Vanar Chain is positioning itself around speed, scalability, and asset execution — but the real question is timing.

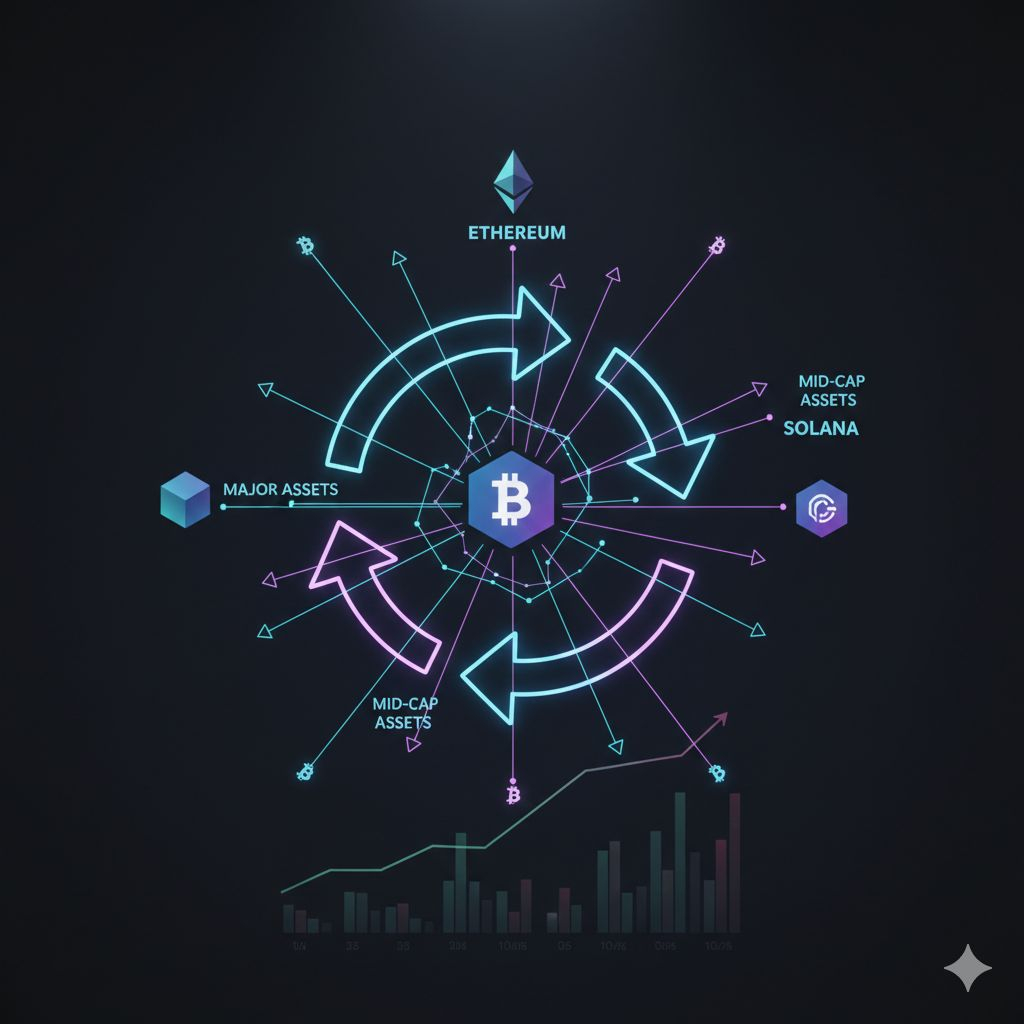

With liquidity rotating between majors and selective mid-caps, infrastructure-focused ecosystems often benefit during transitional phases.

What stands out about Vanar is its low-latency architecture and focus on real-time digital asset environments — particularly relevant for gaming, NFTs, and high-frequency DeFi interactions.

If capital continues rotating from large caps into emerging ecosystems, projects with operational utility — not just narrative hype — tend to attract sustainable attention.

The key is monitoring volume expansion and ecosystem activity rather than short-term price spikes.

Early positioning matters more than late momentum chasing.

Are infrastructure plays next in this rotation?

#vanar #defi #CryptoStrategy #MarketRotation #Binance