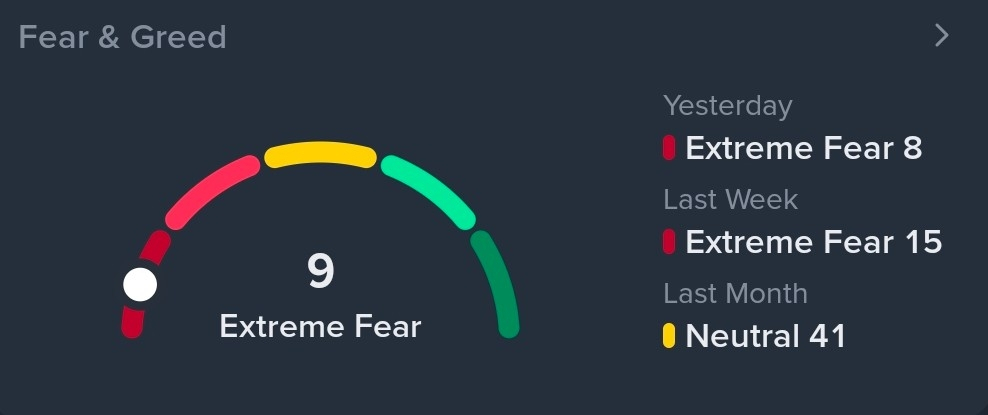

The Fear & Greed Index has fallen to around 14, a level widely classified as “Extreme Fear.” This reading signals intense risk aversion across markets, even as trading activity continues at a steady pace. Historically, such conditions reveal a sharp disconnect between sentiment and participation, a dynamic that often precedes major market inflection points.

In this article, we break down what an extremely low Fear & Greed Index means, why fear can dominate despite active trading, and how investors typically respond in these environments.

What Is the Fear & Greed Index?

The Fear & Greed Index is a sentiment indicator designed to measure investor emotions in financial markets. It aggregates multiple data points such as:

Market momentum

Volatility levels

Trading volume

Price strength

Demand for safe-haven assets

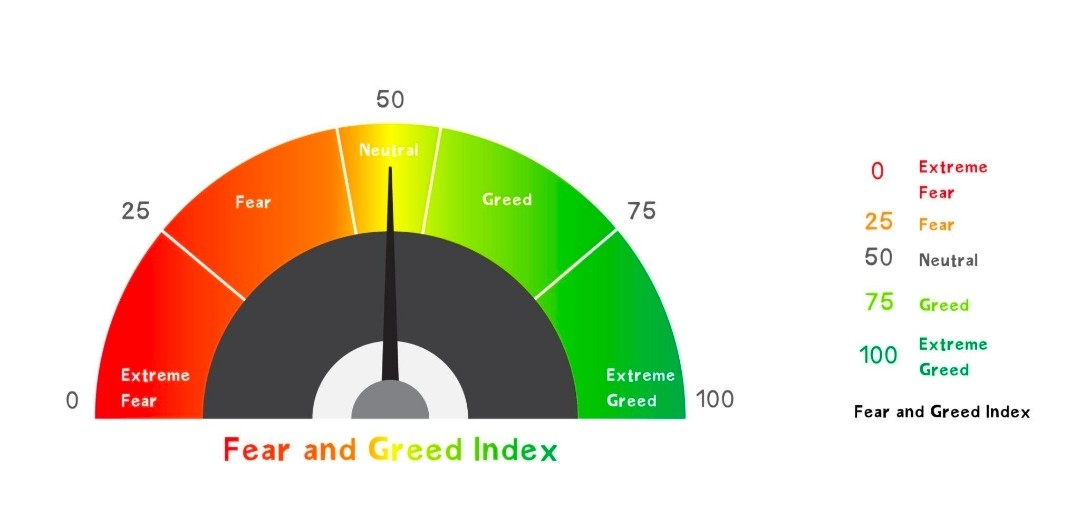

The index ranges from 0 to 100:

0–24: Extreme Fear

25–49: Fear

50: Neutral

51–74: Greed

75–100: Extreme Greed

A reading near 14 places the market firmly in panic territory.

Why Is Fear So High Right Now?

An extremely low index reading typically reflects a combination of factors:

1. Heightened Uncertainty

Macroeconomic pressure, unclear policy direction, or global instability can drive investors to reduce risk exposure aggressively.

2. Volatility Spikes

Sharp price swings increase emotional reactions. Even short-lived drops can amplify fear when confidence is already fragile.

3. Recent Market Drawdowns

Losses tend to linger psychologically. After prolonged downside action, investors often expect further declines, regardless of improving fundamentals.

4. Negative News Cycles

Markets often react more strongly to bad news than good. Persistent bearish narratives can overpower neutral or positive data.

Why Trading Activity Remains Strong Despite Fear

A common misconception is that fear equals inactivity. In reality, extreme fear often increases trading volume:

Short-term traders capitalize on volatility

Long-term investors begin gradual accumulation

Forced liquidations trigger automated selling and rebalancing

Institutions reposition portfolios quietly

This creates an environment where prices fluctuate aggressively, even though sentiment remains deeply pessimistic.

Historical Perspective: What Extreme Fear Has Meant Before

Looking back, periods where the Fear & Greed Index fell below 20 have often coincided with:

Local or macro market bottoms

Capitulation phases before stabilization

High-risk, high-opportunity zones for long-term investors

While extreme fear does not guarantee an immediate reversal, it frequently signals that much of the selling pressure has already occurred.

How Investors Typically Respond to Extreme Fear

Different market participants react in distinct ways:

Retail investors often reduce exposure or exit positions emotionally

Experienced traders focus on range setups and volatility plays

Long-term investors scale into positions gradually rather than all at once

The key distinction is time horizon. Fear-driven environments punish impatience but can reward discipline.

Key Takeaways

A Fear & Greed Index near 14 reflects extreme pessimism, not necessarily market collapse

High fear can coexist with strong trading volume and liquidity

Historically, extreme fear zones often precede stabilization phases

Risk management and patience matter more than prediction

Final Thoughts

An extremely low Fear & Greed Index is less about predicting exact market bottoms and more about understanding emotional extremes. When fear dominates headlines and sentiment metrics, markets are often closer to exhaustion than euphoria.

For investors, this is a time to stay rational, manage risk carefully, and avoid emotional decision-making. Fear may feel overwhelming, but historically, it has also been the emotion most closely associated with opportunity.