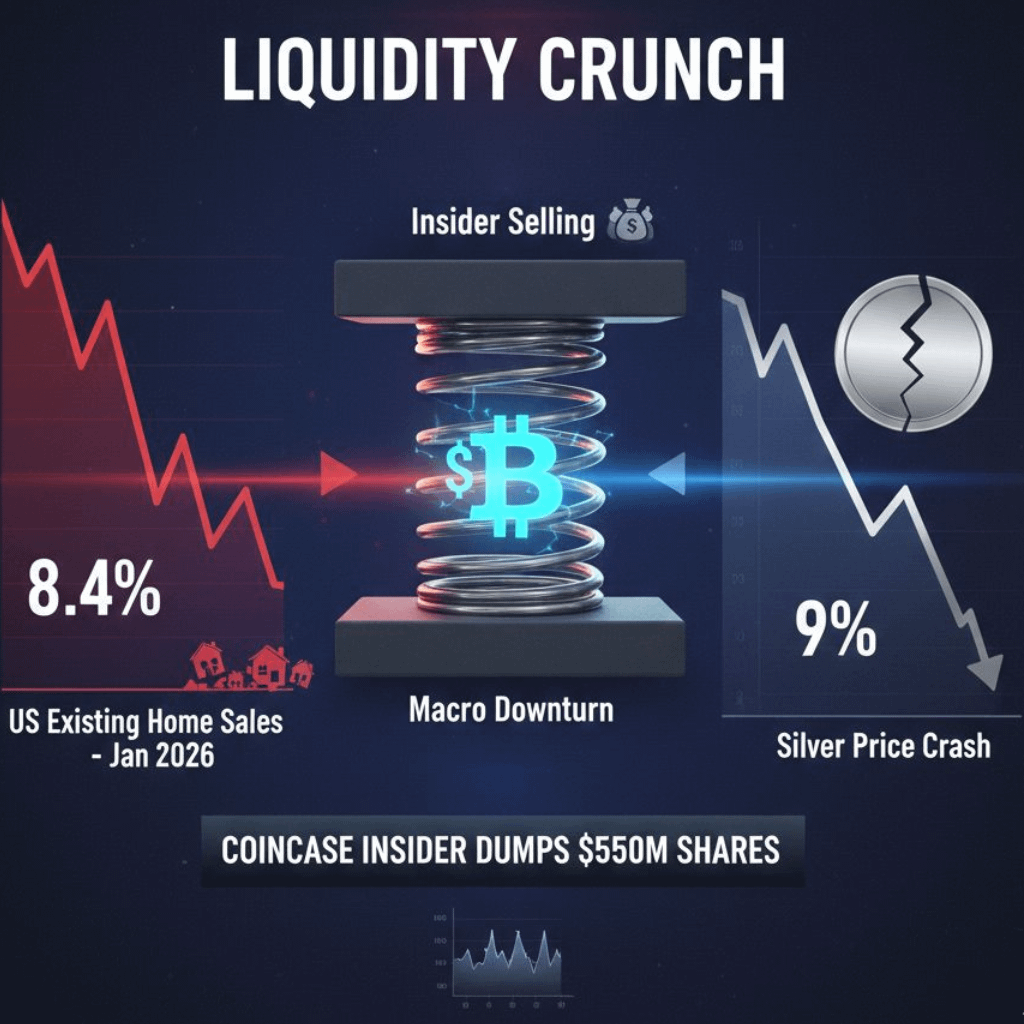

The crypto market is entering a "stress test" phase. While price action remains deceptive, the underlying data points to a massive realignment of capital. Bitcoin is currently compressing near $66,643, acting like a tightly coiled spring in a high-pressure zone.

1. The Macro Shock: Real Estate & Commodities

The broader economy is flashing a warning sign we haven't seen in years.

Housing Crisis 2.0: US existing home sales plunged 8.4% in January, the worst print since 2022. This signals a severe liquidity crunch.

Silver Liquidation: Silver took a brutal 9% hit down to $76.7, as retail investors rush to liquidate assets for cash. When traditional safe-havens bleed, risk assets like $BTC usually follow.

2. Insider Distribution: The $550M Signal

Perhaps the most alarming signal comes from within the industry. Coinbase CEO Brian Armstrong has unloaded over 1.5 million shares (worth approximately $550M) since last April. When exchange executives de-risk this heavily during a period of "compression," it often signals a local top or a major shift in market structure.

3. New Volatility Tools: Polymarket's 5-Minute Bets

Adding fuel to the fire, Polymarket has just launched 5-minute price direction bets for Bitcoin. This "ultra-short-term" gambling introduces massive leverage into an already tight range, making "stop hunts" and "liquidity sweeps" between $66,000 and $68,000 more likely than ever.

The Verdict: Neutral with Bearish Bias

Technically, $BTC is defending the $60,000–$62,800 support zone. However, with Extreme Fear hitting levels of 5 to 8 on the index, the risk of a "liquidity flush" toward $55,000 is real.

Trading Strategy: Do not force trades in this range. A daily close below $65,520 could trigger a deeper cycle reset.

Poll: What is your next move in this environment?

Accumulate more (HODL)

De-risk and wait for $55k

Trade the 5-min volatility on Polymarket

#BTC #bitcoin #CryptoNews #coinbase #macroeconomy