Ethereum (ETH) – Current Snapshot

🔍 Price & Market Overview

ETH is trading around USD $3,470.

Market cap is approximately $418–$420 billion USD, making it the second-largest cryptocurrency by value.

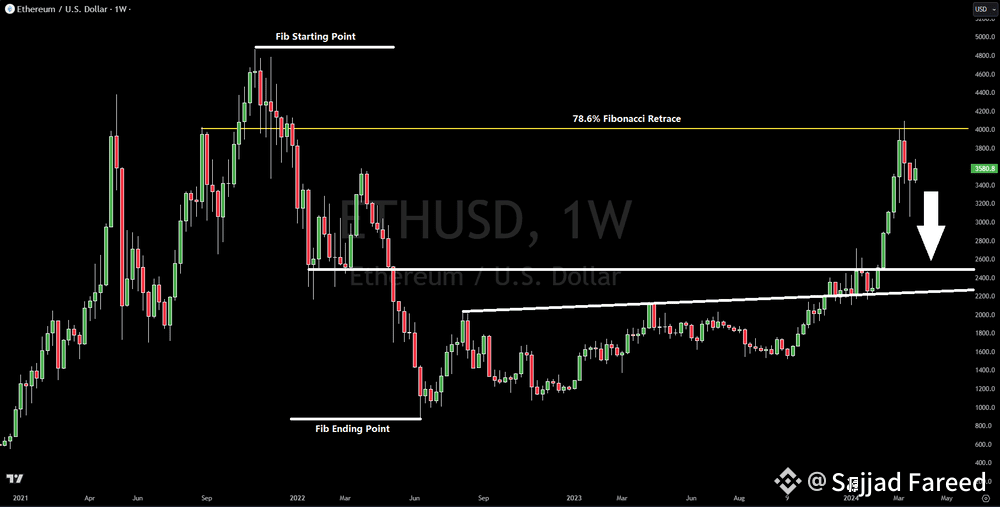

On technical indicators: the daily view for ETH vs USD currently shows a “Strong Sell” signal based on moving averages and other momentum indicators.

✅ Key Strengths

The Ethereum network remains a foundational blockchain for smart contracts, decentralized finance (DeFi), NFTs, tokenization and more.

Supply dynamics: circulating supply is ~120.7 million ETH.

Institutional interest is rising — macro-firms and funds are increasingly considering ETH as part of digital-asset exposure.

⚠️ Current Risks & Challenges

Technical indicators reflect bearish momentum in the short-term (e.g., RSI, MACD are weak) meaning there could be further downside or consolidation before any meaningful rebound.

While ETH has strong fundamentals, some analysts caution that current price levels may be driven more by sentiment than actual usage/activity growth.

Competition: Ethereum faces increasing competition from other blockchains and layer-2 scaling solutions, which may limit its growth potential or erode some advantages.

🎯 Outlook & What to Watch

A key resistance level is around $3,600–$3,700 USD. A break above this could open upward momentum; failure may lead to retest of support nearer $3,300–$3,400.

Watch institutional flows: Large-scale ETH accumulation or outflows, especially from ETFs or funds, may be a meaningful signal.

On-chain usage: growth in transactions, staking participation and network fees may strengthen the case for ETH’s value proposition.

Macro environment: Because cryptocurrencies are still correlated with risk assets, broader macroeconomic conditions (inflation, interest rates, regulatory moves) will impact ETH’s trajectory.

🧮 My Short-Term View (Next 1-3 months)

Given the bearish technicals but strong fundamentals, I lean toward a neutral to cautiously bullish stance:

If ETH holds above ~$3,400 and shows signs of reversal in momentum, we could see a move toward ~$3,800.

If momentum stays weak and broader crypto sentiment deteriorates, a drop toward ~$3,000 is possible.

Longer-term (6-12 months+), fundamentals suggest upside remains intact — but timing and path will likely be volatile.

If you like, I can pull together one-year forecasts, ETH’s staking/yield dynamics, or compare ETH vs another crypto (e.g., Solana). Would you like that?

#StrategyBTCPurchase #CryptoScamSurge #CryptoIn401k #CryptoIn401k #AmericaAIActionPlan #BinanceHODLerC