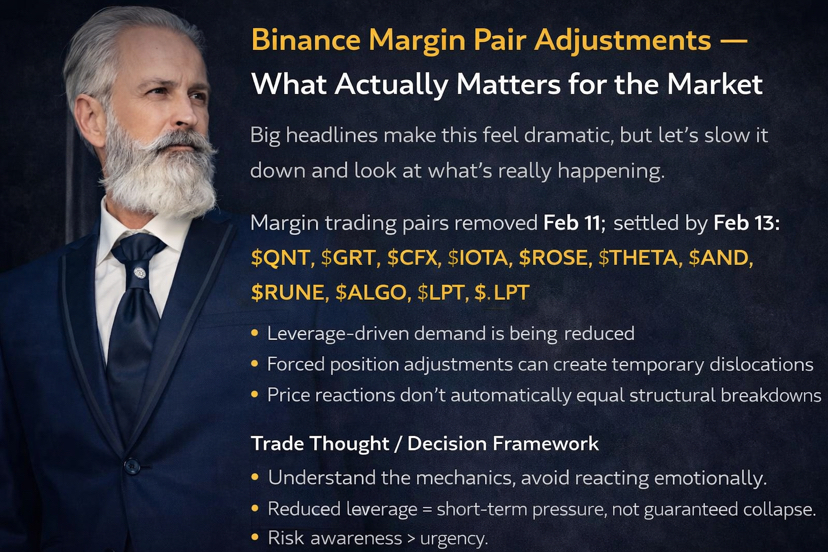

Big headlines make this feel dramatic, but let’s slow it down and look at what’s really happening.

Binance has announced the removal of several margin trading pairs, with lending set to stop on February 11, and positions being settled by February 13. This affects a group of altcoins including $QNT, $GRT, $CFX, $IOTA, $ROSE, $THETA, $SAND, $RUNE, $ALGO, and $LPT.

This isn’t a spot delisting — and that distinction matters. What’s changing here is leverage availability, not the existence of the assets themselves. When margin support is removed, it often leads to short-term volatility as leveraged positions are forced to unwind, especially if liquidity is already thin.

Markets tend to react before the actual event, not after. Much of the price movement around announcements like this comes from repositioning and risk reduction, not long-term reassessment of fundamentals.

What’s important now is context:

Leverage-driven demand is being reduced

Forced position adjustments can create temporary dislocations

Price reactions don’t automatically equal structural breakdowns

Trade Thought / Decision Framework

This is about understanding mechanics, not reacting emotionally.

Reduced leverage increases short-term pressure, not guaranteed collapse.

Let price show acceptance or stabilization after the adjustment.

Risk awareness > urgency.

For clarity — this is market structure discussion, not advice or a signal.

Question:

Do you usually treat leverage removals as temporary volatility events — or long-term trend shifts?