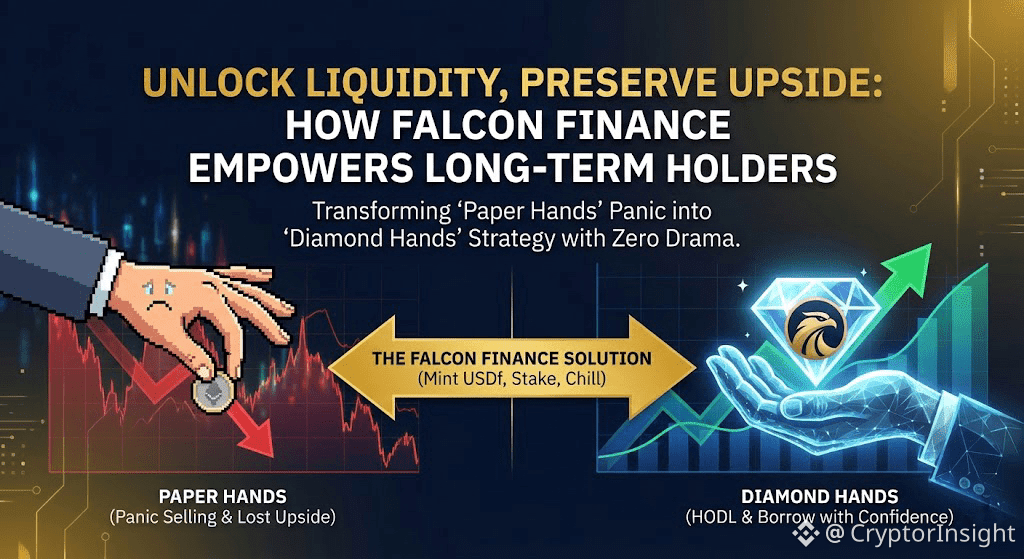

Okay, confession time – we’ve all had those moments where crypto’s volatility turns us into absolute paper hands, right? Not on the charts, where we’re all “HODL to zero” warriors with diamond hand emojis, but in real life. Picture it: market’s dipping hard, your portfolio’s red like a Solana meme coin rug, and suddenly life’s throwing bills at you – rent’s due, car’s making weird noises, or (guilty) you spot a dip in another token that’s screaming “buy me.” Next thing you know, you’re hitting sell on your precious BTC or ETH stack, muttering “just this once,” only to watch it moon weeks later while you’re kicking yourself. Classic crypto L. I’ve lived that script more times than I care to admit, from the 2022 bear to mini-panics this year. But here’s the plot twist that’s got me grinning like a degen who timed a pump perfectly: Falcon Finance turned me into a true diamond hands holder without forcing monk-mode poverty. No selling, no regrets, just pure liquidity magic in a volatile nightmare.

Let’s meme this out with some relatable scenarios, because why not laugh at our shared trauma while uncovering real utility?

Scenario 1: The “Bear Market Blues” Classic

You’re deep in the red, Twitter’s doom-scrolling “it’s over” threads, and your landlord doesn’t accept BTC (yet). Old you: Panic-sells 0.5 BTC at the local bottom to cover rent. Price recovers 50% in a month – you FOMO buy back higher, fees eat you, taxes slap you next year. Net: Pain.

Falcon you: Deposit that BTC as collateral, mint USDf (overcollateralized stablecoin, pegged tight), pay rent with stables. BTC stays locked, rides the recovery. You wake up richer, landlord paid, no tax event. Diamond hands activated. Bonus: Stake USDf into sUSDf for 12-18% APY yields that basically cover next month’s rent passively.

Scenario 2: The “FOMO Ape” Temptation

Some new cat coin’s pumping 10x overnight (we’ve seen it in 2025, don’t lie). You’ve got dry powder… except it’s all in your long-term ETH bag. Old move: Sell ETH to ape in, cat coin dumps 90%, ETH moons anyway. Double rekt.

Falcon move: Collateralize ETH (or mix with SOL, RWAs, whatever), mint USDf instantly, ape responsibly with borrowed stables. ETH keeps its upside, you get the gamble without sacrificing core positions. Win or lose the meme flip, your foundation’s intact.

Scenario 3: The “Real Life Curveball” Gut Punch

Unexpected vet bill for your dog (or kid, or whatever hits home). Crypto’s the bulk of your savings, but selling feels like betrayal to your future self. Old reality: Forced sale at whatever price, emotional wreckage.

Falcon reality: Use any liquid asset – even tokenized gold or Treasuries for stability – mint USDf, handle the emergency. Collateral appreciates if markets turn (they always do eventually). You retain ownership, preserve upside, and keep your soul intact. No more “I sold at the bottom” therapy sessions.

This isn’t just funny hypotheticals – it’s how Falcon Finance is legitimately revolutionizing DeFi by making universal collateralization the norm. As of December 28, 2025, TVL has rocketed past $5.6B in this year-end push, with USDf supply topping $5.1B across every major chain. Over 40 adapters now, onboarding wild RWAs like real estate tokens and corporate bonds alongside all the crypto staples. The modular setup means additions happen fast, governance ($FF holders) keeps it community-driven, and security’s institutional-level – audits stacked, oracles diversified, liquidations smoothed out to avoid those horror cascades.

The yields? Chef’s kiss in a yield-starved world. sUSDf staking pulls 13-19% APY from smart, resilient strategies – no relying on fleeting hype, just consistent performance through chops. Peg’s unbreakable, process seamless on Base or Solana for cheap gas.

Humor aside, the serious edge is how this preserves long-term upside in volatility’s grip. Crypto rewards holders – cohort data screams it – but real life forces sales. Falcon bridges that gap perfectly: borrow without selling, earn on borrowed, stack forever. It’s the anti-paper hands protocol we needed.

I’ve been living this lately – mixed collateral vault running, USDf staked, handling holiday spends without a single sell. Feels like cheating, in the best way. No more internal battles; just chill diamond hands energy.

If you’re tired of those paper hands moments creeping in, stop doom-scrolling and start minting. Hit up @Falcon Finance , deposit something you love, and unlock the freedom.

What’s your most embarrassing “forced sell” regret story? Or how has Falcon (or any tool) helped you stay diamond-handed through 2025 chaos? Spill the tea below – funniest Ls get my repost! And repost this if you’re ready to HODL smarter.