Date: February 19, 2026 | Reading Time: 5 min

The Moment We're In Right Now

If you're checking your portfolio today and feeling that punch in the gut, you're not alone.

The crypto market is going through one of its most brutal corrections since the 2022 bear market. But here's the thing: this exact same pattern has played out before. And the people who understood it? They're the ones who became millionaires in the next cycle.

Let me break down exactly what's happening — no fluff, no jargon, just pure data in simple English.

LIVE MARKET SNAPSHOT (February 19, 2026)

Total Market Cap: $2.3 Trillion (down 1.5%) 📉

24-Hour Liquidations: $223 Million — mostly long positions getting wrecked

💡 Quick Explanation: Liquidations happen when traders use too much leverage and the market moves against them. $223 million wiped out in 24 hours means a lot of people got forced-sold at the worst possible moment.

THIS IS THE PART NO ONE IS TALKING ABOUT

After deep research across multiple data sources, I found something fascinating.

Today's market (February 2026) is almost a perfect mirror of Summer 2019.

Let me show you why:

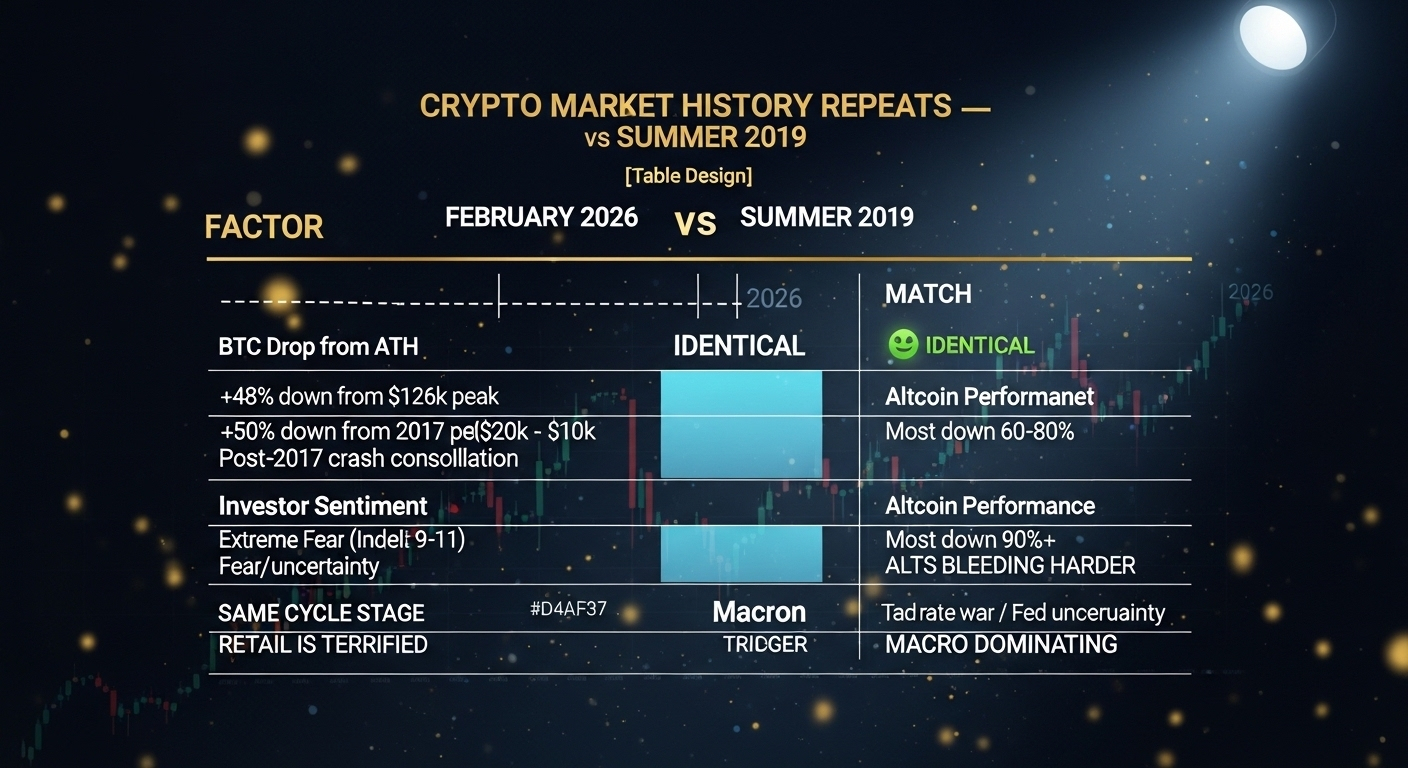

The 2019 vs 2026 Comparison Table

Bitwise CIO Matt Hougan just confirmed this: Investors who bought during the 2018 nadir saw returns of approximately 2,000% , while those who entered during the 2022 lows are up roughly 300% in just over three years .

🧠 Translation: The people who buy when everyone else is panicking? They're the ones who actually make life-changing money.

📉 WHY IS THIS HAPPENING? (4 Simple Reasons)

Forget the complicated explanations. Here's what's actually driving this crash:

1️⃣ Fed Rate Hike Fear 😨

The Federal Reserve just signaled they might raise rates again if inflation stays high . When US interest rates go up, money flows out of risky assets (crypto) into safe assets (bonds). Simple economics.

2️⃣ ETF Outflows 💸

$133 million left Bitcoin ETFs recently. $41.8 million left Ethereum ETFs . When institutions sell, markets drop. And crypto is now big enough that institutions matter.

3️⃣ The "Death Cross" 📊

Bitcoin just formed a "death cross" — when the 50-day average crosses below the 200-day average . This is a technical signal that has historically preceded major drawdowns, including the brutal 2022 collapse and the 2018 bear market .

4️⃣ Safe Haven Failure 🏦

Here's the painful truth: while gold blasted past $5,600 and silver topped $121, Bitcoin has been getting hammered . When real fear hits, investors still reach for traditional safe havens first — and crypto second, if at all.

🧠 WHAT SMART MONEY IS DOING RIGHT NOW

This is the most interesting part. According to recent data:

Directional Funds (funds betting on price going up or down): Down 24% over 6 months

Market-Neutral Funds (funds hedging their bets): Up 1.6% in January

Translation: The professionals have stopped trying to predict direction. They're playing it safe. And if they're confused, it's okay if you're confused too.

🔮 WHAT HAPPENS NEXT? (3 Scenarios)

Scenario A: The 2019 Pattern (Most Likely)

If history repeats, we're in for 3-6 months of sideways consolidation followed by a slow grind up. No V-shaped recovery — just boring accumulation. Then the next leg up starts.

Scenario B: The 2022 Pattern (Possible)

If macro conditions worsen, we could see another 20-30% downside. Analyst Ali Martinez warns that if Bitcoin doesn't reclaim $70,800, a breakdown to $53,000 is possible.

Scenario C: The Catalysts (Watch These)

Bitwise identifies three things that could trigger recovery :

CLARITY Act passage (regulatory clarity)

Fed rate cut expectations shifting

AI + Crypto breakthroughs

✅ WHAT SHOULD YOU DO? (Actionable Steps)

For Long-Term Holders:

Dollar-cost average (DCA) into quality projects

Focus on BTC and ETH primarily

Ignore the noise — check prices once a week, not every hour

For Traders:

Wait for $67,400 resistance to break on BTC before getting bullish

Key support to watch: $65,600

Ethereum needs to reclaim $2,000 to show strength

For Everyone:

Stop checking prices obsessively — it only adds stress

Use this time to learn and research projects

Remember: every single bear market in crypto history has been followed by a new ATH

💬 FINAL THOUGHT

CZ (Binance founder) recently shared his vision for Binance Square — he wants it to become a neutral hub for high-quality news and discussion. He pointed out that social media today is filled with low-quality content and clickbait.

That's exactly what I'm trying to do here. Real data. Clear explanation. No manipulation.

The market is scary right now. But scared money doesn't make money. Informed, patient money does.

WHAT'S YOUR MOVE?

Drop a comment below 👇

Are you buying this dip?

Selling in fear?

Or just waiting on the sidelines?

Let's discuss. And if this helped you understand what's actually happening, follow me and share this post — more people need to see this data instead of panicking blindly.

#CryptoCrash #Bitcoin #BinanceSquare #MarketAnalysis #WriteToEarn #BTC #ETH #Crypto2026

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before investing.