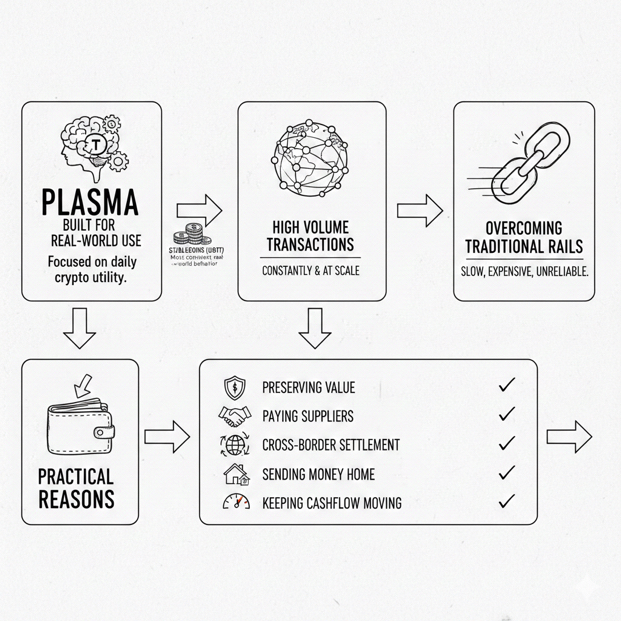

Plasma feels like it was built by people who looked at what crypto is actually used for every single day and decided to stop pretending the answer is more speculation, more hype, or more “general-purpose” everything, because the most consistent real-world behavior in this entire market is simple: people move stablecoins, especially USDT, constantly and at scale, and they do it for reasons that are practical rather than ideological, like preserving value, paying suppliers, settling cross-border business, sending money home, and keeping cashflow moving in places where traditional rails are slow, expensive, or unreliable.

That is the center of Plasma’s identity, and it’s why the project is easy to understand if you ignore the buzzwords and focus on the outcome they are engineering toward, because Plasma is not trying to be the chain for every possible category of crypto activity, it is trying to be the chain that makes stablecoin settlement feel natural, fast, low-friction, and cheap enough that high-volume payments are not an edge case but the default use pattern.

The most important part of Plasma’s design is that it treats stablecoins as the “first-class citizen” of the network, which is not just a branding line but a product philosophy that shows up in the features they highlight and the way they talk about users, because they are explicitly targeting retail users in high-adoption markets and institutions in payments and finance, which is basically a concise way of saying they want Plasma to sit underneath money movement that already exists instead of trying to invent a new reason for people to show up.

On the technical side, Plasma is built to feel familiar to Ethereum developers while behaving more like a settlement network than a general compute playground, since it is EVM compatible and centered around standard tooling, but it pairs that developer familiarity with a consensus and block production setup that is tuned for speed and settlement certainty, because payments do not benefit from vague confirmation timelines or congestion-driven fee spikes, and Plasma’s messaging repeatedly anchors itself to sub-second finality and an experience where transfers are not constantly negotiating with the chain for inclusion.

What makes Plasma distinct is how aggressively it tries to remove the “crypto tax” that normal users always run into when they just want to move stablecoins, because on many networks the stablecoin might be the asset you care about, but the chain still forces you to keep a separate volatile gas token, to understand fee mechanics, and to sometimes pay surprisingly high costs at the worst moment, and Plasma’s stablecoin-first direction is clearly trying to reverse that by leaning into gasless USDT transfers and stablecoin-centric fee behavior so the network feels closer to a modern payment rail than a typical onchain environment.

Another part of the Plasma narrative that keeps showing up is the idea of neutrality and censorship resistance being strengthened through Bitcoin anchoring, because once you accept the premise that stablecoins are turning into global settlement instruments, then the settlement layer becomes a pressure point, and Plasma wants to frame itself as a network that is harder to capture and more resistant to arbitrary interference over time, which is not a promise that everything is magically trustless but a statement about the direction they are trying to push the security and governance posture as the project matures.

The token, XPL, is best understood as the infrastructure token rather than the “product” token, since Plasma is trying to make stablecoins the thing people use and experience directly, while XPL is there to secure the network, align incentives, and support validator economics, which is generally the cleaner way to design a payments-focused system because it reduces the temptation to force the native token into every user flow where it does not belong, even though it still plays a critical role behind the scenes in how the chain stays live, safe, and economically coherent.

Plasma’s token structure is also fairly explicit about long-term alignment through allocations and vesting, because they describe a large ecosystem and growth bucket meant for liquidity, incentives, and integrations, while team and investor portions are set on multi-year schedules, which matters because payment rails do not get built in a weekend and they do not win by short-term charts, and the project is signaling that distribution and ecosystem buildout are part of the strategy rather than an afterthought.

When you look at what Plasma appears to be doing operationally, the direction is not “ship a thousand random apps” but “make stablecoin settlement easy, then drive adoption through the places where stablecoin liquidity and demand already exist,” because that is how payments infrastructure grows in the real world, and it also explains why their public content leans into stablecoin opportunity, settlement focus, and distribution-style partnerships instead of trying to compete for every narrative at once.

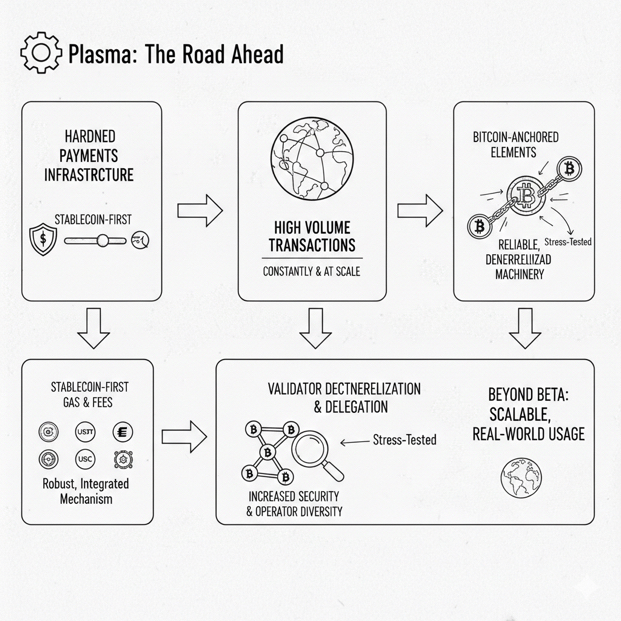

What comes next for Plasma, if you follow the logic of what they have built and what they keep emphasizing, is a sequence of upgrades that tighten the network into something that feels less like a beta chain and more like hardened payments infrastructure, since stablecoin-first gas and fee flexibility need to expand beyond slogans into a robust, widely integrated mechanism, validator decentralization and delegation need to progress so security is not defined by a narrow set of operators, and the Bitcoin-anchored elements need to prove themselves not just as an idea but as reliable and increasingly decentralized machinery that can withstand real usage and real stress.

Plasma becomes important is not whether it can produce fast blocks or claim low fees, because many chains can do that, but whether it can become the default path for stablecoin movement in meaningful corridors and platforms, because liquidity depth, routing convenience, and integrations are what turn a chain from “working technology” into “used infrastructure,” and Plasma’s entire positioning suggests they understand that the fight is won in distribution, user experience, and reliability rather than in theoretical throughput numbers.