Lately, it feels like Bitcoin just can’t catch a break. Since Q4 2025, it’s been lagging behind almost every major asset class. Gold moves. Equities move. Even other risk assets bounce. And Bitcoin? It feels heavy. Stuck. Pressured.

Lately, it feels like Bitcoin just can’t catch a break. Since Q4 2025, it’s been lagging behind almost every major asset class. Gold moves. Equities move. Even other risk assets bounce. And Bitcoin? It feels heavy. Stuck. Pressured.

One explanation people keep bringing up is the idea of “lost” coins.

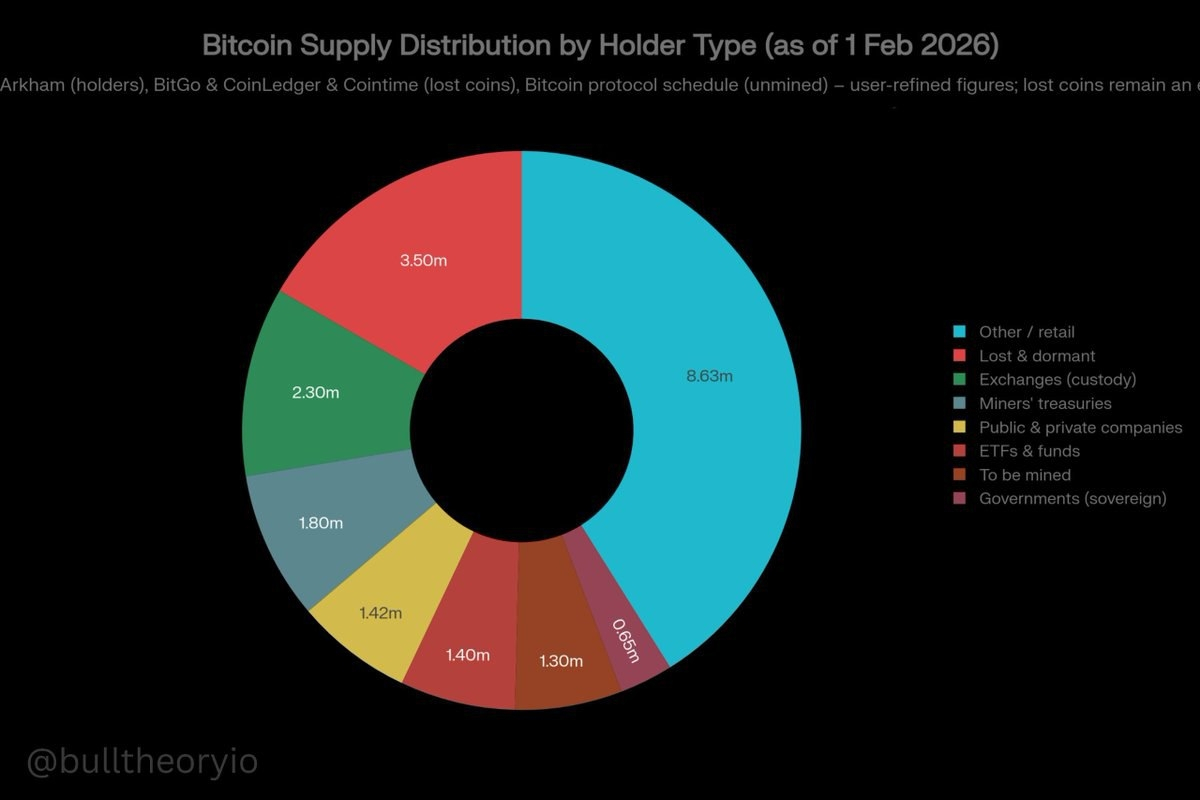

Roughly 3.5 to 4 million BTC from the early years are believed to be permanently lost or dormant. That’s close to 18% of total supply. For years, the market treated those coins as gone forever, almost like they never existed. Scarcity narrative strengthened because of that assumption.

But now quantum computing enters the conversation again.

Suddenly, people are asking: what if some of those early wallets — especially ones with exposed public keys — aren’t as untouchable as we once believed? What if, years from now, technology advances enough to threaten those old keys?

Even the possibility changes psychology.

Markets don’t wait for events to happen. They price in probabilities. If there’s even a small chance that part of that 3–4 million BTC could re-enter circulation one day, forward supply expectations shift. And when expected supply increases, price pressure naturally builds.

What makes it more complex is this: since 2020, institutions, ETFs, and corporations have accumulated roughly 2.5–3 million BTC combined. That number is almost the same size as the “lost” supply narrative.

So now the market is looking at two competing forces. On one side, long-term institutional absorption. On the other, a theoretical future overhang.

But here’s what I find interesting.

On-chain data shows 13–14 million BTC have already moved during this cycle. That’s massive redistribution. If Bitcoin was fragile, if it couldn’t handle liquidity shifts, we would have seen a structural collapse already. But we didn’t.

That makes me question whether the fear of dormant coins returning is being overstated compared to what the market has already absorbed.

Also, quantum risk isn’t a network-wide death sentence. It mainly affects older wallets with exposed keys. Bitcoin itself isn’t frozen in time. Wallet standards evolve. Security improves. Researchers are already discussing quantum-resistant upgrades at the protocol level.

To me, this doesn’t feel like Bitcoin is “broken.” It feels like the market is wrestling with uncertainty. A theoretical future risk versus a system that keeps adapting.

Right now, price reflects hesitation.

But hesitation isn’t the same as weakness. Sometimes it’s just the market thinking out loud.

#Bitcoin #OnChainData #QuantumComputing $BTC