The global financial system is undergoing one of the most profound transformations in modern history. At the heart of this evolution lies blockchain technology, a decentralized and transparent infrastructure that challenges traditional intermediaries and redefines how value is stored, transferred, and managed. Among the various layers of blockchain architecture, Layer 1 blockchains stand out as the foundational networks that enable decentralized applications (dApps), smart contracts, and digital assets to function securely and at scale.

As adoption grows, Layer 1 blockchains are becoming essential pillars of the emerging decentralized economy. Projects such as Bitcoin, Ethereum, Solana, Avalanche, Polkadot, and privacy-focused networks like DUSK Network (@dusk_foundation, $DUSK) are demonstrating how base-layer innovation can reshape financial markets, improve efficiency, and expand access to financial services worldwide.

This article explores the transformative potential of Layer 1 blockchains, their advantages, real-world use cases, challenges, and their long-term impact on the future of finance.

Understanding Layer 1 Blockchains

A Layer 1 blockchain is the base network that validates and records transactions directly on its main chain. Unlike Layer 2 solutions, which operate on top of an existing blockchain, Layer 1 protocols are responsible for:

Consensus mechanisms

Network security

Transaction finality

Smart contract execution

These networks form the backbone of decentralized ecosystems. Their design determines how fast transactions are processed, how secure the network is, and how decentralized governance remains.

Bitcoin pioneered this model as a peer-to-peer digital cash system, while Ethereum expanded it with smart contracts. Today, newer Layer 1 blockchains aim to solve limitations such as scalability, energy efficiency, and privacy—making them increasingly attractive for financial applications.

Key Advantages of Layer 1 Blockchains

1. Scalability

Scalability refers to a network’s ability to handle increasing transaction volumes without congestion or high fees. Modern Layer 1 blockchains use innovations such as:

Proof-of-Stake (PoS) consensus

Sharding

Parallel processing

These approaches allow networks to process thousands of transactions per second, enabling real-time financial activity such as trading, lending, and payments.

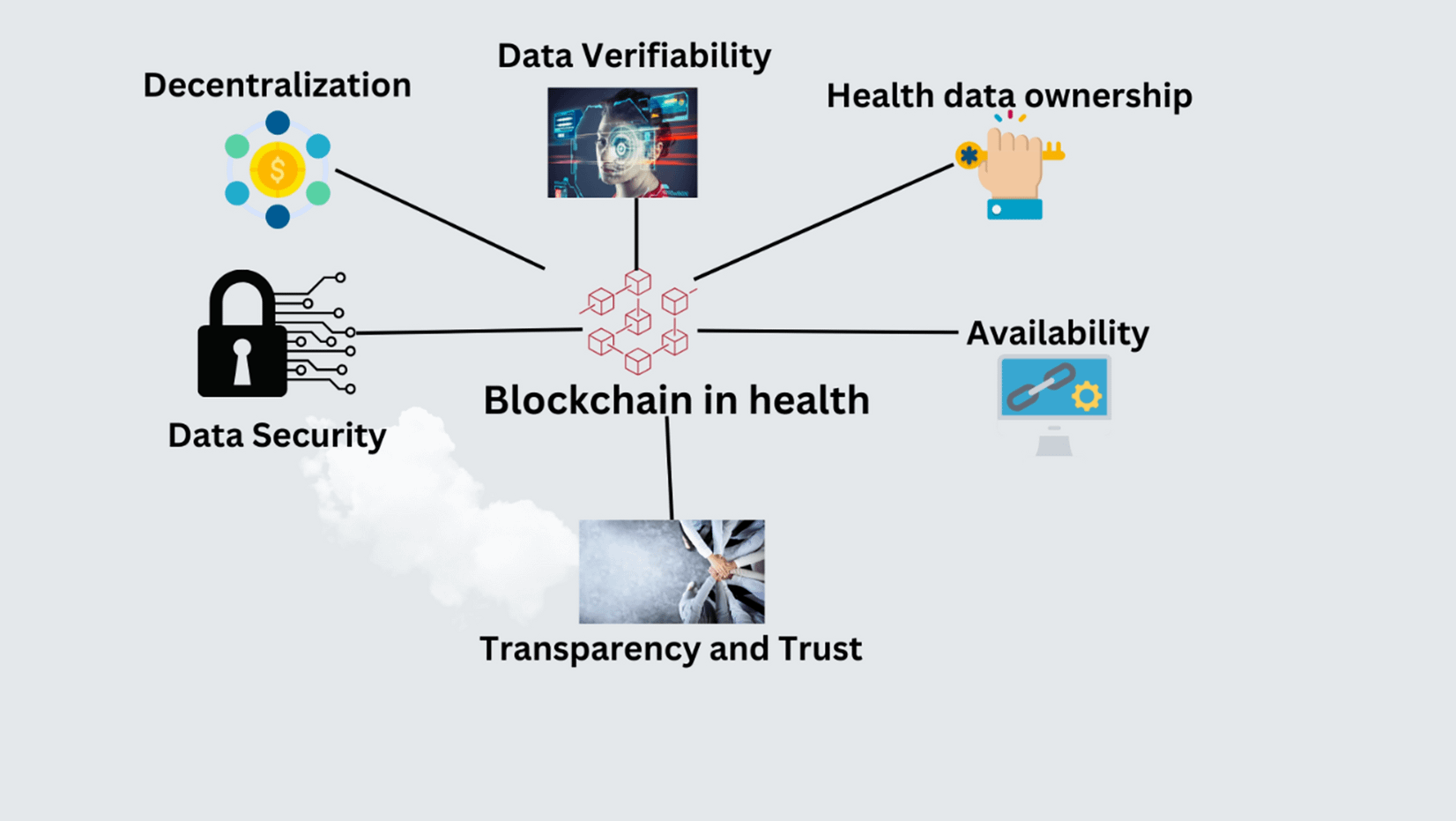

2. Decentralization

Decentralization ensures that no single entity controls the network. This reduces censorship risk and increases trust among users. Financial systems built on decentralized Layer 1 blockchains allow individuals to retain control of their assets without relying on centralized institutions.

3. Security

Layer 1 blockchains use cryptographic techniques and distributed consensus to secure data. Once a transaction is confirmed, it becomes extremely difficult to alter, providing an immutable record of financial activity. This is particularly important for applications involving high-value transfers and asset ownership.

4. Privacy and Compliance

Some Layer 1 networks focus on privacy-preserving technology while still enabling regulatory compliance. DUSK Network, for example, integrates zero-knowledge proofs to support confidential transactions and tokenized securities—bridging decentralized finance with real-world financial regulations.

Enabling the Rise of Decentralized Finance (DeFi)

Decentralized finance (DeFi) is one of the most impactful use cases of Layer 1 blockchains. Built directly on base-layer networks, DeFi applications allow users to:

Lend and borrow assets

Trade tokens on decentralized exchanges

Earn yield through staking and liquidity provision

Unlike traditional finance, DeFi operates without intermediaries. Smart contracts automatically enforce rules, reducing costs and increasing transparency.

Layer 1 blockchains provide the reliability and security needed for these applications to function at scale. As networks become faster and cheaper, DeFi adoption is likely to accelerate, drawing in both retail and institutional participants.

Tokenization of Real-World Assets

Another revolutionary application of Layer 1 blockchains is asset tokenization—the process of representing real-world assets as digital tokens on a blockchain.

These assets can include:

Stocks and bonds

Real estate

Commodities

Intellectual property

Tokenization enables fractional ownership, 24/7 trading, and instant settlement. For example, an investor could own a fraction of a commercial building or government bond and trade it globally within seconds.

Projects like DUSK Network focus specifically on compliant tokenization of securities, offering a bridge between traditional capital markets and blockchain infrastructure. This approach could unlock trillions of dollars in liquidity.

Driving Global Financial Inclusion

Around the world, billions of people remain unbanked or underbanked. Layer 1 blockchains offer a powerful alternative by providing open access to financial services through a smartphone and internet connection.

With blockchain-based wallets, individuals can:

Store value securely

Send and receive money globally

Access lending and savings tools

This has profound implications for developing economies, where traditional banking infrastructure is limited. By removing barriers to entry, Layer 1 blockchains empower individuals and small businesses to participate in the global economy.

Transforming Cross-Border Payments and Remittances

Cross-border transactions are often slow, expensive, and opaque. Layer 1 blockchains enable near-instant, low-cost transfers across borders without intermediaries.

For migrant workers sending remittances home, this can mean:

Lower fees

Faster settlement

Greater transparency

Stablecoins and blockchain-based payment rails built on Layer 1 networks are already disrupting traditional remittance providers, offering a more efficient alternative.

Challenges Facing Layer 1 Blockchains

Despite their promise, Layer 1 blockchains face several challenges:

Scalability vs. Decentralization

Increasing throughput without compromising decentralization remains difficult. Some networks sacrifice decentralization for speed, which can undermine trust.

Regulatory Uncertainty

Governments worldwide are still developing frameworks for cryptocurrencies and blockchain-based finance. Unclear regulations can slow adoption and investment.

Interoperability

With many Layer 1 blockchains in existence, seamless communication between networks is essential. Cross-chain bridges and interoperability protocols are emerging solutions.

User Experience

Complex interfaces and technical barriers can discourage mainstream users. Improving usability is crucial for mass adoption.

Long-Term Impact on the Global Financial Ecosystem

Layer 1 blockchains are not merely an incremental improvement—they represent a fundamental shift in how financial systems are built and operated .

.

Over time, we can expect:

Hybrid models combining traditional finance and decentralized infrastructure

Increased transparency in capital markets

Reduced reliance on intermediaries

As blockchain networks mature, they may become the underlying settlement layer for global finance.

Institutional Adoption and New Opportunities

Institutional investors are increasingly recognizing the potential of Layer 1 blockchains. Major banks, asset managers, and corporations are exploring blockchain-based solutions for payments, custody, and asset issuance.

This institutional interest is driving:

Greater liquidity

Improved infrastructure

Higher standards of security and compliance

For projects like @dusk_foundation and the broader Layer 1 ecosystem, this represents a massive growth opportunity.

Conclusion

Layer 1 blockchains are at the forefront of a financial revolution. By offering scalability, decentralization, security, and innovation, they are reshaping how value is created and exchanged.

From DeFi and tokenized assets to global payments and financial inclusion, these networks are building the foundation for a more open and efficient financial system. As challenges are addressed and adoption grows, Layer 1 blockchains will play an increasingly central role in the global economy.

The future of finance is decentralized—and it is being built today on Layer 1 blockchains like DUSK.