Plasma has started to make me think less about “blockchains” and more about the kind of boring infrastructure you only notice when it’s missing—like a city’s payment switches or the backroom conveyor belts that keep supermarkets stocked. The point isn’t that it can do everything. The point is that it’s trying to make one thing feel effortless: moving stablecoins as if they’re just… money.

What makes Plasma unusual is how aggressively it designs around the stablecoin user’s actual pain: you want to send USD₮, not learn a new token, not hunt for gas, not time your transaction like you’re catching a train. Plasma’s “stablecoin-first” idea isn’t just marketing copy on the website—it shows up in the chain’s mechanics, where USD₮ transfers can be sponsored (so the sender experiences them as fee-free), and where the system is explicitly built to support stablecoins as the unit you use, not merely the unit you hold.

And this is where I like Plasma’s mindset: it doesn’t try to pretend fees don’t exist. It tries to move the fee conversation away from end users and into infrastructure policy—who sponsors what, under which limits, and how you prevent the “free lane” from getting swallowed by bots. In their own docs, the gasless USD₮ flow is described as a relayer-based design with controls like identity-aware limits and rate limiting, which reads more like payments risk management than crypto “number go up” engineering.

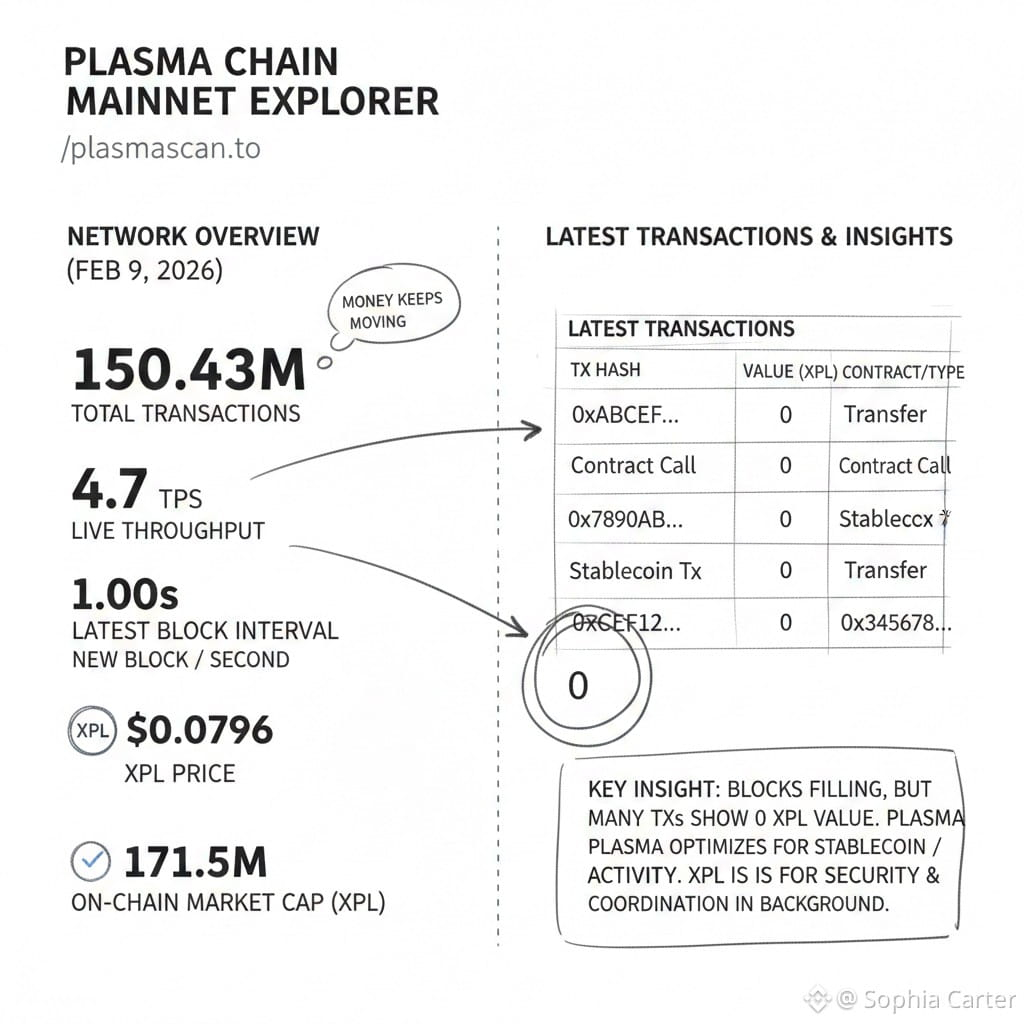

The best “latest” way to sanity-check whether Plasma is acting like a settlement rail is to peek at its pulse, not its promos. Right now (Feb 9, 2026), the Plasma explorer shows the network sitting at 150.43M total transactions, a live throughput snapshot around 4.7 TPS, and a ~1.00s latest block interval, with the newest blocks arriving every second like clockwork. It also surfaces XPL around $0.0796 and an on-chain market cap readout around $171.5M (as displayed on the explorer). That’s not a victory lap, but it is the kind of steady, metronomic behavior you want if the chain’s job is “money keeps moving.

A small detail on that same explorer page made me pause: many of the “latest transactions” show 0 XPL value moved even while blocks keep filling. That’s a reminder of what Plasma is optimizing for: the chain doesn’t need people to constantly toss XPL around for the system to be “alive.” The activity can be dominated by stablecoin transfers and contract calls while the network token does its quieter job as the security and coordination substrate in the background.

In the “what changed recently that actually matters” bucket, I’m watching token mechanics as much as partnerships, because settlement networks get judged on reliability and on whether their incentives stay clean. One fresh datapoint (updated Feb 9, 2026 on Tokenomist) is the next scheduled unlock on Feb 25, 2026, attributed to the Ecosystem and Growth allocation. That matters because Plasma’s adoption story will increasingly be measured by whether incentives translate into durable usage (wallet integrations, payment flows, liquidity venues) rather than short-lived volume spikes.

If I had to describe Plasma’s “feel” in one line, it’s this: it’s trying to make stablecoins behave like a native feature of the internet, not like a crypto ceremony. When that works, the chain becomes almost invisible—people stop talking about blocks and start talking about “it arrived instantly” and “I didn’t need to top up gas.” That’s the kind of invisibility payments infrastructure is supposed to earn.