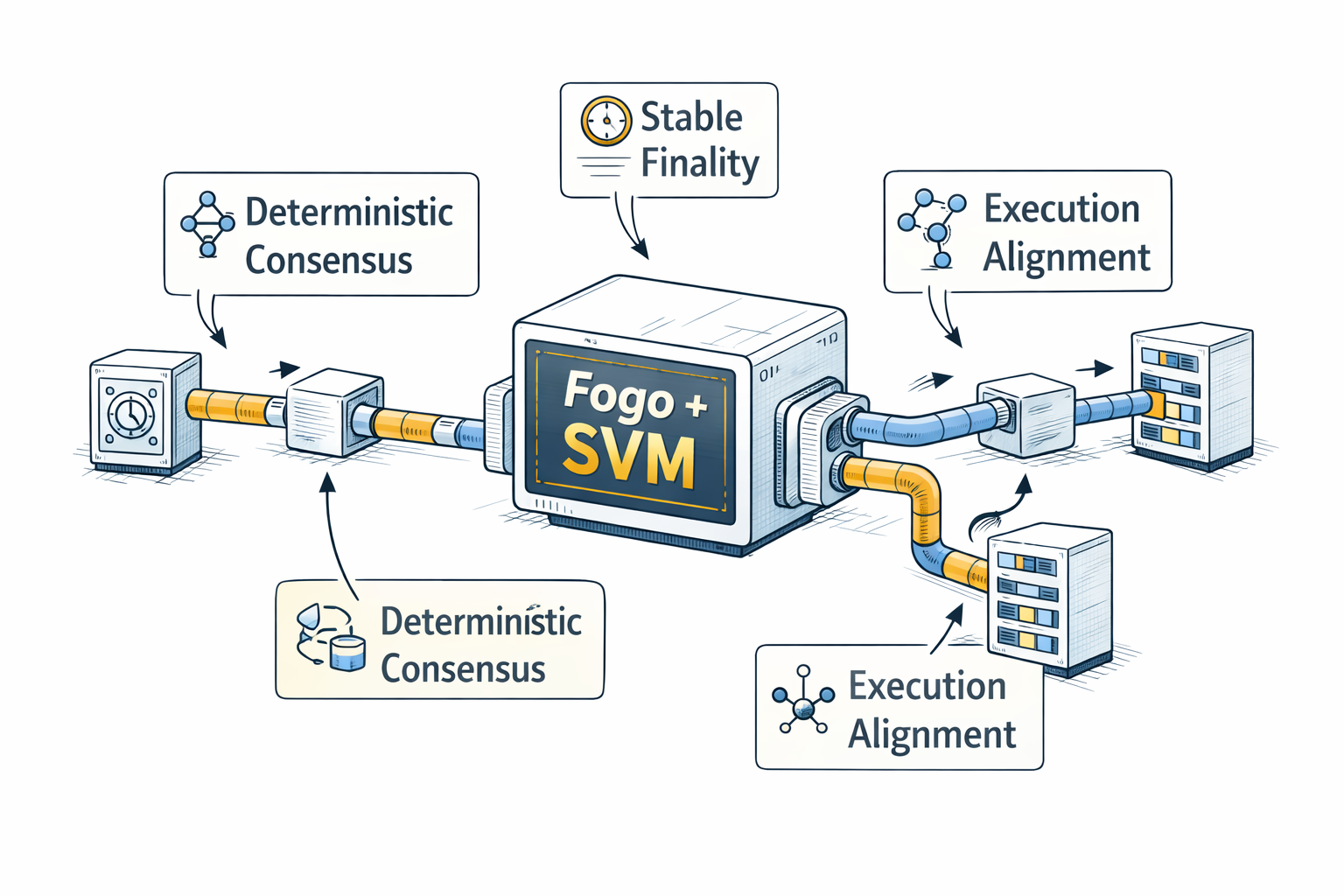

Fogo’s real differentiation does not come from marketing speed metrics, but from how tightly it integrates the Solana Virtual Machine into an environment engineered specifically for deterministic performance. The SVM inside Fogo is not merely reused; it is contextually optimized. Execution pathways are structured to minimize variance in transaction ordering and confirmation, which is where most perceived latency actually originates in high-frequency on-chain environments.

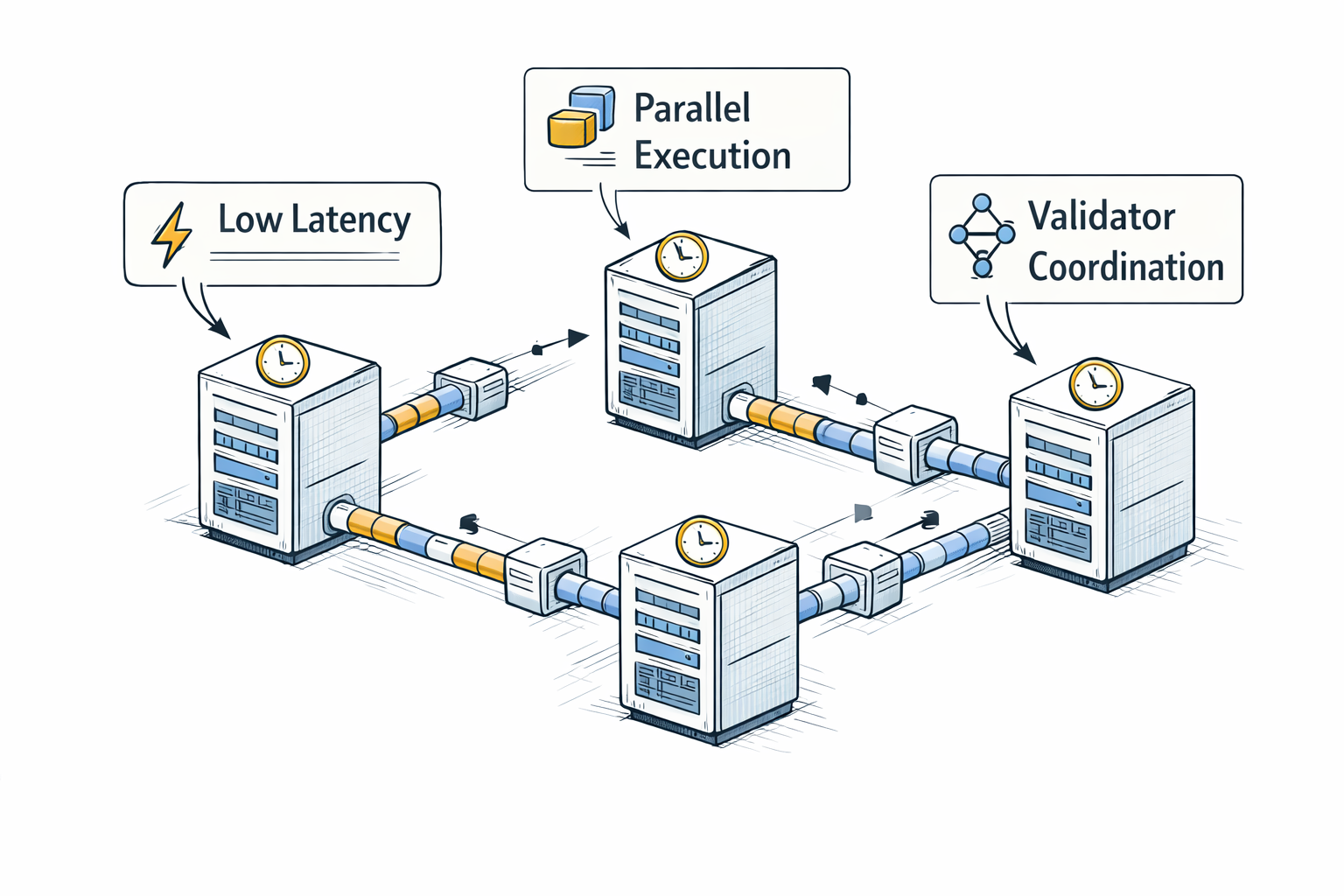

The Firedancer client architecture plays a decisive role in this equation. Rather than treating throughput as a linear scaling problem, Fogo treats it as a latency-discipline problem. Firedancer’s parallelized execution model and optimized networking stack reduce jitter at the validator layer. Combined with a curated validator topology and multi-local consensus coordination, this compresses propagation delays into predictable windows. In trading systems, predictability often matters more than raw speed; variance is the hidden tax. Fogo’s integration of SVM with Firedancer effectively reduces that tax.

The practical outcome is that 40-millisecond block production and near-instant finality are not isolated achievements but emergent properties of architectural alignment. Execution, networking, and consensus are synchronized around a single performance thesis: minimize uncertainty at every layer. This allows complex on-chain trading logic to execute without the friction typically introduced by mempool congestion or inconsistent validator propagation.

From my perspective, the elegance of Fogo’s SVM integration lies in restraint. It does not attempt to reinvent virtual machine semantics; instead, it refines the execution environment around them. I think this disciplined approach is why latency feels real rather than theoretical. The SVM provides composability, while Firedancer and validator curation provide temporal precision.

Over time, the value of such integration may extend beyond trading use cases. Deterministic execution environments tend to attract sophisticated financial logic because they reduce systemic ambiguity. Fogo’s SVM alignment suggests a future where performance is not measured solely in throughput numbers, but in the reliability of time itself within decentralized systems.

@Fogo Official #fogo $FOGO $CYBER $GPS