Last year I tried logging back into an old online game I used to spend hours on. My account was still there, technically. But half the items I had collected were gone because the studio had “updated the system.” Nothing dramatic. Just a quiet reset. I remember staring at the screen thinking, this is strange and I paid for some of this, and yet it exists only as long as someone else decides it should.

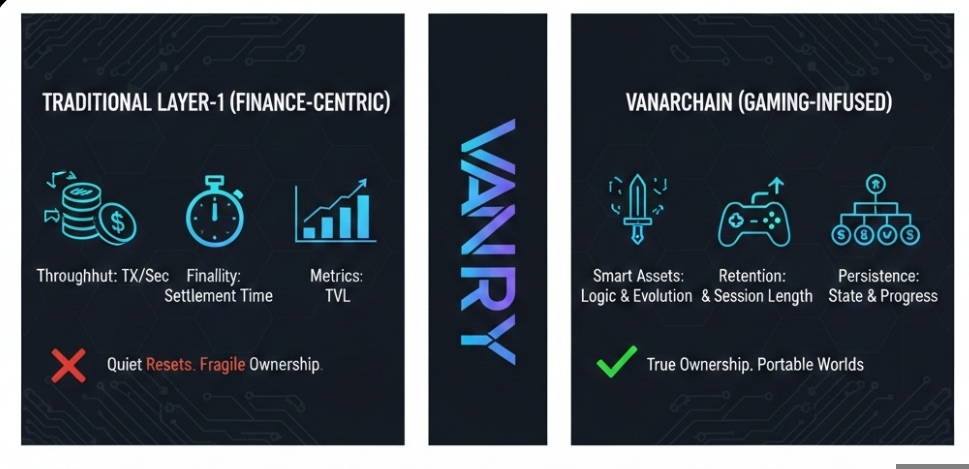

That feeling comes back whenever I look at and the idea behind . Most Layer-1 blockchains were born out of finance. You can tell. They talk about throughput, meaning how many transactions they can push through per second, and finality, which is just the time it takes for a transaction to be locked in permanently. Those numbers matter. But they feel like exchange metrics. They don’t feel like world-building metrics.

Gaming infrastructure is built differently. In a game, state is sacred. “State” is simply the current condition of everything, who owns which sword, what level you reached, what changed in the environment because you were there. If that state glitches, players leave. They don’t debate decentralization on forums. They just close the tab.

That’s where VanarChain’s focus on smart assets stands out. A smart asset isn’t just a token proving ownership. It carries logic inside it can use rules about how it can be used, transferred, maybe even evolved. That feels closer to how game items behave than how financial tokens behave. It suggests infrastructure designed around interaction, not just settlement.

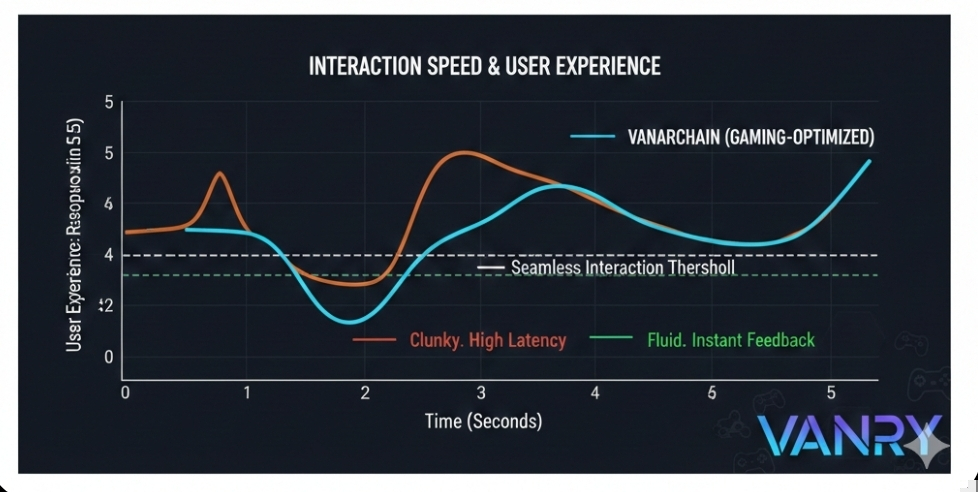

And here’s something I don’t see discussed much: gaming chains are forced to think about repetition. A trader might move funds a few times a day. A player might trigger dozens of actions in minutes. If block time, the interval at which the network groups transactions, is even a few seconds, it can start to feel clunky. Not in theory. In muscle memory. That difference between one second and three seconds is invisible on a dashboard, but very visible when you’re clicking fast.

Still, speed is the easy part to advertise. Retention is harder. Finance-centric chains often highlight total value locked, which is just the dollar amount sitting inside protocols. That number can spike during hype cycles and collapse just as quickly. Games measure daily active users and session length. They care about whether someone comes back tomorrow. If a Layer-1 carries gaming DNA, maybe it quietly optimizes for that instead of chasing capital inflows. Maybe.

There’s also the gas problem. Gas fees are the small payments users make to process transactions. In DeFi, paying a few dollars can make sense if you’re moving thousands. In a game economy where items might be worth cents, that logic breaks. So gaming-oriented chains tend to abstract fees away, meaning the user doesn’t directly handle them. Cleaner experience, yes. But someone still pays. Either developers subsidize it or token economics absorb it. There’s no magic.

I’m not fully convinced that gaming DNA automatically makes a stronger base layer. It introduces tension. Games thrive on centralized creative control. Blockchains claim decentralization, meaning control is spread across many validators instead of one company. Those instincts don’t always align. A game studio wants to patch, rebalance, tweak. A decentralized network resists sudden change. So the design has to bend somewhere.

What I do think is interesting is cultural alignment. Gaming communities understand digital scarcity. They understand cosmetic value, ranking systems, progression. On platforms like Binance Square, even content visibility runs on a kind of gamified structure, dashboards, engagement metrics, AI-driven scoring systems that reward consistency and relevance. People adapt quickly to that environment because it feels like leveling up. A chain designed with gaming psychology in mind may instinctively understand that dynamic.

At the same time, there’s a risk of turning everything into a scoreboard. Not every financial interaction needs to feel like a quest. Infrastructure should sometimes fade into the background. Quiet reliability beats constant stimulation.

If I strip away the token charts and branding, what interests me about VanarChain is not whether it can claim high transactions per second. It’s whether it treats digital ownership as something that should behave like saved progress in a game persistent, portable, and resistant to arbitrary resets. That’s a different design philosophy.

Maybe that’s the real question here. Not whether gaming can redefine Layer-1 architecture, but whether infrastructure can learn from the simple expectation players have had for years: if I build something here, it shouldn’t disappear just because the system changes its mind.