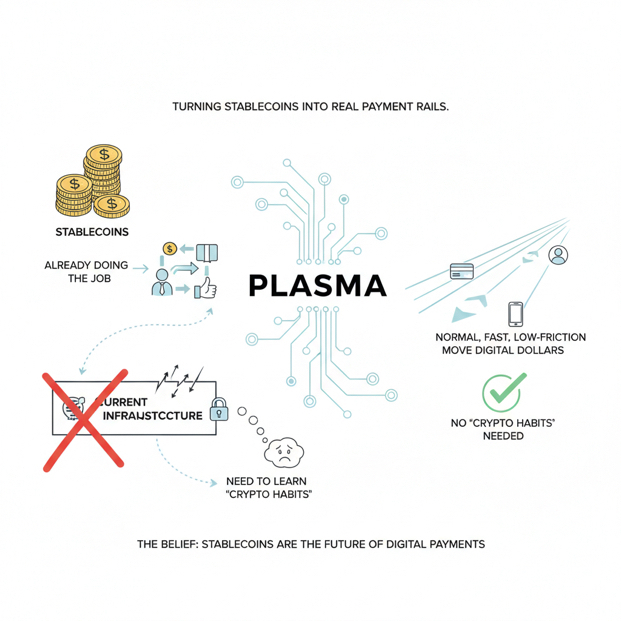

Plasma is basically built around one belief that feels obvious once you say it out loud: stablecoins are already doing the job people promised crypto would do, but the infrastructure they ride on still makes them feel like a workaround instead of a real payment rail. The project is trying to turn stablecoin transfers into something that feels normal, fast, and low-friction, where you do not need to learn “crypto habits” just to move digital dollars from one person to another.

At the core, Plasma is a Layer 1 that stays fully EVM compatible, which means developers can bring the same Ethereum-style contracts and tooling without learning an entirely new environment, but the chain is not trying to be a general-purpose everything machine, because its identity is stablecoin settlement first. The way Plasma frames it is pretty direct: it pairs an EVM execution stack built with Reth and a consensus layer called PlasmaBFT that is designed for quick, deterministic finality, because payments do not want “probably confirmed,” they want “done.” That is why the sub-second finality angle is not just a flex, it is part of the product, because the moment you aim at commerce, remittances, and high-frequency settlement, you cannot hide behind slow confirmations or unpredictable user experience.

The most distinctive part of Plasma is not that it is EVM, because plenty of chains are EVM, and it is not even speed by itself, because speed is also common now, it is the stablecoin-first design choices that try to remove the two biggest points of friction that keep stablecoins from feeling like everyday money. The first is the idea of gasless stablecoin transfers through a protocol-managed paymaster approach, where a simple USDT transfer can be sponsored so the user does not need to hold a separate gas token just to send dollars. The second is the direction toward stablecoin-first gas, where fees can be paid in the stablecoin itself rather than forcing every user into the same “buy gas token first” ritual. Those two ideas sound small until you picture a real user in a high-adoption market who receives stablecoins as income or remittances and immediately needs to send some out again, because in that moment the chain that makes them acquire and manage another volatile asset just to pay fees is not a payment rail, it is a hurdle.

Behind the scenes, those choices are harder than they look, because anything that makes transactions feel “free” creates attack surface for spam and abuse, and anything that lets multiple tokens pay fees creates complexity in pricing, execution, and risk management, so the difference between a chain that claims this UX and a chain that ships it safely is all in the details of scope, controls, and how the protocol enforces what gets sponsored and what does not. Plasma’s own language around a protocol-maintained paymaster and approved tokens is a signal that the team understands this is not meant to be a casual convenience feature, because if they want the chain to be credible for stablecoin settlement, they have to make the cheap path resilient rather than fragile.

Another layer of the story is the neutrality and censorship resistance narrative, where Plasma talks about being Bitcoin-anchored in its security direction, because if you are selling stablecoin settlement as infrastructure, you eventually run into the question of who can stop it, who can pressure it, and how the system holds up when it matters. Whether the Bitcoin anchoring ends up being a decisive differentiator depends on execution, but the intention is clear, because payments systems live or die on trust assumptions, and Plasma is trying to strengthen its trust posture in a way that feels aligned with global settlement rather than just app experimentation.

On the public surface, Plasma is not sitting in a purely theoretical stage, because the Mainnet Beta details and endpoints exist and the explorer is live, which makes the project feel more like a functioning network you can observe than a brand you can only describe. When you look at the explorer, you see consistent block production and large cumulative transaction counts, and you also see ongoing contract activity, which matters because payment chains are not built only by marketing, they become real when teams deploy contracts, integrate wallets, route bridges, and push value through the network. That is also why the ecosystem presentation matters less as a “logo wall” and more as a map of intent, because the categories and partners it highlights lean toward stablecoins, payments, infrastructure, and integration rails instead of only speculative DeFi loops, which fits the settlement-first posture.

The token story, XPL, sits in an interesting tension that Plasma has to balance carefully, because the project’s biggest user-level promise is to reduce the pain of gas and onboarding, but the token still needs a coherent reason to exist that does not break the stablecoin-first experience. Plasma frames XPL as the native asset for network security and transaction fees, and it ties the token to validator incentives and staking dynamics, which is the standard foundation, but the real question is how value capture works when the product is trying to keep users inside stablecoins. If Plasma succeeds in making stablecoin gas normal and gasless transfers common for basic flows, then XPL’s long-term importance depends on the network becoming so widely used that staking and security participation become meaningful and persistent, because you can remove friction for users without removing the need for economic alignment at the protocol layer, but you cannot fake demand for the token if the network never becomes a real settlement venue.

That is why the healthiest way to read XPL is as an alignment and security asset that grows in relevance as the chain’s settlement role grows, rather than as a token that demands direct payment from every user action in order to matter, because the whole Plasma thesis is that stablecoin movement should not feel like an obstacle course. In practice, the project will be watched on whether it can create real, sticky stablecoin volume that comes from payments and settlement loops, because if volume is real and persistent, then the network’s economic layer becomes real too, and if volume is mostly fleeting and incentive-driven, then token pressure and unlock dynamics become more visible than utility.

When people ask what is next for Plasma, it usually collapses into three things that are easy to say and hard to deliver. The first is moving stablecoin-first gas from a concept into something that is broadly live and reliable across wallets and applications, because this is the UX unlock that can make Plasma feel like the default chain for stablecoin activity instead of one option among many. The second is validator decentralization over time, because a settlement chain that aims to be neutral and globally credible cannot look like a network operated by a single party forever, and the journey from early-stage control to meaningful decentralization is where serious infrastructure projects either mature or get stuck. The third is operational hardening of the gasless layer, because if Plasma becomes known for cheap and effortless stablecoin transfers, then adversaries will test it continuously, and the protocol has to prove it can keep the experience smooth for normal users without becoming a playground for spam.

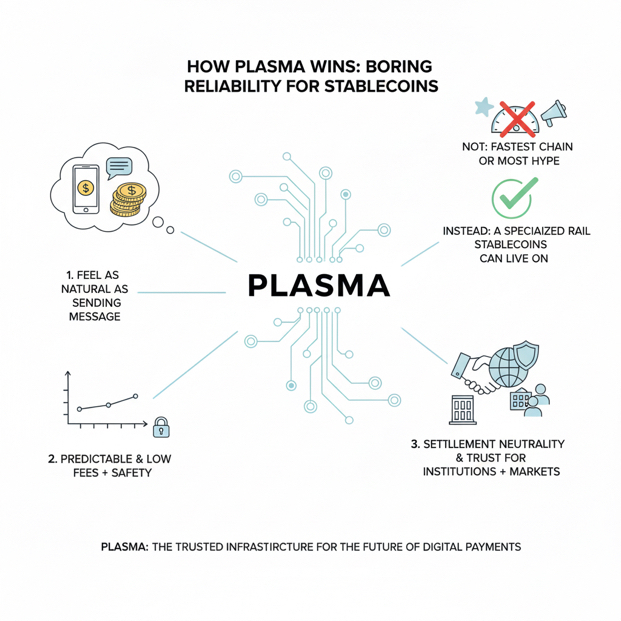

The way Plasma ultimately “wins” is not by being the fastest chain on a benchmark or by collecting the most hype for a season, because the niche it is targeting rewards boring reliability more than flashy experimentation. If Plasma can make stablecoin transfers feel as natural as sending a message, if it can keep fees predictable and low without compromising safety, and if it can build a credibility story around settlement neutrality that institutions and high-adoption markets can trust, then it becomes something more important than another EVM chain, because it becomes a specialized rail that stablecoins can actually live on.

My takeaway is that Plasma is most compelling when you treat it like infrastructure rather than a trend, because the design choices are trying to solve a very specific pain that most chains ignore, and the outcome depends on execution that users will feel immediately. If the chain delivers the stablecoin-first UX at scale while steadily strengthening decentralization and security assumptions, then Plasma has a real shot at becoming the place where stablecoins stop acting like crypto assets and start acting like money, and that is a bigger milestone than most “next L1” narratives ever reach.