From the moment you see a transaction settle in under a second, you feel the difference and that’s exactly the experience $FOGO aims to deliver. Built from the ground up as a performance-first Layer-1 blockchain, FOGO isn’t just another token chasing headlines; it’s infrastructure engineered to change how on-chain trading and DeFi behave in the real world.

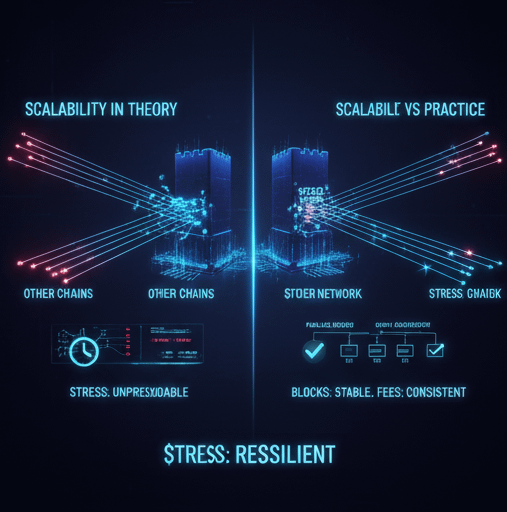

The current Layer-1 landscape has a clear problem. Many chains promise scalability, but under real stress, performance becomes unstable. Blocks slow down. Fees spike. Confirmations become unpredictable. For institutions and large traders, unpredictability is risk. And risk reduces capital allocation. The market is saturated with chains that work well in calm conditions but struggle when activity surges. Scalability in theory is not the same as scalability in practice.

$FOGO addresses this problem directly by focusing on execution quality and network stability. Instead of reinventing everything, it leverages the Solana Virtual Machine as a high performance timing engine and builds around parallel execution as a baseline, not an upgrade. The architecture is designed to maintain steady confirmations even during heavy transaction flow. That matters. Stable block times and consistent execution are not marketing features they are capital infrastructure. When a network can process activity smoothly under pressure, it becomes usable for real applications, not just speculative trading.

Another critical factor is validator design and latency optimization. FOGO’s approach emphasizes performance at the hardware and network level, reducing inefficiencies that often go unnoticed in other ecosystems. This is not about flashy announcements. It is about engineering decisions that compound over time. Scalability is not only about higher TPS numbers; it is about sustaining that performance without degrading user experience. That is where long-term value is created.

Now the timing. Most investors enter only after proof becomes obvious and adoption metrics are already reflected in valuation. The asymmetric window exists before that stage when fundamentals are strong but broad attention has not yet arrived. s still in that phase. The infrastructure thesis is clear, but market pricing has not fully adjusted to the implications of reliable high speed execution. Early positioning in fundamentally strong infrastructure plays has historically delivered the most favorable risk-reward outcomes.

This is not about unrealistic targets or overnight moves. It is about identifying a network built with performance discipline in a market that increasingly demands reliability. As institutional participation grows across crypto, the chains that provide consistent execution and scalable architecture will naturally attract more capital. That shift does not happen instantly it happens gradually, and then suddenly.

$FOGO presents an asymmetric opportunity because downside is limited to normal early-stage volatility, while upside is tied to structural adoption of scalable infrastructure. That is a calculated bet, not a gamble. When you focus on engineering quality, execution stability, and long-term network design, you position yourself ahead of narrative cycles rather than reacting to them.

The market eventually rewards real performance. FOGO being built for that moment.