maintain the confidentiality of a user's transaction information without preventing the public from having access to that same information. This selective disclosure feature will allow the recipient of a transaction to cryptographically verify the source of their transaction to an approved authority. This will improve compliance with the EU's Markets in Crypto-Assets (MiCA) regulation and Travel Rules. Dusk has quickly established itself as a destination for resources that are moving away from traditional privacy coins, which usually lack regulatory compliance, to compliant alternatives.

Dusk's Technical Foundation: Mainnet, DuskEVM and Interoperability

Such an ambitious vision requires a sound technological infrastructure. Dusk has achieved many important milestones with its infrastructure that will help enable the NPEX project to take place:

- Live Mainnet: The transition of the Dusk network from testnet to Layer-1 mainnet was completed on January 7th, 2025. The Dusk network is now officially operational following 6 years of development work.

- Developer Availability: Dusk has developed a new product called DuskEVM. DuskEVM creates an Ethereum-like programming environment for developers. Developers can use existing Solidity tools to deploy their applications and immediately take advantage of Dusk's built-in privacy and compliance functionality.

Cross-Chain Future: A highlight of the Chainlink partnership will be to integrate Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This will address liquidity fragmentation and allow Dusk tokenized assets to transfer securely across all major blockchains such as Ethereum, thereby providing exponentially more market opportunity and utility.

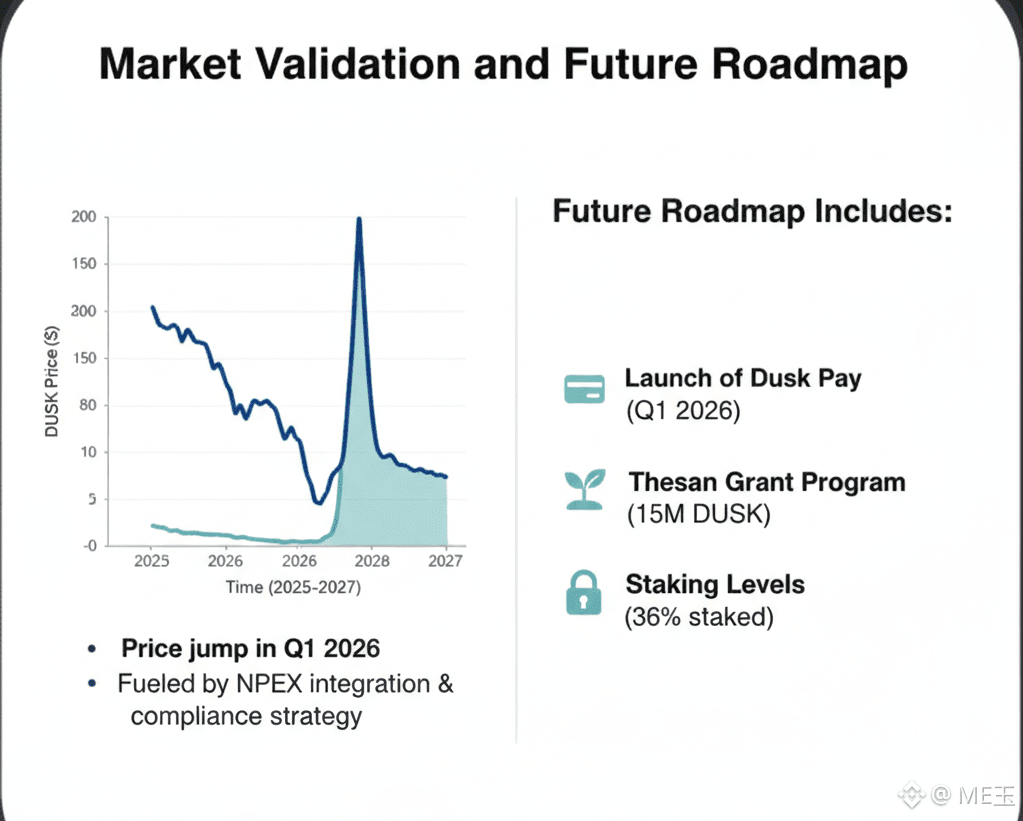

Market Validation and Future Roadmap

The market has taken notice; in early 2026, the price of DUSK jumped significantly after approximately 1 year of steady decline. This was not only due to speculative activity, but also due to the recent material evolution of NPEX (the integration of the #Dusk platform with NPEX) and the clear strategy that Dusk has adopted with regards to its compliance-first strategy.

Looking ahead, Dusk's roadmap includes:

· The launch of Dusk Pay, a payment network compliant with MiCA regulations for businesses, scheduled for Q1 2026

· Continued support for the Thesan Grant Program, which has provided 15 million DUSK for the development of the ecosystem

· Staking levels are significant; currently over 36% of DUSK supply is staked, demonstrating strong long-term holders’ confidence in the platform’s security and future.

Conclusion: Not Just a Token - Building a Financial Network

The transition from partnering with NPEX to having a live mainnet hosting hundreds of millions of Euros of assets is evidence of a more widespread transformation. Dusk Network’s journey shows that they are evolving from being a cryptocurrency project into becoming an integral part of the financial market infrastructure. By successfully tokenizing more than €300 million of real world assets, Dusk has shown that the future of finance is not about replacing financial systems that already exist; instead it is about enhancing them using blockchain technology, which provides efficiency, transparency and programmability while also ensuring compliance through appropriate controls.

As such, the DUSK Token is also evolving from simply being an asset into being an element that facilitates accessing a regulated financial layer. The token’s restriction of use and its demand will also be linked to the continued growth of tokenized assets.