Vanar makes me think about the one part of “mass adoption” that crypto people rarely admit out loud: normal users don’t struggle with blockchains because they’re slow… they struggle because nothing feels predictable.

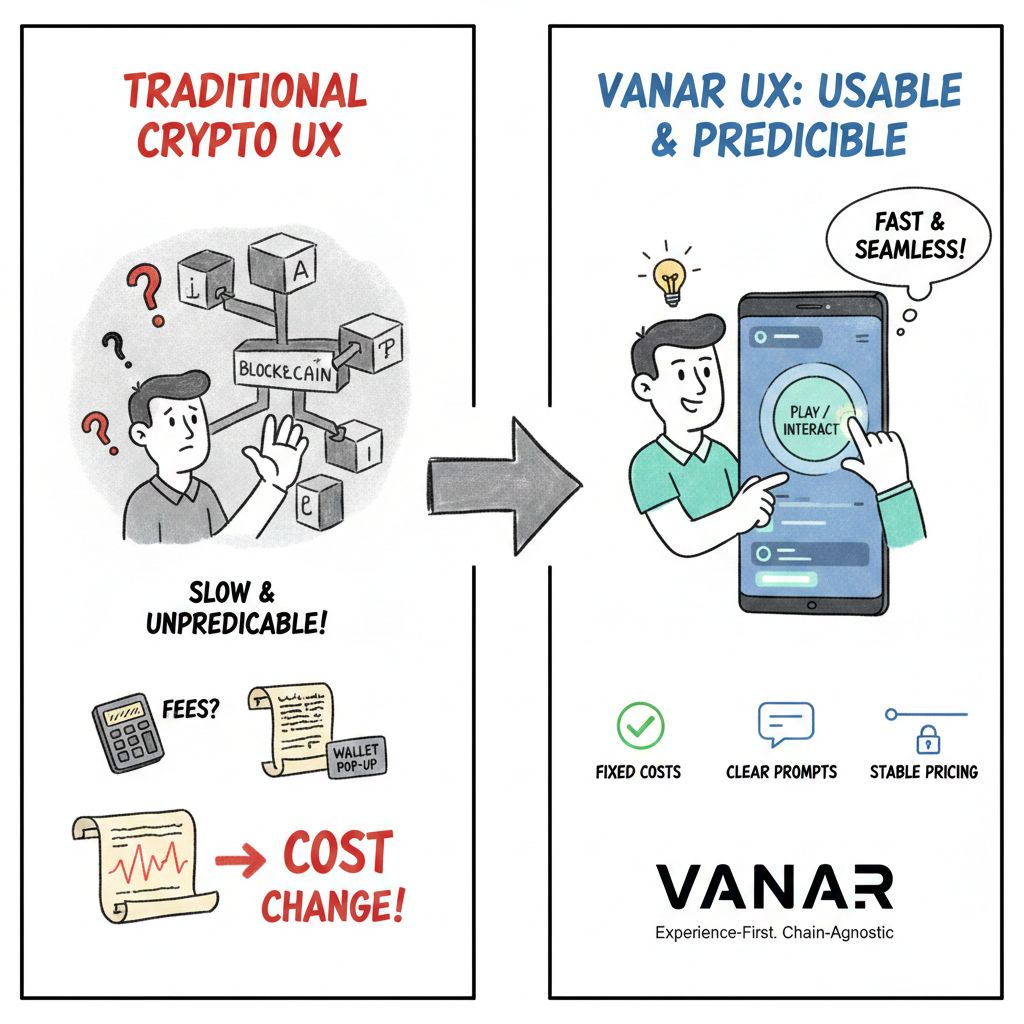

In a game or an entertainment app, people will tap a button ten times in a row without thinking. They won’t stop to calculate fees, they won’t read a wallet pop-up like it’s a legal contract, and they definitely won’t tolerate a moment where the cost suddenly changes for no obvious reason. That’s why Vanar’s whole vibe feels different. It’s less “look how decentralized we are” and more “how do we make this usable when nobody cares what chain it’s on?”

The strongest signal isn’t even speed. It’s the focus on stability. Fee predictability sounds boring, but boring is exactly what mainstream products need. If you want the next billion users, “sometimes cheap, sometimes expensive” isn’t a feature it’s a support nightmare. A chain that treats fees like a user experience promise is basically speaking the language of product teams, not just crypto traders.

The other thing that stands out is how Vanar talks about “meaning,” not just transactions. A lot of chains are great at recording what happened: wallet A sent to wallet B, token moved, block confirmed. But real-world use cases depend on context what that token represents, what rights come with it, what rules are attached, what proof exists behind it. That’s the part where most systems end up relying on off-chain servers, private databases, or “trust me bro” middleware.

Vanar’s AI angle gets interesting when you look at it through that lens. Instead of “AI” as a marketing layer, it’s positioned as a way to store and use context more intelligently. The idea is basically: don’t just store events on-chain, store compact, structured objects that an application can interpret and act on. If an app can ask, “what is this thing?” before it grants access or moves value, you reduce the number of fragile off-chain steps where things can be manipulated or quietly changed.

That matters a lot for the spaces Vanar keeps leaning into: gaming, entertainment, brands, memberships, and consumer experiences. These aren’t environments where people patiently learn new tools. They are environments where friction kills retention instantly. If a ticket doesn’t scan, if an item doesn’t arrive, if a payment hangs, the user doesn’t blame “blockchain complexity.” They just uninstall.

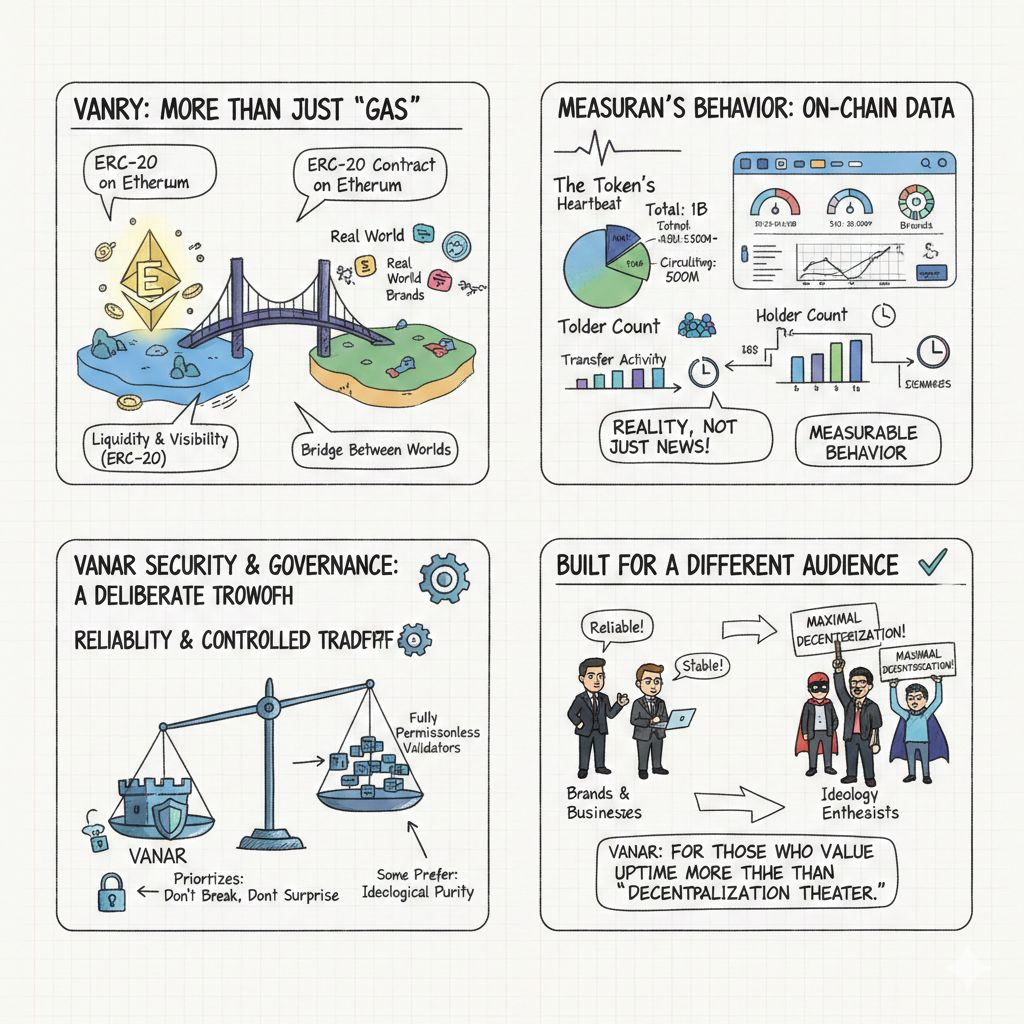

The token side is also more practical than people make it sound. VANRY isn’t just “gas.” It’s also the bridge between worlds, because the ERC-20 contract on Ethereum is where a lot of liquidity and visibility live. And the on-chain data gives you a reality check that doesn’t depend on announcements: supply parameters, holder count, transfer activity — that’s the heartbeat of how widely distributed and actively used the token is. It’s not “news,” it’s measurable behavior.

On security and governance, Vanar seems to be making a very deliberate tradeoff: optimize for reliability and controlled growth rather than ideological purity. Some people will always prefer fully permissionless validator sets from day one. But if your target is brands and consumer-scale apps, the priority often becomes “don’t break” and “don’t surprise anyone.” That doesn’t automatically make it better, it just means it’s built for a different audience one that cares about uptime and predictable rules more than maximal decentralization theater.

If I had to describe what Vanar is really betting on, it’s not that the world needs another fast chain. It’s betting that the next wave of adoption is about more decisions happening on-chain, not just more transactions. Decisions require context. Context is messy. And if Vanar can actually make context usable, verifiable, and automatable without shoving everything off-chain, it starts to look less like “another L1” and more like infrastructure for experiences people actually use every day.

That’s the part that feels worth watching: not the slogans, not the hype, but whether this chain can make Web3 feel boring in the best way stable, predictable, and invisible enough that normal users stop noticing it’s crypto at all.