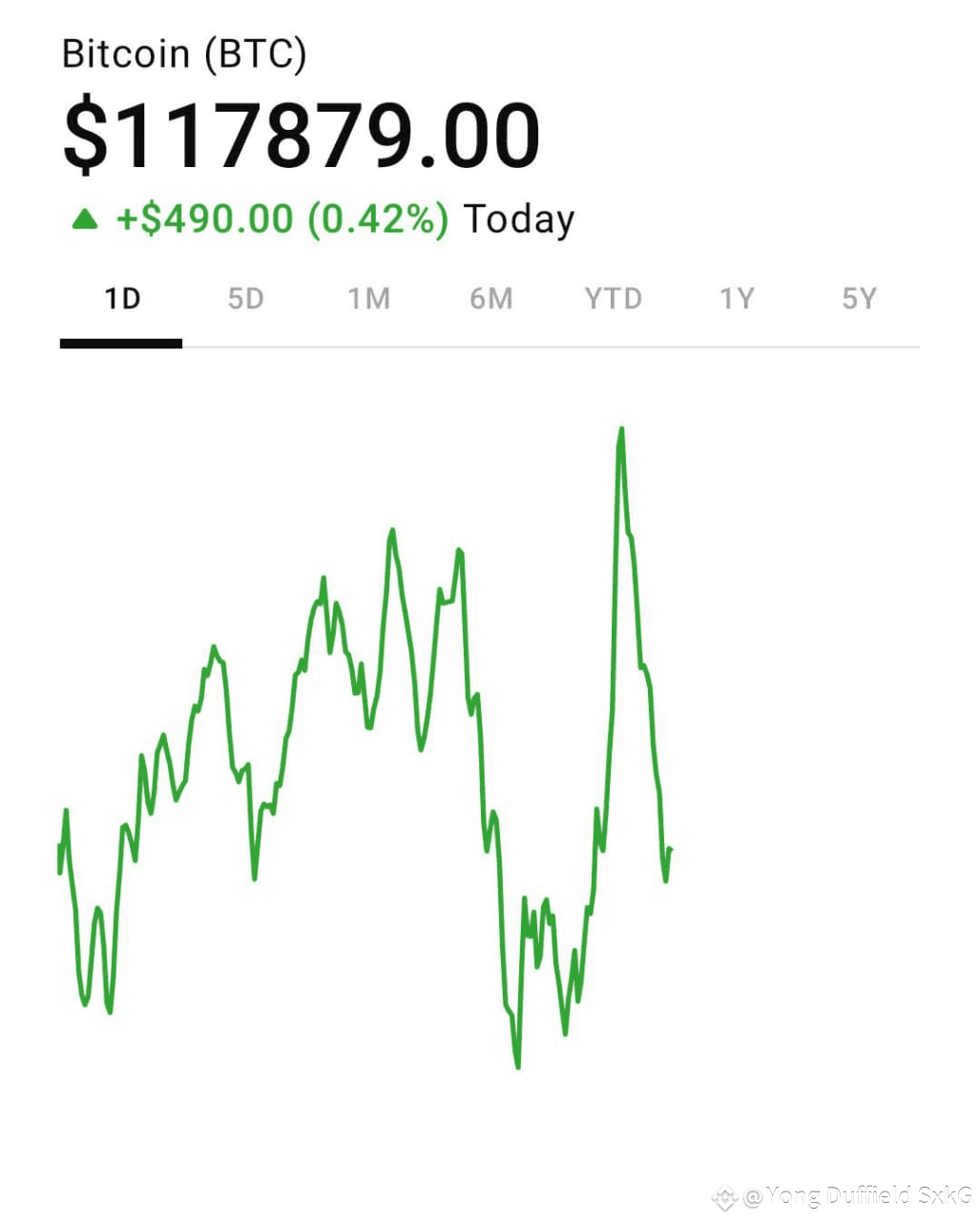

📰 Bitcoin: Where It Stands Today (as of July 30, 2025)$BTC

$118K .

$ .

.

🔍 Factors Influencing BTC Price Trends

✅ Regulatory Momentum & Institutional Adoption$BTC

.

$ .

📊 Macro Drivers & ETF Flows

.

.

📈 Forecasts & Price Targets – What the Experts Say

Forecaster / Institution2025 OutlookCommentary Wide range suggests volatility risk.Citigroup analysts$135K–$199K Balanced projection based on ETF flows.ARK / Bernstein / VanEck$175K–$200K+ High-end institutional targets.Tom Lee & others$200K–$250K+ Bullish based on scarcity and momentum.Ultra‑bull case (Cantor, BlackRock, Cathie Wood)Coined $ Speculative, very long horizon.

⏳ What Comes Next: Will BTC Rise or Fall?

💰 Upside Scenario

$150K–$

.

⚠️ Downside Risks

$ .

Regulatory setbacks or geopolitical missteps could reverse sentiment quickly—bitcoin’s price can be sensitive to changes in policy regimes.

✍️ Sample Post: Binance “Write & Win” Campaign

Title:

🔍 Bitcoin’s Crossroads: Can BTC Break $150K This Year?

Body:

Bitcoin is currently trading around $118K, just a few points shy of its $123K high achieved in mid-July 2025. Despite today’s market-wide dip (~4.8%), bullish sentiment remains firm—bolstered by strong ETF inflows, government adoption of strategic BTC reserves, and new regulatory clarity in the U.S. and abroad.

Experts forecast a wide range of outcomes. Balanced models by Citi suggest BTC may land between $135K and $199K this cycle, while consensus among institutional and crypto-focused analysts targets $150K–$200K, with ultra-bulls eyeing $250K or more. Taxonomical surveys hint at a $145K average by year-end, though potential lows near $87K underscore Bitcoin’s volatility risk.

What to expect next:

Continued ETF and corporate treasury adoption may lift #BTC toward $150K–$200K.

Watch global monetary policy: surprises from the Fed or shifting macro data could sway prices sharply.

Regulators in the U.S. have passed major bills (GENIUS, CLARITY), accelerating institutional trust—but any reversal could disrupt momentum.

Is Bitcoin on track to reach $200K—or destined to retrace first? I expect a volatile push upward, with a realistic range of $140K–$160K by year-end, assuming regulatory stability and sustained institutional demand.

Let me know where YOU think BTC heads next—and let’s win together! 🏆

✅ TL;DR

Current price: ~$118K, near all-time highs

Catalysts: ETF inflows, strategic reserves (including U.S. government holdings), regulatory clarity

Upside potential: $145K–$200K by end of 2025 (Citi, VanEck, Bernstein)

Bear case: Potential dips to $90K+ in event of macro headwinds or sentiment reversal

Conclusion: Bi‑directional outlook, but lean bullish if adoption and policy trends stay supportive$BTC

BTCUSDTPerp67,852.8+1.03%

BTCUSDTPerp67,852.8+1.03%