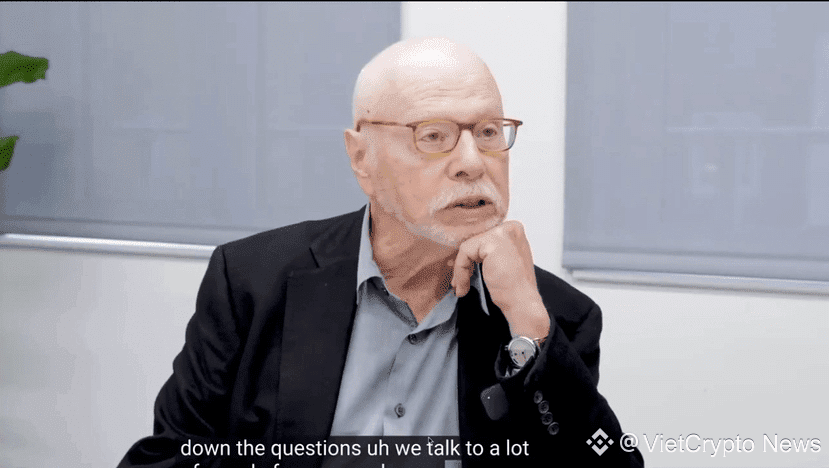

Meet Paul Singer.

The most relentless trader in history.

He’s made $72 billion — and never lost a single trade since 1977.

Here are the 10 brutal rules that made him unstoppable.

(#7 could make you millions 👇)

⸻

1️⃣ The Origin of a Beast

Paul Singer founded Elliott Management (1977).

Now: $70B+ AUM — zero losing years.

He’s forced CEOs to resign, governments to pay, and moved markets.

This isn’t investing — it’s domination.

⸻

2️⃣ “Never take a risk you can’t recover from.”

After a brutal loss in ’74, Singer changed forever:

→ Kill risk first. Profit second.

If one trade can wipe you out — it’s not worth it.

In crypto terms:

• No overleveraging

• No illiquid garbage

• No hype chasing

⸻

3️⃣ He plays games where direction doesn’t matter.

Litigation finance. Distressed debt. Merger arbitrage.

He finds edges where markets don’t move.

Crypto equivalents:

• NFT liquidation sniping

• DAO legal arbitrage

• On-chain funding rate arbs

You profit while others get trapped.

⸻

4️⃣ Elliott digs deeper than anyone.

They interview ex-employees.

Track footnotes.

Map entire ecosystems.

In Web3:

• Track unlock schedules

• Follow internal wallets

• Read DAO logs & Discords

⸻

5️⃣ 70% of wins happen in silence.

No headlines. No leaks. Just results.

Crypto version:

• Whales move off-chain

• Real alpha never shouts

• Follow wallets, not noise

⸻

6️⃣ He turns fine print into profit.

Argentina missed a clause — he walked away with $2.4B.

In DeFi, code is law:

• DAO rules

• Token rights

• Voting mechanics

Ignore the details — someone will weaponize them.

⸻

7️⃣ He bets against winners — when they look strongest.

Early success hides cracks:

→ Bloated spending

→ Broken integration

→ Weak retention

In crypto:

→ Fake volume

→ Treasury games

→ VC exit signals

⸻

8️⃣ He plays the infinite game.

His edge? Ruthless patience.

Web3 mindset:

• Build quietly

• Accumulate conviction

• Ignore the hype

Wealth flows to those thinking in years, not cycles.

⸻

9️⃣ He studies humans, not just markets.

History. Religion. Psychology.

Because markets = mass human behavior.

In crypto, memes are signals:

• Power shifts

• Narrative flips

• FOMO vs silent conviction

⸻

🔟 His greatest fear?

Complacency disguised as progress.

Bubbles. Debt. Fake innovation scaling to billions.

Crypto edition:

→ Ponzi yields

→ Fake L2 hype

→ Cult tokens with no revenue

The longer stupidity lasts, the harder it crashes.

⸻

⚔️ Paul Singer doesn’t chase trends — he bends systems.

He finds weak points and strikes with precision.

Crypto lesson:

• Think like an operator, not a trader

• Cut emotions

• Learn the game — then bend it

⸻

💡 If your portfolio bleeds in bear markets — you’re playing the wrong game.

Paul Singer hasn’t lost a trade since 1977.

These are the rules that made him Wall Street’s most feared mind.

#CryptoWisdom #APRBinanceTGE #MarketPullback #BitcoinETFNetInflows #BinanceHODLerTURTLE