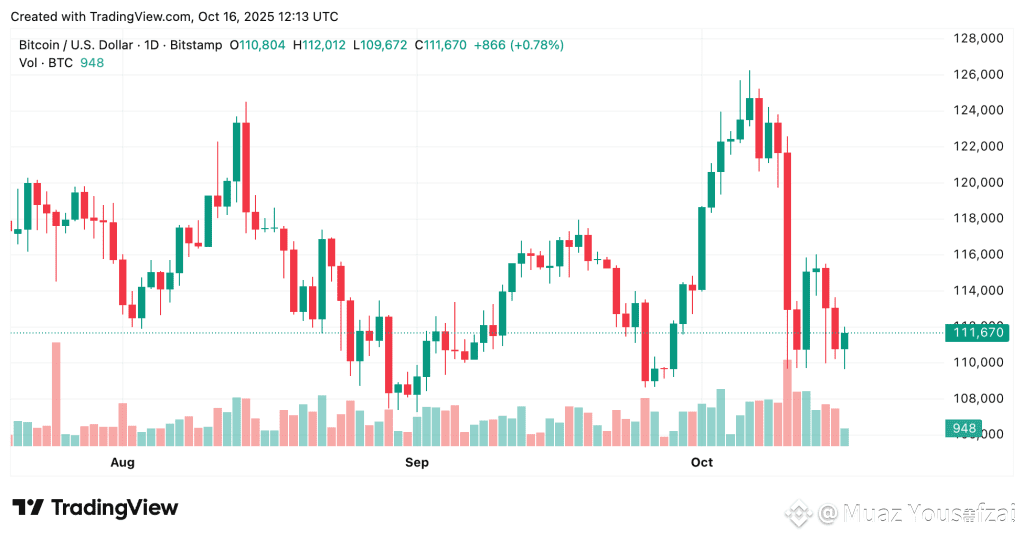

A trader dubbed “Trump’s insider” opened a $120-127 million Bitcoin short position at $111,386 ahead of an expected presidential announcement Tuesday, sparking fears of another market crash.

Social media erupted with warnings that the whale, who maintains a 100% win rate, could trigger the same devastation witnessed during October 11’s $19 billion liquidation event.

The trader gained notoriety after opening over $1.1 billion in shorts against BTC and ETH just before President Trump announced 100% tariffs on Chinese imports, generating an estimated $160-200 million in profits as Bitcoin plunged from $122,000 to below $102,000.

Back then, blockchain tracking firm Lookonchain identified the wallet as belonging to a “Bitcoin OG” who held 86,000 BTC from 2011.

Multiple reports claim the trader opened shorts ranging from $120 million to $600 million across BTC, ETH, and SOL ahead of Trump’s 3 PM ET announcement.

The precise timing, just as during the tariff crash, fueled accusations of insider trading and market manipulation.

$

On-chain analyst @mlmabc reported the whale closed approximately 90% of Bitcoin shorts and completely exited Ethereum positions at the bottom, pocketing between $190 million and $200 million in realized profits within a single day.

The market collapse triggered over 1.66 million liquidations in 24 hours, wiping out $19.33 billion in positions, according to data from CoinGlass.

However, Mlmabc argued that “the real number is likely much higher, somewhere in the $30B-$40B+ range.”

The whale’s identity traces back to the 2011 accumulation of 86,000 BTC. Records show that he sold 35,991 BTC, worth $4.43 billion, starting on August 20 to purchase 886,371 ETH, valued at $4.07 billion.

Fresh Bearish Bets Multiply as Other Whales Join Short Campaign

On October 14, the same trader opened a 3,440 BTC short position worth $392.67 million at $115,783.

Currently, the position is sitting on a $5.7 million unrealized profit, with a liquidation threshold of $128,030.

About $80 million in USDC was bridged into Hyperliquid to fund the position.

Other heavy hitters joined the bearish campaign.

Whale 0x9eec9 holds $98 million in shorts across DOGE, ETH, PEPE, XRP, and ASTER. Whale 0x9263 wagers $84 million against SOL and BTC.

However, the trader’s previous success closing 90% of shorts at exact market bottoms has crypto investors on high alert, with many questioning whether another crash is coming.

Original Whale Trade Generated $200M as Markets Collapsed

The October 11 trade established the whale’s reputation for prescient market timing.

Lookonchain data shows the trader deposited 80 million $USDC

$ into Hyperliquid starting October 9, followed by additional deposits totaling tens of millions throughout the week.

The whale’s positions included a 10x leveraged short on 6,189 $BTC , valued at $752.9 million, with a liquidation price of $130,810, and a 12x leveraged short on 81,203 ETH, worth $353.1 million, with a liquidation price of $4,589.