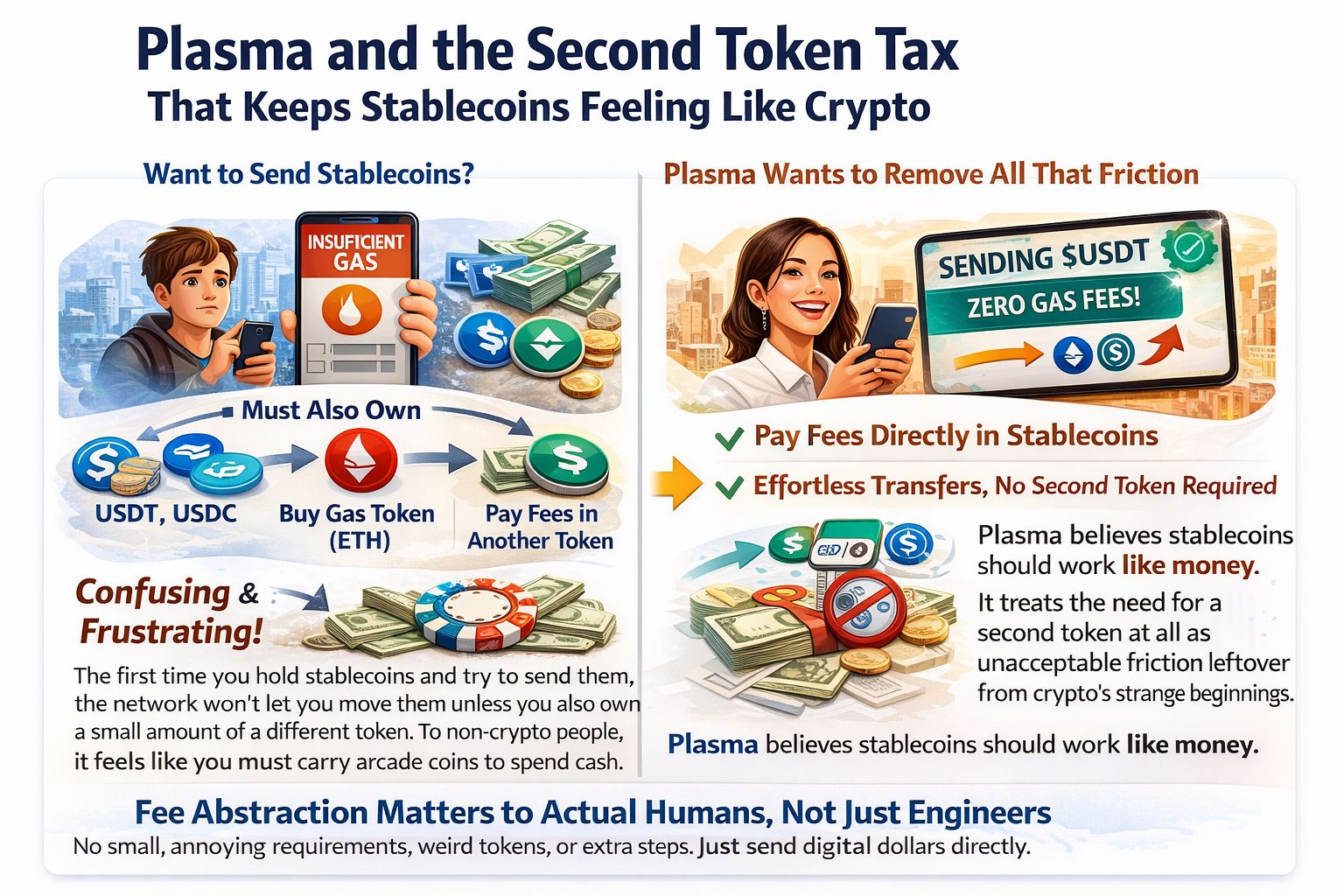

The first time you hold stablecoins and try to send them, crypto reveals its weirdest little secret. You can have digital dollars sitting in your wallet, but the network won’t let you move them unless you also own a tiny amount of some other token that has nothing to do with the money you’re trying to send. To people who live inside crypto, that’s normal. To everyone else, it feels like being told you can’t spend cash unless you also carry a handful of arcade coins. That one tiny requirement is more than a fee problem. It is a trust problem, because the moment a person is forced to buy an unfamiliar token just to complete a simple transfer, the whole experience starts to feel like a trick. Plasma is interesting to me because it treats that friction like the core issue, not an annoying side quest, and that design tone changes the entire story. It is not trying to win an identity contest about who is fastest or who is most philosophical. It is trying to make stablecoins behave like what people already think they are, money you can actually use without learning the chain’s private rituals.

When most chains talk about adoption, they still talk like engineers speaking to engineers, and the solution is almost always more throughput, more block space, more optimizations, and a better chart. Performance matters, obviously, but speed does not fix the moment when a new user stares at an error message that basically says you are poor in the wrong currency. Plasma feels like it was designed by people who have watched that moment happen in real life, the pause, the confusion, the why do I need this token, the hesitation, then the person closes the app and quietly decides crypto is not for them. That is why fee abstraction matters more than raw speed in practice. You can make a chain fast and still lose the user if the flow demands extra assets, extra steps, extra decisions, and extra places to make a mistake. Plasma is built around the idea that stablecoin payments should not require a second token at all, and it tries to hardwire that expectation into the network rather than leaving every application to invent its own fragile workaround.

What makes Plasma’s approach feel less like a buzzword and more like architecture is that it describes two different ways to solve the gas problem depending on the scenario. One is custom gas tokens, which basically means the network can allow certain ERC 20 assets, including stablecoins, to be used for transaction fees through a protocol level paymaster. Instead of asking users to keep a separate gas token around, the system can price the gas cost and deduct it in the asset the user already holds, while the paymaster handles the underlying mechanics. The second is a zero fee USD₮ transfer experience designed specifically for the most common action people want to do, which is simply moving USD₮ from one address to another without thinking about gas at all, using a sponsored flow with rate limits and controls to prevent abuse. Even if someone never reads the documentation, the intent is clear. Plasma is trying to standardize the thing that normally breaks, the gap between owning stablecoins and being able to use them, and it is trying to do it in a way that feels consistent across apps rather than scattered across a thousand different relayers with different rules.

This is also why Plasma’s technical choices land differently when you look at them in context. Yes, it is EVM compatible, and yes, it uses Reth for execution and a BFT style consensus design it calls PlasmaBFT, but those are not the emotional core of the project. They are the practical foundation that lets builders bring existing tooling, existing contract patterns, and existing integrations without a painful rewrite, which is important if your goal is to become a stablecoin payments rail rather than a niche experiment. If you want stablecoins to move in high volume, you need developers to ship quickly and you need infrastructure operators to run things reliably, and familiarity is not a luxury in that world. You cannot demand everyone relearn everything. Plasma’s stack looks like it is trying to keep the familiar parts familiar while changing the part that users actually feel in their hands.

The Bitcoin anchoring narrative is the other piece that stands out, and it is a topic where it is smart to be cautious because plenty of projects borrow Bitcoin’s reputation like a costume. What makes Plasma’s version more believable is that it frames Bitcoin less as an aesthetic and more as a strategic base layer for neutrality assumptions. Stablecoin settlement is not neutral in the real world. Issuers can freeze. Regulators can pressure. Validators can censor. Infrastructure providers can become chokepoints. Plasma’s idea is that anchoring parts of the system to Bitcoin’s security and settlement assumptions can widen the neutrality base, or at least make it harder for any single ecosystem’s politics to fully capture the story. It is not presented as perfect, and it should not be treated as perfect, because bridges and wrapped assets always introduce trust assumptions. But Plasma is fairly explicit that its bridge and pBTC design are still under development and that the trust model is a living subject rather than a finished product. That kind of honesty matters. When a project pretends bridges are magically trustless, it is usually a sign they are selling vibes. When a project spells out that assumptions exist and that the design is evolving, it feels more like builders doing architecture in public.

There is also a quieter signal in how Plasma talks about payments privacy. Most stablecoin users do not want the whole internet to see who they paid, how much, and when, and businesses especially hate that. Plasma does not pretend it is turning the EVM into a full privacy chain overnight, but it still treats confidentiality as a real requirement rather than an optional future dream. That attitude lines up with the stablecoin payments focus. If you want real usage, you have to acknowledge the everyday discomfort people feel when every transfer is publicly legible, and you have to explore ways to support private or selectively disclosed transfers without destroying composability or accountability. Even if the module is still maturing, the fact that it exists in the design conversation tells you Plasma is thinking about real world constraints, not just crypto tribal metrics.

And then there is the simplest, most grounding part, the network is not only a whitepaper concept. Plasma has a mainnet beta environment and a public explorer, which is where you can actually see blocks producing and transactions flowing rather than only reading about what might happen someday. Explorers never tell the full story, but they are a reality check. A payments chain is ultimately judged by whether it stays up, whether transfers settle cleanly, whether fees stay predictable, and whether the experience stays simple across the messy long tail of wallets, users, and integrations. The visible infrastructure suggests Plasma is actively moving from narrative to operations, and that is where projects either become real or fade into a quiet archive.

Stepping back, what I find most compelling is that Plasma does not feel like it is trying to be the everything chain. It feels like it is trying to remove one specific recurring irritation that has been holding stablecoins back from feeling like actual everyday money. In a world where stablecoins are already behaving like digital dollars in people’s minds, the infrastructure should not keep treating them like exotic tokens that require extra rituals to move. If Plasma succeeds at making the first stablecoin transfer feel effortless, not fast in a benchmark sense, but emotionally effortless in a human sense, then it will have solved something deeper than speed. It will have solved the moment where a person decides whether this technology is for them or not, and that decision is usually made long before they care about block times, consensus names, or execution clients.