“If you have time and truly want to succeed in your trading journey, please spend just five minutes reading this.

If you choose not to read it, then success is up to you.”

What Is Trading?

Trading means buying at a lower price and selling at a higher price (Long), or selling at a higher price and buying back at a lower price (Short).

This is only a trading setup.

Real trading starts by spending time in the market, understanding price action, volume, and trend.

When you analyze the market properly and follow a fixed process, the process itself will eventually generate profits.

👉 Focus on watching the chart, not continuously watching your open positions.

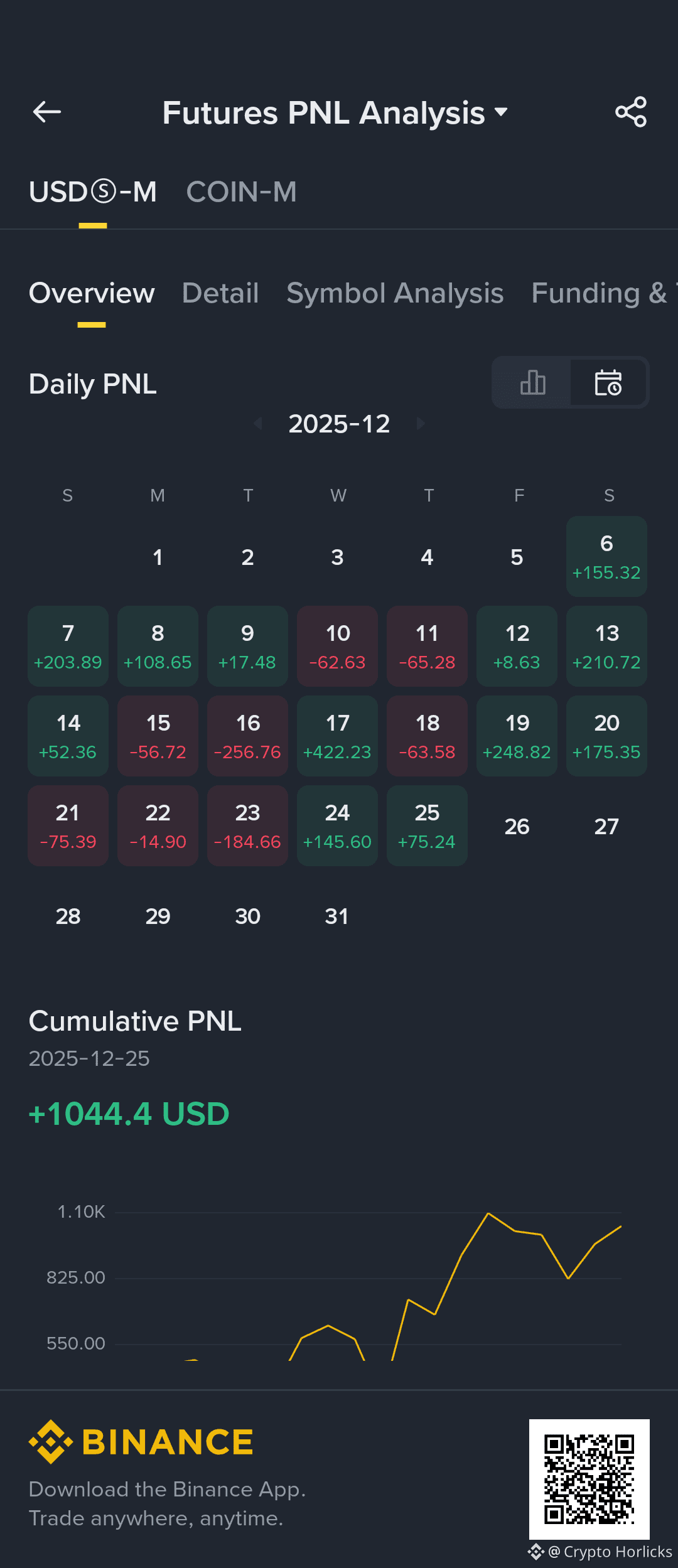

My Crypto Journey

I have been in crypto since 2021

P2P Trading: August 2021 – March 2022

Spot Trading: March 2022 – August 2022

Futures Trading: August 2022 – Present

My Trading Experience & Beliefs

About Trading

Capital protection is the first priority. Follow the trading process, not profit desire or greed.

Strict risk and money management is mandatory.

Many people say don’t overtrade or revenge trade. Honestly, I used to do this too 😂 — but understanding it changed everything.

What Is Overtrading?

Overtrading happens when:

You make a profit,

Your mind says “Let me take one more trade to earn more”,

That trade goes into loss,

Then you keep taking trades emotionally,

Slowly losing your capital.

What I Actually Do

When I wake up, I open Binance

I check market trends and volume

I select only two markets that feel good

I focus on the process, not only profit

My Trading time:

Starts at 6:00 AM

Ends at 10:00 PM

If I make a profit in one market, I move to another market.

If I face a loss, I wait patiently for a perfect entry in the same market.

Risk–Reward & Consistency

I always follow 1:1 Risk–Reward Ratio (RRR)

Example: 10% TP and 10% SL

No matter profit or loss, I never change:

TP %

SL %

Trading amount (USDT)

I don’t increase or decrease my lot size emotionally. That’s how consistency is maintained.

What Is Revenge Trading?

Revenge trading means:

SL gets hit,

Immediately opening another trade,

Increasing lot size,

Trading emotionally to recover loss.

What I Do Instead

If my SL hits, I wait for the next good setup

I use:

15-minute chart for analysis

15m + 5m chart for entry confirmation

I never increase lot size

I am not afraid of SL hits because I strictly follow risk and money management

👉 This is not revenge trading.

👉 This is waiting for opportunity.

My Money & Risk Management

Example with $500 Balance

Total capital = $500 (100%)

I trade only two altcoin markets

I allocate $500 per market

Total exposure = $1000

Each market:

Trade size = $500

TP = 10% → Profit = $50

SL = 10% → Loss = $50

With $500 capital:

You can afford 10 trades

If all 10 trades win → $500 profit

Capital doubles

But the most important rule:

Never trade emotionally.

Never change your strategy after a loss.

You may refine it, but don’t abandon it.

Leverage Selection

Leverage Selection

Never think in terms of leverage alone

Think in terms of trading amount

Example:

Trade size = 500 USDT

Leverage x20 → Margin = 25 USDT

Leverage x10 → Margin = 50 USDT

👉 Leverage doesn’t matter

👉 Trading amount and risk control matter

Summary Advice

Don’t trade with emotion, greed, or FOMO

Strictly follow risk and money management

Never trade without proper TP and SL

Avoid holding trades overnight or while sleeping

Avoid overtrading and revenge trading

Don’t change your trading amount frequently,

Same amount in profit or loss = consistency

Final Words

Celebrate every day, every month, and every year.

Merry Christmas 🎄

Happy New Year 🎉

Welcome 2026

Thank You.