The Big Picture: The market is currently undergoing a "Rational Deleveraging." We’ve seen a massive $6.3B supply shock as miners move BTC to exchanges to cover margins. While retail is waiting for "Alt Season," institutions are treating this as a flight to safety, rotating capital into USD and high-utility L1s.

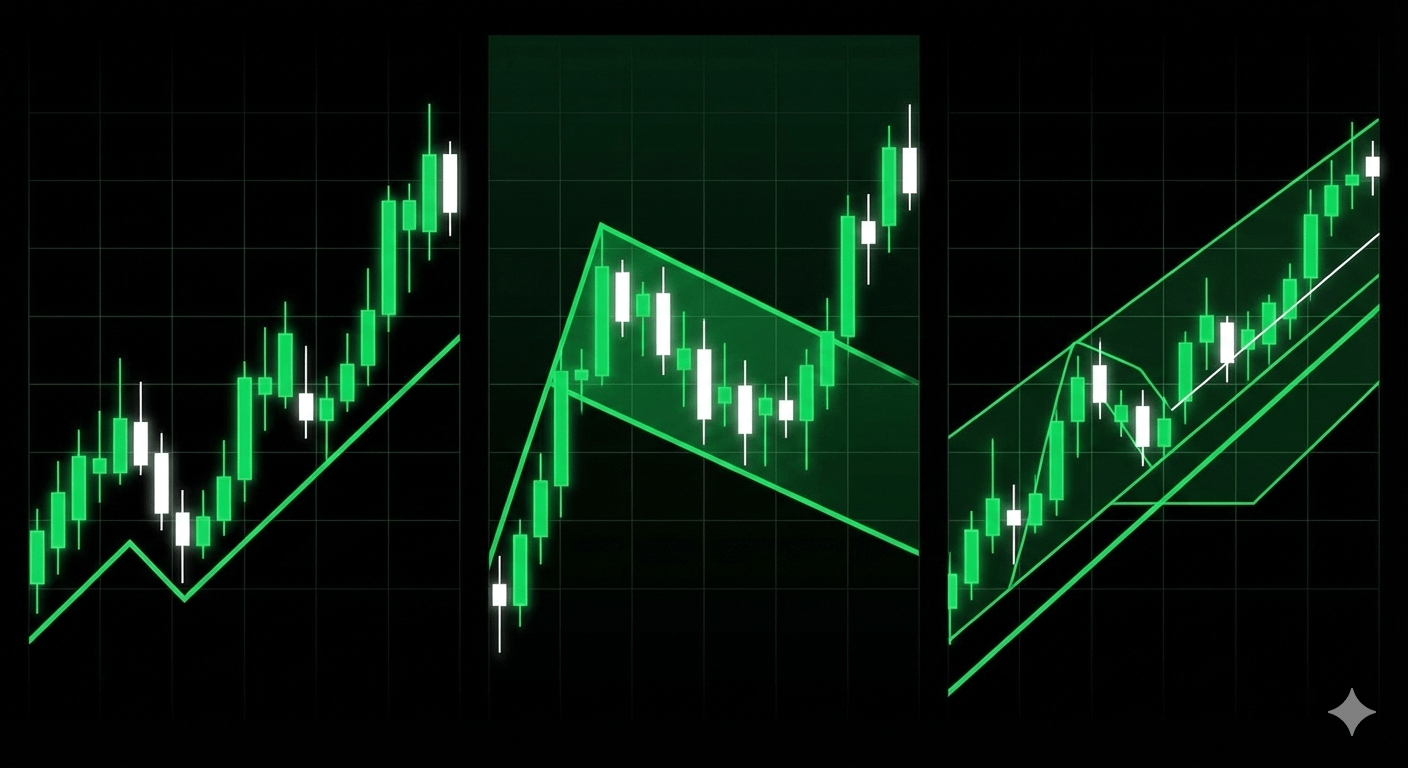

🔥 3 Coins Breaking the Downtrend:

If you’re looking for assets with high "Relative Strength" (staying green while BTC is red), watch these:

$HYPE (Hyperliquid): 🛡️

The Specialty: Currently showing a negative correlation to Bitcoin. While the market bleeds, HYPE is acting as a hedge.

Trading Tip: Look for entries if it holds the 4H support. It's the "anti-gravity" play of the moment.

$VANRY (Vanar Chain): 🤖

The Specialty: The "AI-Native" L1. With their recent NVIDIA Inception partnership and the rollout of the "Kayon" reasoning engine, it’s attracting the AI-narrative crowd.

Trading Tip: This is a "fundamental hold." Watch the $0.15–$0.18 zone for accumulation.

$ZEC (Zcash): 🚀

The Specialty: Surprise performance! ZEC is up +17% today. Privacy coins are seeing a niche resurgence as traders seek "stealth" liquidity.

Trading Tip: Don't FOMO the top; wait for a retest of the breakout level near $310.

💡 Pro Strategy for the Weekend:

The 200-Week EMA (~$68,000) is the line in the sand. If BTC stays below this, we are in a "cleansing phase." Don't go "All-In." Instead, use DCA (Dollar Cost Averaging) into the "High-Beta" alts like BNB or SOL which are currently discounted by 6-10%.

What’s your move? Are you 💎 holding through the miner sell-off, or are you hunting for the next AI gem? Let’s talk in the comments! 👇

#MarketUpdate #TradingTips" #Bitcoin❗ #Altcoins #BinanceSquare