Most people think money is fast now because the screen says sent. But real speed is not the notification. Real speed is settlement, the moment doubt disappears and the transfer becomes irreversible in practice, not just in feeling. The modern world is full of instant looking movement sitting on top of slow, cautious plumbing. Plasma is built around a simple refusal to accept that gap. It treats stablecoin settlement as the core job, not a side effect of a general purpose chain.

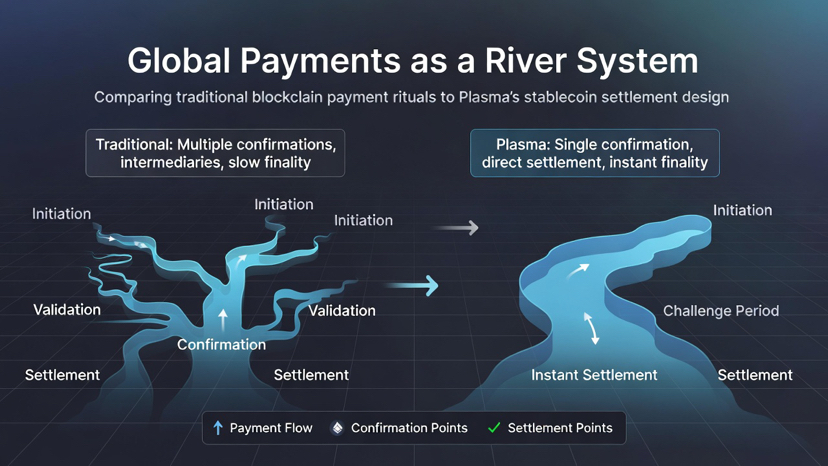

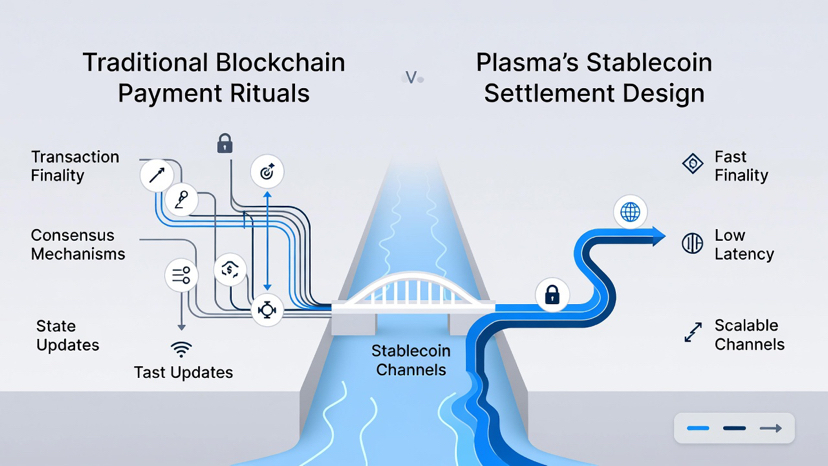

Imagine global payments as a river system. Some rivers are wide and impressive, but they meander, they flood, they depend on gates that open only at certain times. Stablecoins are like carving new channels through the terrain. They do not fix every risk, but they change the shape of what is possible. Plasma positions itself as a channel designed from the beginning for stable value to flow through smoothly, consistently, and without the usual rituals that make blockchain payments feel like a technical chore.

The first ritual Plasma tries to dissolve is the strange requirement that you must hold a separate volatile asset just to move stable value. That requirement has always felt like making someone buy a special kind of fuel to drive on a road that is supposedly public. Plasma introduces the idea that the cost of moving stablecoins should also feel stable, and that stablecoin transfers should not punish the user with extra steps. When fees and transfers are designed around stablecoins, the network starts to feel less like a niche system and more like money infrastructure you can actually live on.

Speed in this context is not about bragging. It is about trust. In everyday payments, sub second finality is not a number, it is a social signal. It is the difference between a merchant hesitating and a merchant continuing their day. It is the difference between payroll feeling like a promise and payroll feeling like a maybe. Plasma aims for rapid finality because stablecoin settlement only becomes a true alternative when the experience is confident and repeatable under pressure, not just fast in ideal conditions.

Underneath the user experience, Plasma holds onto a familiar execution environment so builders do not have to relearn everything from scratch. This is a quiet but consequential choice. Settlement networks scale through integration, not through novelty. When developers can bring existing tools, assumptions, and habits, the work becomes less about translating concepts and more about shipping real products. Plasma is basically saying that the future of stablecoin settlement should not require a new civilization of software, just a better foundation for the one that already exists.

Then there is the question that always shows up once money gets serious. Who can push it. Who can stop it. Who gets to decide what is allowed. Plasma leans into a security design meant to strengthen neutrality and resistance to interference by anchoring to a deeply established base. It is not a magic shield, because pressure can appear at many layers in any system. But it is a statement that neutrality is not decoration. It is part of the product. If stablecoins are becoming a settlement standard, the network carrying them cannot be easy to capture without consequences.

The broader environment makes this focus feel less like a niche bet and more like a timely one. Stablecoins are shifting from an experimental tool into a mainstream settlement instrument, and systems around them are hardening. More rules, more institutional involvement, more expectations about reliability. That shift changes what users and businesses value. They care less about endless features and more about predictability, cost clarity, and the ability to move stable value without operational friction. Plasma is built for that moment, the moment where the market stops rewarding spectacle and starts rewarding infrastructure that behaves like infrastructure.

None of this removes the central tension of stablecoins. They are stable in unit, but they are also governed instruments tied to issuers and rules. A chain can be neutral and fast and still carry assets that can be constrained elsewhere. Plasma cannot solve that alone. What it can do is make the settlement layer as clean and dependable as possible, so the remaining risks are clearer rather than hidden inside clunky mechanics and delayed finality.

The most unique thing about Plasma is not any single feature. It is the personality of the whole design. It feels like a network built to disappear. Not because it lacks identity, but because the best settlement systems do not demand attention. They reduce the number of decisions a person has to make just to move value. They make costs legible. They make timing reliable. They make the act of paying feel ordinary again.

If the next chapter of digital finance is written in stable value, the winners may not be the chains that try to be everything. They may be the ones that choose one responsibility and take it so seriously that the rest of the world can safely build on top. Plasma is trying to be that kind of foundation, a quiet engine for stablecoin settlement where certainty arrives quickly and stays put.