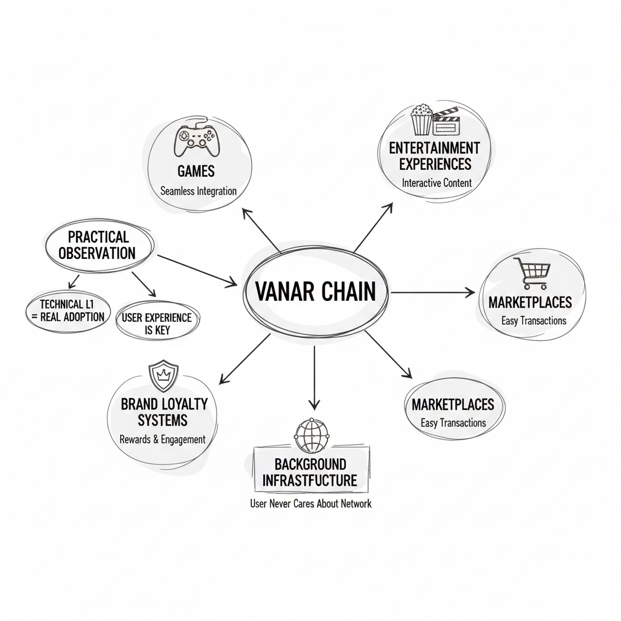

Vanar Chain reads like a project that started with a very practical observation, which is that “real adoption” does not happen because an L1 is technically impressive, it happens when the blockchain becomes background infrastructure for products people already understand, like games, entertainment experiences, brand loyalty systems, and marketplaces where the user never has to care what network they are touching.

What makes Vanar feel distinct right now is how openly it is leaning into an “AI-native infrastructure” identity, because instead of presenting itself as another EVM chain that happens to be fast and cheap, it is trying to sell the idea that onchain applications should be intelligent by default, meaning they can compress and structure data, preserve context, and support agent-like behavior rather than behaving like isolated smart contracts that only respond to explicit transactions.

If you look at the way they describe the core chain today, the messaging is very specific: Vanar calls itself “The Chain That Thinks,” and then immediately anchors that phrase to concrete claims like native support for AI inference and training, semantic-friendly data structures, vector storage with similarity search, and consensus/validation that is designed around AI workloads rather than being retrofitted after the fact, which is exactly the kind of wording that creates a measurable future test, because once builders can touch the stack they will either find real primitives or they will find branding that collapses under scrutiny.

The “behind the scenes” logic becomes easier to understand when you treat Vanar as a layered product company rather than a chain that hopes developers show up someday, because the site currently frames everything as a five-layer stack where the base layer is Vanar Chain itself and then higher layers are intended to add capabilities like data compression and semantic memory (Neutron) and contextual reasoning (Kayon), with further layers like Axon and Flows shown as coming next, which is a very deliberate attempt to turn the blockchain from a single substrate into a full application intelligence pipeline.

Neutron in particular is presented as the “data brain” piece of the ecosystem, where the emphasis is on transforming static files and platform data into AI-ready formats that can be searched, queried, and acted on, and even on that page you can see how Vanar is trying to connect the idea to mainstream business workflows by naming examples like QuickBooks and CRM-style history as targets for conversational querying, which is a tell that they are designing for enterprises and consumer-scale products rather than only for DeFi-native users.

Kayon is positioned as the reasoning layer that sits above that data layer, and their description focuses on natural-language querying, contextual insights, and compliance automation for Web3 and enterprise backends, which is basically Vanar saying that the “user interface” of blockchain should become human language and business logic rather than block explorers and raw transactions, and if that direction works it naturally supports consumer-grade experiences where the user does not need to understand the chain to get value out of it.

The most grounded signal that Vanar is still thinking in consumer verticals is that the ecosystem story keeps connecting back to entertainment and virtual worlds, and Virtua’s own site explicitly describes its Bazaa marketplace as being built on the Vanar blockchain, which matters because it ties the chain to an actual product surface where users trade and interact rather than just staking and speculating, even though the real adoption question remains whether independent teams and third-party apps follow beyond the core orbit.

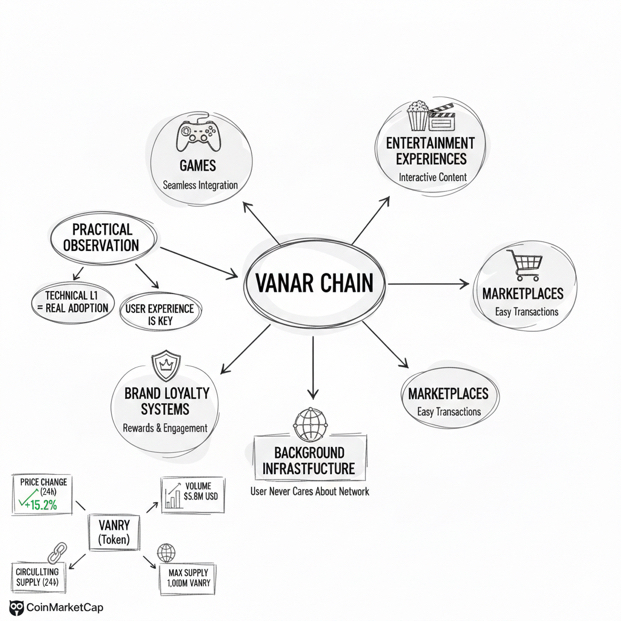

On the token side, VANRY is framed as a utility-first asset rather than a purely narrative token, because the documentation is explicit that it is used to pay transaction fees and that holders can stake it through a delegated proof-of-stake style mechanism to support network security while earning rewards, and the docs also describe a tiered fee design where common actions like token transfers, swaps, minting NFTs, staking, and bridging sit in the lowest tier, with the intent of keeping everyday usage cheap while making abusive, oversized transactions more expensive.

The deeper token “story” is in the whitepaper, because it sets the maximum supply at 2.4 billion, states that 1.2 billion were minted at genesis, and frames additional issuance as being produced through block rewards rather than arbitrary minting, and this is also where Vanar describes the TVK-to-VANRY transition structure on a one-to-one basis, which is important for continuity because it tells you the project wants to present VANRY as an evolution rather than a dilution event, even though the real-world investor checklist still includes watching treasury management, emissions reality, and how incentives actually play out over time.

Your Ethereum link matters because it is the “liquidity rail” that makes VANRY legible to the wider market, and Etherscan shows the VANRY ERC-20 contract at the exact address you shared, which is useful for anyone tracking holders, transfers, and exchange/DEX integrations, while the project narrative on Etherscan also reinforces their positioning around mainstream entertainment use-cases rather than DeFi-first branding.

When people ask why this matters from an adoption point of view, the simplest answer is that Vanar is trying to collapse the gap between blockchain and product UX by making intelligence, context, and automation native to the stack, and if they actually deliver those higher layers as usable tooling then developers can build experiences that feel closer to modern consumer apps, where the chain becomes the trust and settlement layer and the user interacts with agents, workflows, and interfaces that do not require crypto fluency.

What comes next is therefore less about another “partnership announcement” cycle and more about whether the layers that are currently marketed as a stack become tangible developer primitives with clear documentation, predictable performance, and real reference apps that are not only first-party, because Vanar has already set itself a high bar by claiming AI-native features at the chain level and by framing Neutron and Kayon as system layers rather than optional products, so the next phase is essentially proving that these are not just names but working components that third parties can build on without hand-holding.

For “latest updates” that are easy to verify without guessing, Vanar’s own site currently lists event presence happening right now in the calendar window around February 9–12, 2026, with AIBC Eurasia in Dubai (Feb 9–11) and Consensus Hong Kong (Feb 10–12), which is a strong sign they are in a visibility and ecosystem-building cadence at this exact moment rather than sitting quiet.

For the “last 24 hours” specifically, the cleanest objective update that changes hour-by-hour is market activity rather than product shipping notes, and CoinMarketCap shows the rolling 24-hour price change, volume, circulating supply, and max supply figures for VANRY, which is the best way to describe what is “new” in a strictly time-bounded sense without inventing announcements that may not exist.

My takeaway, said like a person rather than a deck, is that Vanar is trying to become the chain you do not notice because the experience is carried by products people already like, and at the same time it is trying to sell a bolder idea that onchain apps should behave like intelligent systems that can store context and reason over data, which makes the upside narrative compelling but also makes the execution test very simple, because the next chapter is either “developers can actually build with this stack and users arrive through real apps,” or the market reclassifies it as another EVM L1 with good positioning and an ecosystem that never expands beyond the home orbit.