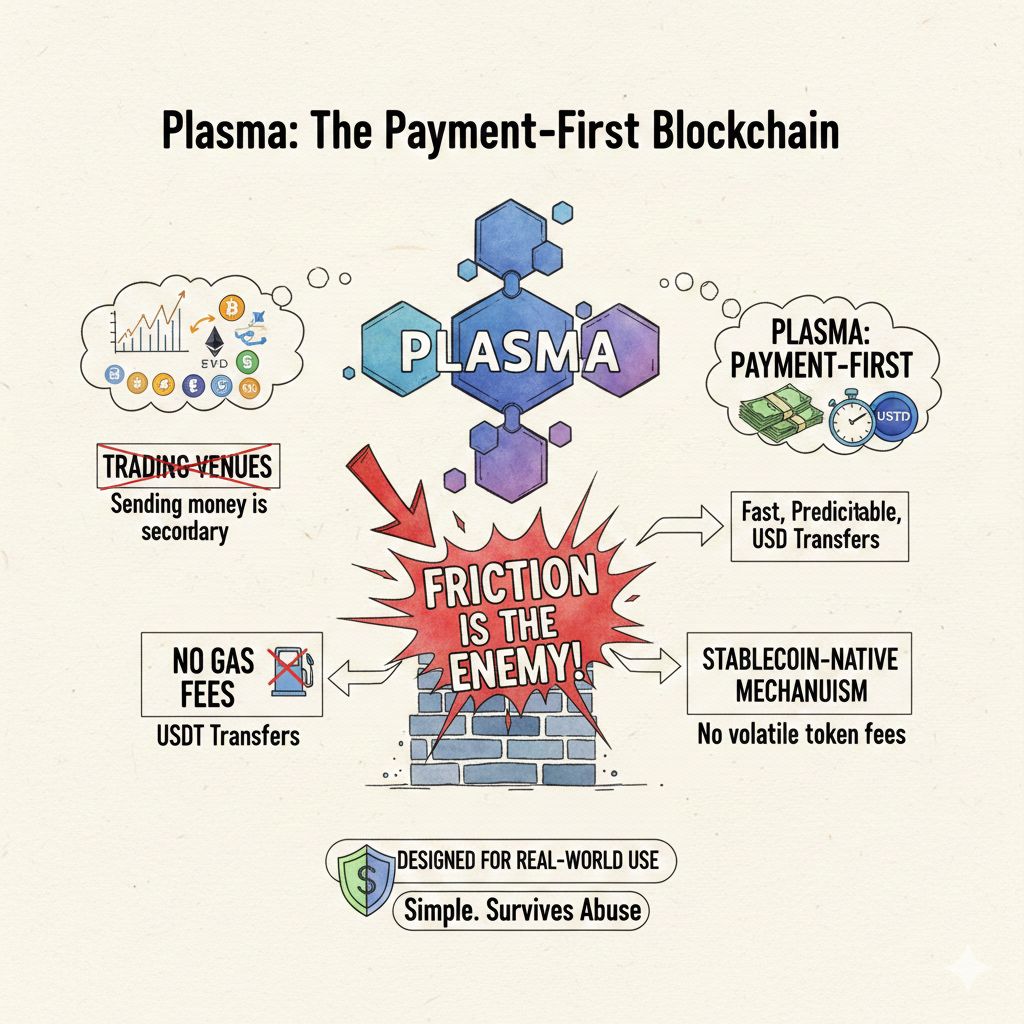

If you squint at most “payment chains,” they still look like trading venues that also let you send money. Plasma reads like the opposite: a chain that starts from the boring, practical reality of payments people want to move dollars quickly, predictably, and without learning a new hobby.

The part that feels most honest is how Plasma treats friction as the enemy, not “competition.” Gasless USDT transfers aren’t just a nice-to-have; they’re a refusal to make users buy a volatile token just to pay a fee. Plasma’s docs frame this as a deliberately scoped, stablecoin-native mechanism (not a blanket “everything is free” subsidy), which is exactly how you build something that’s supposed to survive real-world abuse while still feeling simple.

And the speed story lands differently when you view it through a payments lens. Sub-second finality isn’t about bragging rights; it’s about compressing uncertainty. In payments, the most expensive thing is not milliseconds—it’s “maybe.” If the system behaves like settlement, you can re-use liquidity faster, reduce operational buffers, and stop treating every transfer like it might roll back. Plasma’s positioning around stablecoin settlement plus EVM familiarity is basically trying to make “crypto rails” feel like infrastructure rather than an experiment.

The recent update that actually changes the shape of the product is the integration with NEAR Intents (reported January 23, 2026). This matters because it attacks a problem payments teams hate: the messy middle. Bridging, routing, signing multiple steps, hunting liquidity—those are where users drop off and where institutions rack up support costs. Intents shift the workflow to outcomes (“I want USDT there”), and solvers handle the path. If Plasma becomes a stablecoin settlement endpoint that’s easy to “arrive” at from elsewhere, that’s a genuine distribution advantage—not just another partnership logo.

Now, the “latest 24 hours” snapshot (as reflected by public dashboards when checked today) is what I look at to sanity-check whether the chain is behaving like a payment rail or like a narrative.

DeFiLlama’s Plasma chain page currently shows:

Stablecoins market cap ~ $1.836B, with USDT dominance ~ 76%

Chain fees (24h) ~ $385

DEX volume (24h) ~ $7.69M

App fees (24h) ~ $312,575

That combination is interesting. Low chain fees can mean “nobody is using it,” but paired with a large stablecoin base, it can also mean “the rail is cheap by design.” For stablecoin settlement, cheap is not a promotional tagline—it’s the product. Meanwhile, app-level fees and DEX volume hint that activity exists above the base layer, even if Plasma’s identity is “payments first.”

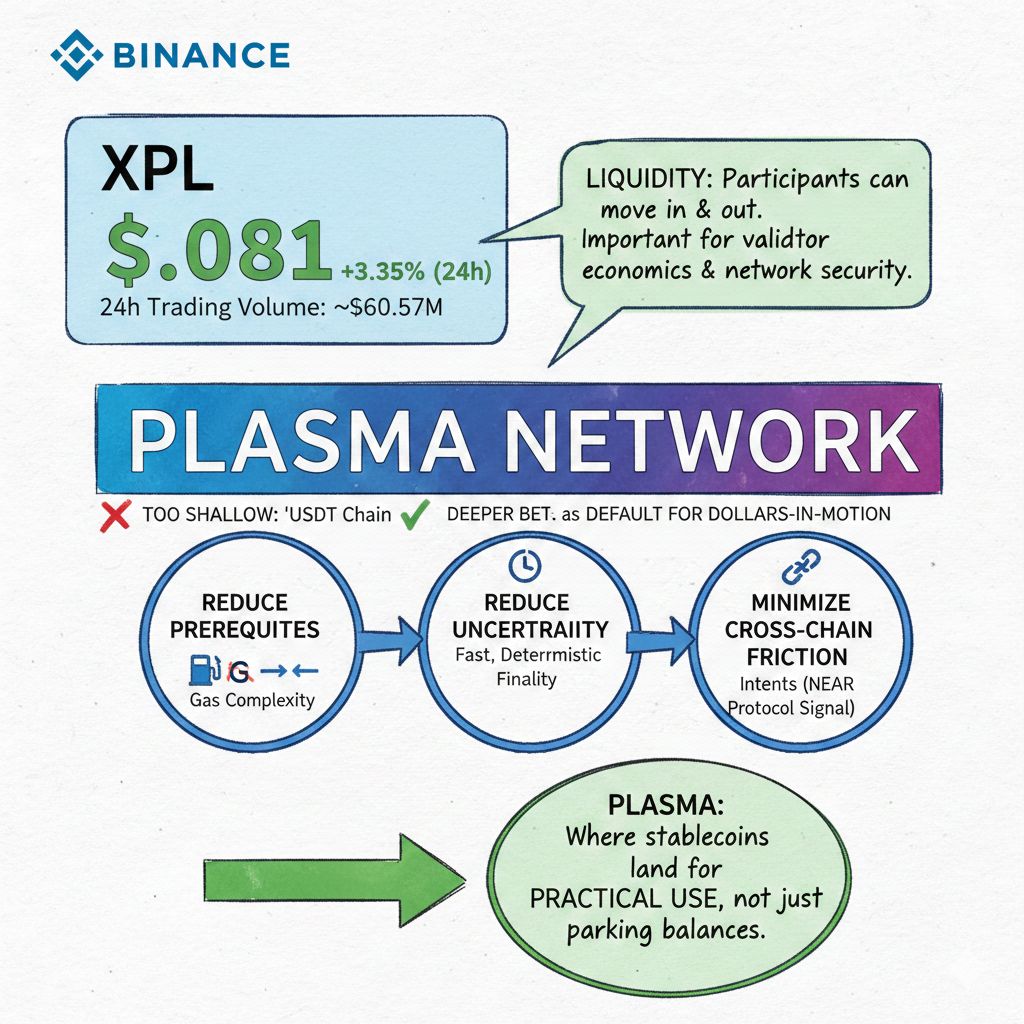

On the market side (also last-24-hours data), Binance’s price page shows XPL around $0.081 with ~$60.57M 24h trading volume and +3.35% over 24h at the time of viewing.

I don’t read that as “bullish” or “bearish” by itself—I read it as: the token is liquid enough that participants can move in and out, which matters if the token is expected to play a serious role in validator economics and network security over time.

Where I stay cautious is the temptation to summarize Plasma as “the USDT chain.” That’s too shallow. The deeper bet is that stablecoins are shifting from crypto’s best app to a default format for dollars-in-motion, and that the winning infrastructure will be the one that removes prerequisites (gas complexity), reduces uncertainty (fast, deterministic finality), and minimizes cross-chain friction (intents). The NEAR Intents move is a signal that Plasma wants to be the place stablecoins land when someone needs to do something practical—not just the place they park balances.

If I were tracking “is this working?” over the next few weeks, I wouldn’t obsess over TPS screenshots. I’d watch whether that ~$1.8B stablecoin base holds or grows, whether the 24h fees stay predictably low as volume rises, and whether intent-based routing starts showing up as smoother inflows and more repeat usage. Because if Plasma wins, it probably won’t feel like a crypto win it’ll feel like nothing happened at all, which is exactly what good payments infrastructure looks like.