I remember the first time I tried to trade during a volatility spike on Solana. The chart was moving fast, my order went through, but I still felt that slight delay between intention and confirmation. It was small. A fraction of a second. But in trading, fractions have texture. They matter. That quiet gap is where this conversation about Fogo really begins.

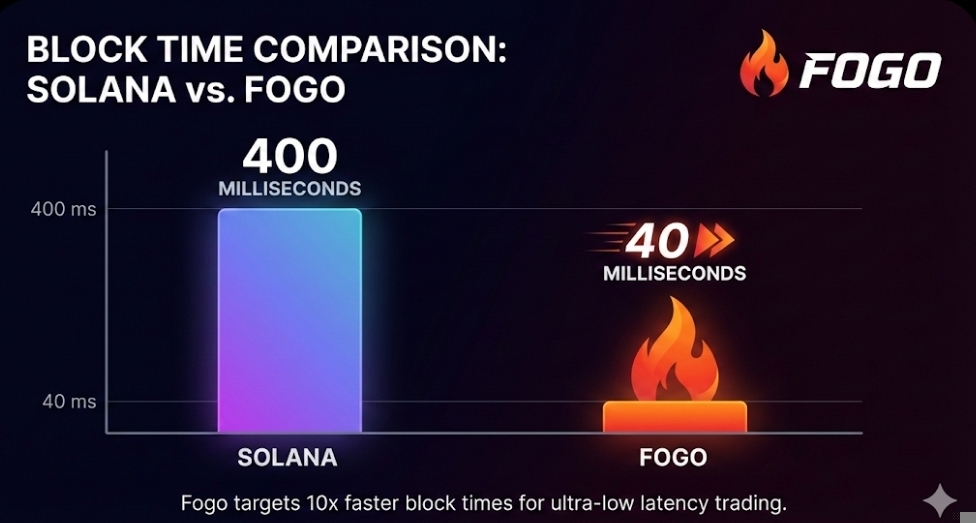

Fogo is positioning itself as a performance-first SVM chain, built specifically for trading environments. Solana already dominates that narrative with theoretical throughput north of 65,000 transactions per second and block times around 400 milliseconds. Those numbers aren’t just marketing. They mean a trader can place, cancel, and replace orders rapidly without the chain choking. Solana has proven this at scale, with daily transaction counts often exceeding 30 million. That’s real usage.

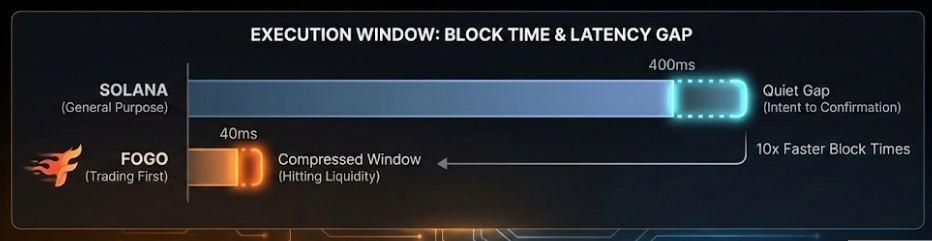

But Fogo is pushing a different angle. Early technical disclosures suggest block times closer to 40 milliseconds. That’s roughly ten times faster than Solana’s 400 milliseconds. On the surface, that sounds incremental. Underneath, it changes how order books feel. A 40 millisecond block time compresses the window between intent and settlement. In high frequency terms, that gap is the difference between hitting liquidity and chasing it.

Understanding that helps explain why Fogo talks about colocation and validator positioning. The idea is simple: reduce physical distance between validators and trading infrastructure. Less physical distance means lower latency. In traditional markets, firms pay millions to colocate servers next to exchange engines to shave microseconds. Fogo is borrowing that logic and embedding it into its validator design. On the surface, it’s just network topology. Underneath, it’s about who gets price priority.

Solana, to be fair, already optimized for parallel execution. Its Sealevel runtime allows multiple smart contracts to execute simultaneously if they don’t conflict. That’s why Solana can maintain throughput even during NFT mints or meme coin surges. We saw this during the recent meme cycle when Solana-based tokens processed spikes of over 2,000 transactions per second sustained for hours. The chain held. That resilience earned trust.

Fogo is compatible with the Solana Virtual Machine, which means developers can port contracts without rewriting logic. That’s important because ecosystems don’t move easily. Developers follow liquidity. Liquidity follows users. And users follow momentum. Solana’s DeFi total value locked has fluctuated between $3 billion and $5 billion over the past year. That capital depth creates a steady foundation. Fogo starts without that cushion.

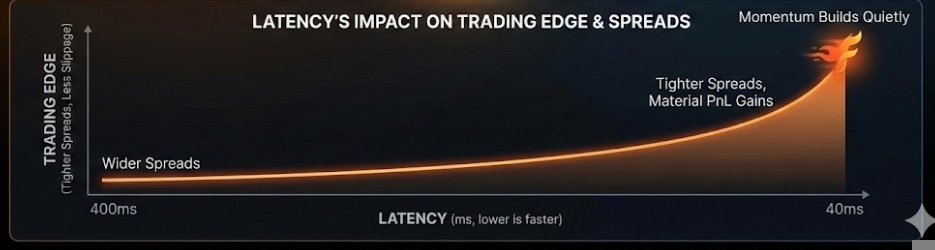

Yet speed creates its own gravity. If a chain consistently finalizes transactions in 40 milliseconds instead of 400, market makers notice. For a firm running automated strategies, a 360 millisecond difference per block compounds across thousands of trades. Over a day, that latency edge can mean tighter spreads and less slippage. That, in theory, attracts more liquidity. And that liquidity then tightens spreads further. Momentum builds quietly.

But speed isn’t free. Shorter block times increase pressure on validators. Hardware requirements rise. Bandwidth demands rise. That can reduce decentralization if only well-funded operators can participate. Solana has faced similar criticism. Its validator hardware costs are already higher than many other chains, which concentrates participation. Fogo’s colocation model might amplify that dynamic. If validators need to be physically near exchange hubs, geographic diversity shrinks. That’s a tradeoff.

When I first looked at this, what struck me wasn’t the headline speed claims. It was the intent. Solana was built to scale general purpose applications. Fogo feels narrower. Focused. Trading first. That focus changes design decisions. On Solana, NFTs, DeFi, gaming, and payments all compete for block space. On Fogo, the pitch suggests block space optimized for execution speed above everything else. Specialization has advantages. It also have limits flexibility.

Meanwhile, market conditions matters alot . Right now, volatility is very uneven. Bit coin hovers in the wide ranges. Meme coin rotations are frequent. Traders care about execution quality more than ideology. If Fogo can demonstrate real world spreads tighter by even a few basis points compared to Solana-based DEXs, that difference shows up directly in PnL. A basis point is 0.01 percent. On a $1 million position, that’s $100. Multiply that across hundreds of trades and it becomes material.

Solana still holds the advantage of network effects. It processes millions of daily active addresses. It has established DEXs with deep liquidity. It survived outages and congestion cycles and kept building. That resilience has texture. It feels earned. Fogo, at this stage, remains early. Early chains often look perfect in controlled conditions. Real stress tests reveal weaknesses. It remains to be seen how Fogo behaves during a true mania phase when bots flood the mempool.

There’s also governance and tokenomics underneath all of this. Faster chains often rely on strong economic incentives to keep validators aligned. If rewards aren’t balanced carefully, short term profit motives can destabilize consensus. Solana has adjusted inflation schedules and staking incentives over time to maintain participation above 60 percent of supply staked. That high staking ratio reinforces security. Fogo will need similar alignment, especially if its validator set is smaller.

Yet something else is happening in parallel. Exchanges and on-chain trading are converging. Traders increasingly expect centralized exchange performance on decentralized rails. That expectation is changing how chains compete. It’s no longer about theoretical throughput. It’s about how a DEX order book feels at 3 a.m. during a liquidation cascade. Solana narrowed that gap. Fogo is trying to narrow it further.

If this holds, the question isn’t whether Fogo replaces Solana. It’s whether specialization splits the market. One chain becomes the general purpose liquidity layer. Another becomes the ultra low latency execution venue. That mirrors traditional finance where different exchanges serve different niches. Depth versus speed. Breadth versus focus.

There’s risk in betting against incumbents. Solana’s ecosystem depth creates inertia. Developers don’t migrate easily. Capital doesn’t migrate without incentive. But traders chase edge. And edge often starts small. A few milliseconds. A slightly tighter spread. A marginally better fill rate.

Zooming out, what this reveals is a broader pattern. Blockchain infrastructure is maturing from experimentation to performance competition. Early narratives centered on decentralization versus speed. Now it’s about measurable execution quality. Chains are becoming specialized tools rather than ideological statements. That shift feels steady, almost quiet, but it’s real.

So will Fogo outtrade its big brother. It might in specific lanes if latency advantages translate into consistent execution gains. It might not if network effects overpower marginal speed improvements. The early signs suggest that traders will test it aggressively. And in markets, tests are honest.

In the end, the chain that wins mindshare won’t be the one that claims to be fastest. It will be the one where traders stop thinking about speed at all because the fills just feel right.

Articolo

Fogo vs. Solana: Will This SVM Powerhouse Outtrade Its Big Brother?

Disclaimer: Include opinioni di terze parti. Non è una consulenza finanziaria. Può includere contenuti sponsorizzati. Consulta i T&C.

0

14

181

Esplora le ultime notizie sulle crypto

⚡️ Partecipa alle ultime discussioni sulle crypto

💬 Interagisci con i tuoi creator preferiti

👍 Goditi i contenuti che ti interessano

Email / numero di telefono