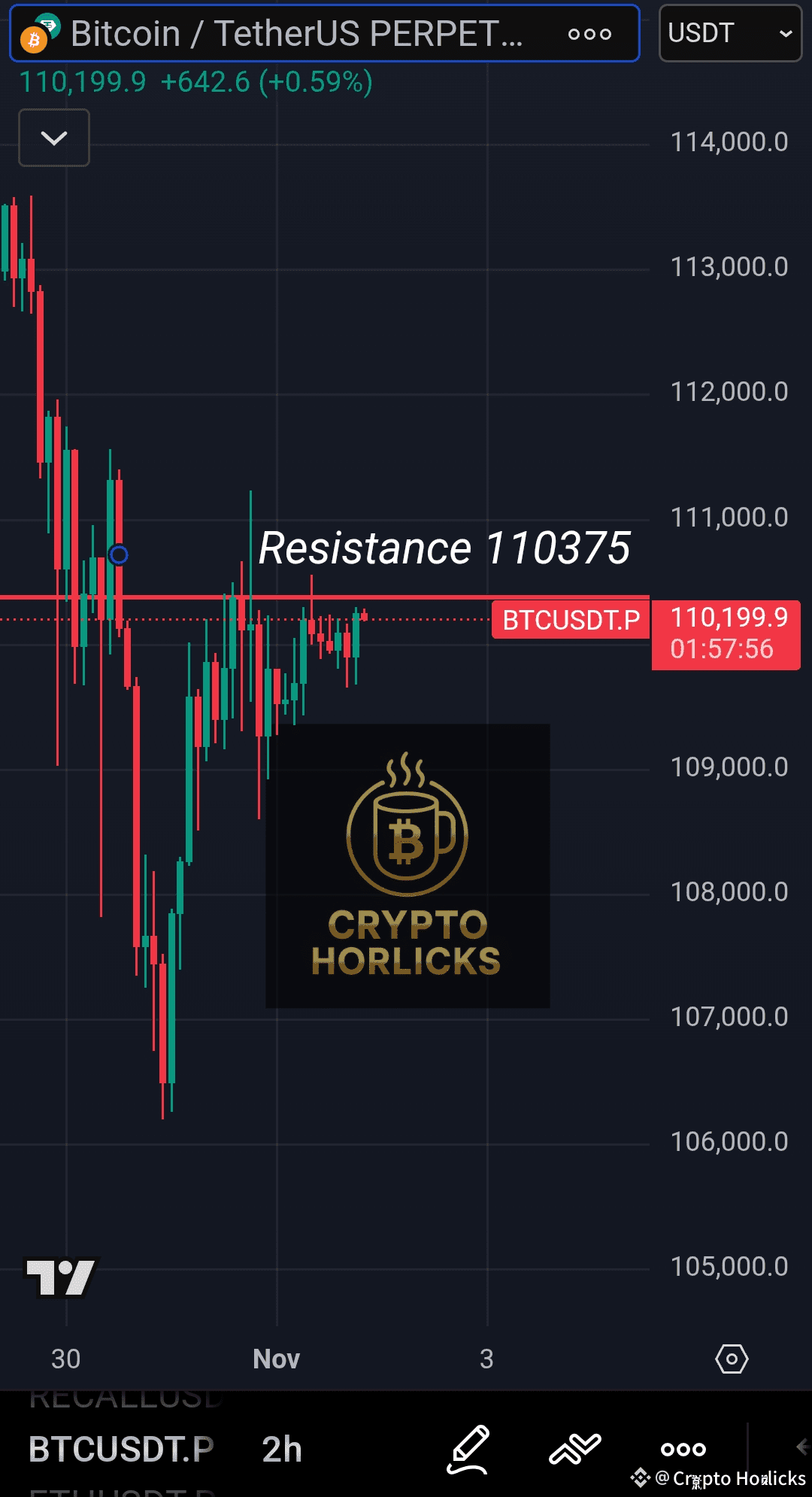

Based on the current 2-hour chart structure, Bitcoin is facing substantial resistance surrounding the $110,375 zone. Recent attempts to break above this price have stalled, underlining this area as a crucial level for bearish/bullish momentum transitions.  If BTC manages to close decisively above $110,375, it paves the way for a renewed upward surge, with upside targets cited in multiple forecasts as $113,300, $115,000, and $116,100 through the month. Breakouts above these levels could open room for rallies extending toward $120,000-$126,199 as on-chain and institutional flows remain supportive especially if ETF inflows persist and macro sentiment (such as the expected Fed rate cut) turns favorable. #FOMCMeeting

If BTC manages to close decisively above $110,375, it paves the way for a renewed upward surge, with upside targets cited in multiple forecasts as $113,300, $115,000, and $116,100 through the month. Breakouts above these levels could open room for rallies extending toward $120,000-$126,199 as on-chain and institutional flows remain supportive especially if ETF inflows persist and macro sentiment (such as the expected Fed rate cut) turns favorable. #FOMCMeeting

However, failure to sustain closes above this resistance signals vulnerability to steep corrections. Numerous technical analyses outline that if BTC slips below this resistance, accelerated selling may drag the price under the $108,000 and $107,350 short-term supports, with the key risk of testing the previous swing low—potentially as low as $105,000 or even $102,505, should bearish momentum intensify. #MarketPullback

Macro factors, especially the upcoming US Federal Reserve decision and ongoing equity market volatility, add further uncertainty to price action with technical indicators (MACD, RSI) now losing bullish momentum and signaling a neutral to corrective phase.Traders, especially those participating in futures, must follow strict risk management protocols given these volatile swings.

The present channel consolidation warns against aggressive positions without confirmation above resistance, as false breakouts and sudden drops remain likely in this environment. Proper stop-loss placement and disciplined position sizing are vital to protecting capital if the previous low gets breached or if November’s forecasted volatility materializes.

Summary

while bullish momentum could return if BTC closes above $110,375 and holds the next resistance zones ($113.3K–$116.1K), failure at this level may trigger a move towards $105K or lower. The interplay of technical levels with macro headlines makes the current market a high-risk, high-opportunity setup for informed crypto traders.