The market shows volatility and mixed signals: sellers have been active, but some analysts see early buy signals near key support zones.

Technical indicators suggest $BTC is in a sideways phase as traders look for a breakout either back above resistance or a drop below support.

A move above $74,000–$78,000 could spark renewed momentum. Analyst models and on-chain data sometimes point to potential upside if key resistance breaks.

Bearish risk: A break below support around $66,000 might open the door to lower price zones or deeper corrective action.

$BTC price swings are influenced by market sentiment, trading volume, and macro conditions, including investor risk appetite and global economic news.

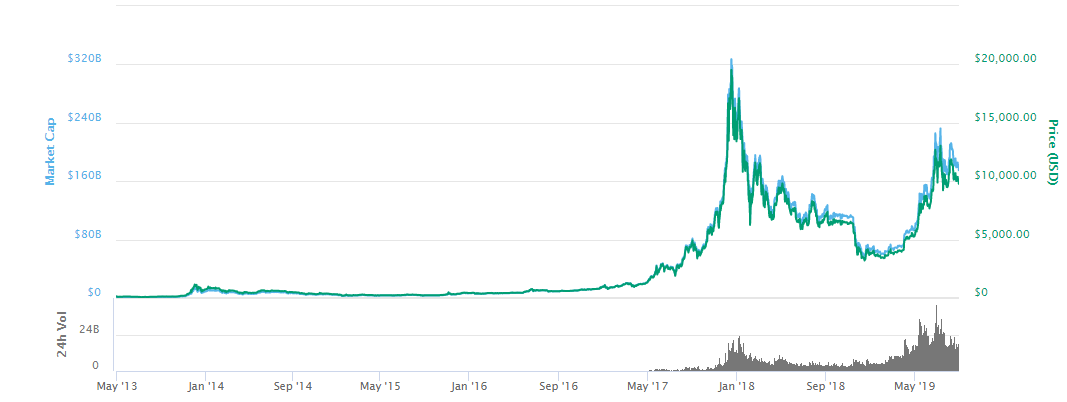

Bitcoin has historically been volatile and can react strongly to both positive and negative catalysts, including institutional flows or regulatory headlines.

Here’s a short Bitcoin (BTC) market analysis you can use for Binance Square or general BTC update, with a chart image imagede

$BTC price is trading around key zones with mixed momentum — recent volatility has shown both rebounds and risks of deeper pullbacks.

.

.

Analysts see BTC hovering near critical support levels (~$68,000–$70,000). Breaking below this could lead to stronger bearish moves, while holding above it may stabilize price.

Market Sentiment

Indicators suggest bearish pressure recently, but the market is not deeply oversold yet — meaning rebound chances exist if buyers enter.

Broader crypto news also shows BTC recently rebounding above $70,000 after a dip earlier, which highlights market volatility and mixed signals.

If BTC stays above support, this could signal sideways price action or slow upward movement.

If BTC breaks below support zone hard, the market might move toward deeper correction

#USRetailSalesMissForecast #ADPJobsSurge #BinanceHODLerMMT #PrivacyCoinSurge

BTC67,972.91-1.53%

BTC67,972.91-1.53%