🔴 Scenario 1: Short (Primary Bias)

Conditions:

Price retraces into 1.55 – 1.58

Bearish confirmation appears:

Lower-timeframe CHOCH (5m/15m)

Or Rejection wick candles / Bearish Engulfing

OI remains flat or decreases during the retracement

Invalidation:

1H candle closes above 1.58 with rising volume and OI

Targets:

TP1: 1.522 (POC)

TP2: 1.503

TP3: 1.447 (if bearish continuation confirms)

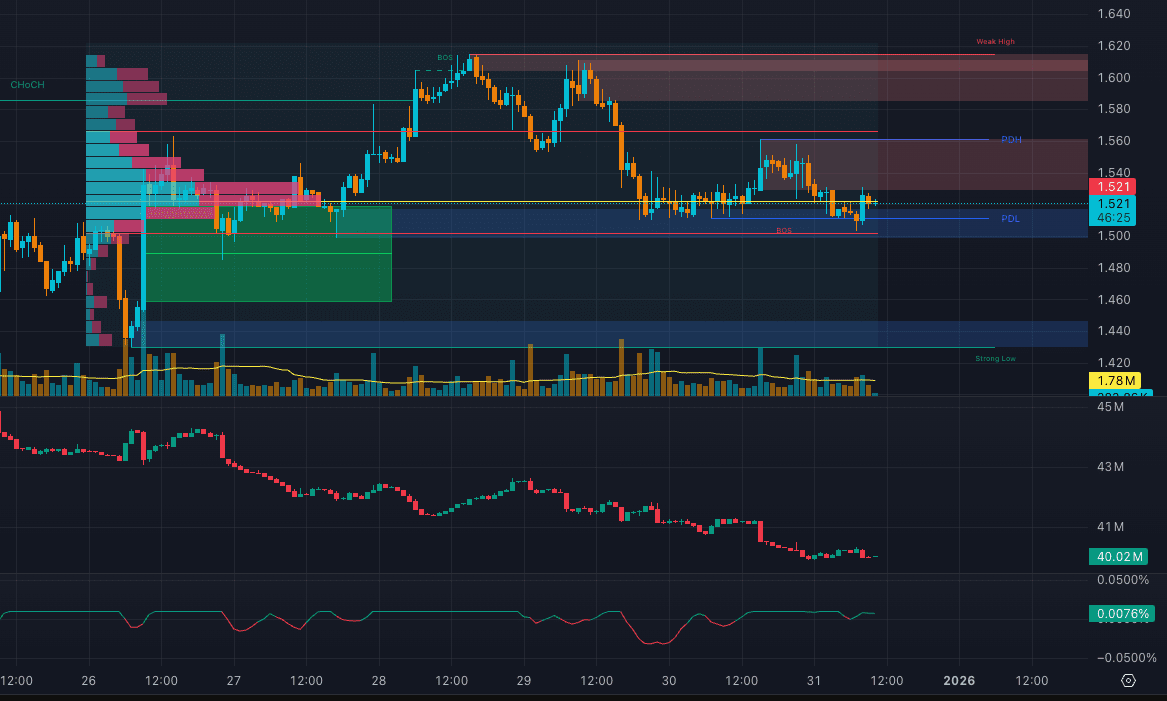

1️⃣ Market Structure

On the H1 timeframe, the market remains in a bearish / distribution structure.

A prior bullish CHOCH occurred from the ~1.45 area, driving price toward ~1.60.

However, the upside move failed to continue, showing weak follow-through.

From the ~1.60 high:

Price formed a Lower High

Followed by a bearish BOS

Price has since rotated back into the mid-range around 1.52, without forming any new bullish CHOCH.

Structure conclusion:

H1 bias remains bearish. The current price action represents consolidation within a bearish context, not a confirmed reversal.

2️⃣ Key Price Zones

🔴 Supply / Premium Zones

1.585 – 1.616

Previous High

Previous distribution area

High-probability zone for short continuation or swing shorts

1.548 – 1.566

Minor supply

Reactive zone suitable for lower-timeframe short setups

🔵 Demand / Discount Zones

1.504 – 1.485

PDL + high-volume node

Acts as a short-term balance area

1.446 – 1.430

Strong Low

Major sell-side liquidity resting below

Current positioning:

Price is trading inside the value area, not at an extreme. Risk–reward is unfavorable for aggressive entries.

3️⃣ Volume, Open Interest & Funding Rate

📉 Volume

The impulse move down from ~1.60 showed higher relative sell volume

Recent consolidation candles show declining volume

Bullish candles lack volume expansion → no real demand stepping in

📊 Volume Profile

Point of Control (POC): 1.518 – 1.527

Price is continuously accepted around POC, indicating value trading

No signs of strong initiative buying or selling

📉 Open Interest (OI)

OI has been steadily declining

Indicates:

Position unwinding

Lack of fresh leverage entering the market

This environment is not supportive of squeeze conditions

💰 Funding Rate

Funding remains slightly positive (~+0.0076%)

Longs are paying shorts

Positioning bias leans mildly long, but not at extreme levels

OI + Funding takeaway:

The market is in a weak participation phase, leaning slightly bearish, with no leverage imbalance to force a squeeze.

4️⃣ Trade Scenarios

🔴 Scenario 1: Short (Primary Bias)

Conditions:

Price retraces into 1.55 – 1.58

Bearish confirmation appears:

Lower-timeframe CHOCH (5m/15m)

Or Rejection wick candles / Bearish Engulfing

OI remains flat or decreases during the retracement

Invalidation:

1H candle closes above 1.58 with rising volume and OI

Targets:

TP1: 1.522 (POC)

TP2: 1.503

TP3: 1.447 (if bearish continuation confirms)

🟡 Scenario 2: Long (Conditional & Defensive)

Not recommended at current levels.

Long setups only become valid if:

Price sweeps sell-side liquidity below 1.50

Followed by strong bullish displacement

Clear bullish CHOCH on H1 or M15

OI expansion + funding remains neutral or low

🧠 Summary

Primary bias: Bearish

Market state: Range-bound within distribution

OI declining + mild positive funding = weak market

No sell-side liquidity sweep yet

Best strategy: Wait for price to reach premium or discount zones

This is a market for patience and precision, not prediction.

#trading #TradingSignal #futures

✍️ Written by @CryptoTradeSmart

Crypto Insights | Trading Perspectives

⚠️ DISCLAIMER:

NOT financial advice. Perpetuals trading is high risk - you can lose your entire capital. This is my personal setup for educational purposes only. Always DYOR, use strict risk management, and never risk more than you can afford to lose. You are solely responsible for your decisions.

Trade safe! 🎯