#Contentos #COS #TradeyAI #AIAgent #AI #Write2Earn

Support and resistance look simple on charts — until price moves too fast to react.

In intraday trading, timing matters more than drawing perfect lines.

Support and resistance are foundational concepts in trading — yet identifying them accurately in intraday timeframes remains a challenge. Rapid price movement, false breakouts, and market noise often blur these key levels.

This is where AI-assisted analysis, such as that provided by TradeyAI, becomes increasingly valuable.

Why BNB and SOL Are Ideal for Intraday Trading

BNB and SOL are among the most actively traded altcoins, known for:

Strong intraday volatility

Clear reaction to technical levels

Frequent momentum-driven moves

However, these same traits make them difficult to trade manually without constant monitoring.

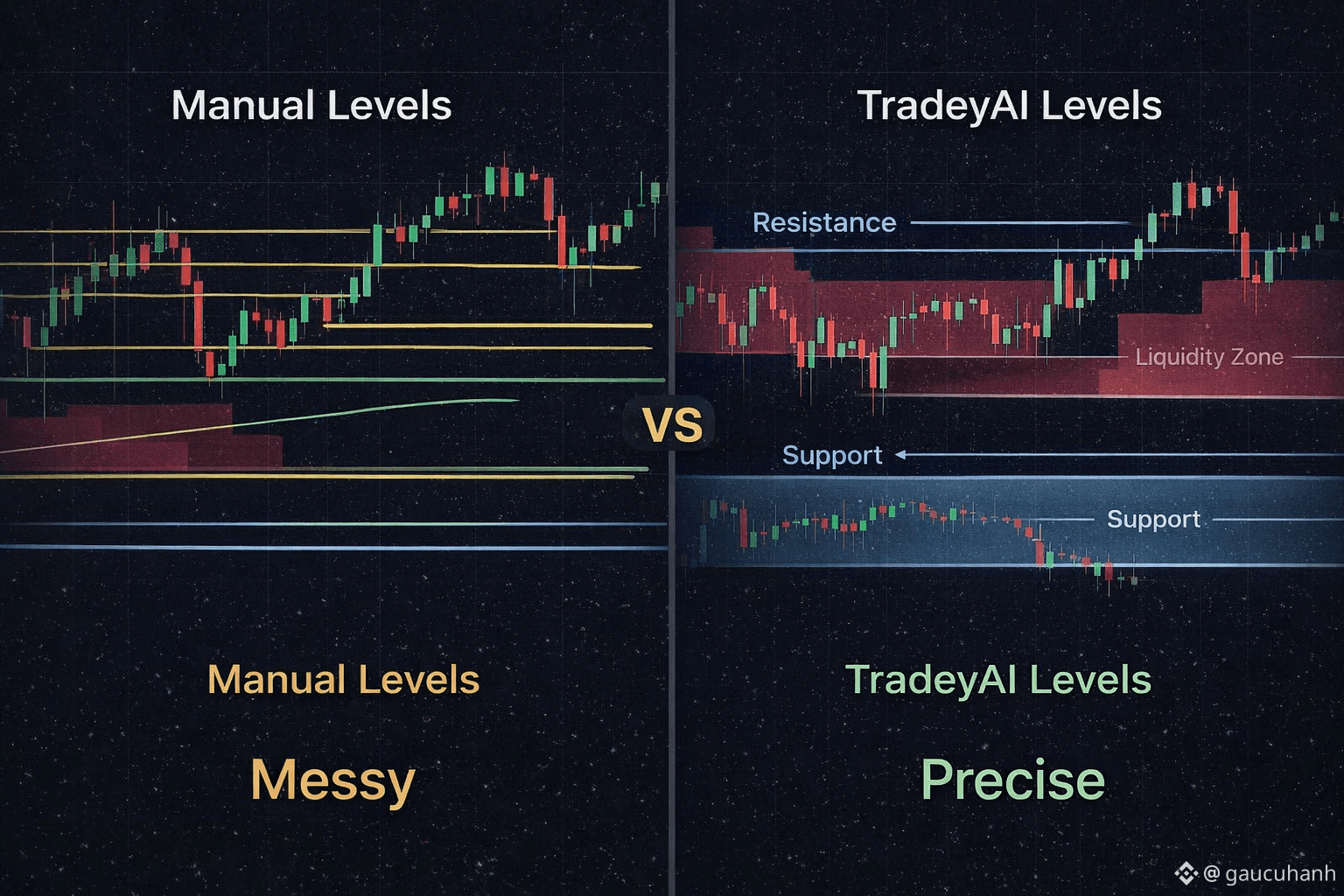

How TradeyAI Identifies Key Levels

TradeyAI continuously tracks market structure and price behavior to highlight:

Intraday support zones where buying pressure may emerge

Resistance zones where selling pressure historically increases

Potential breakout or rejection scenarios

By automating this process, TradeyAI reduces subjective bias and helps traders focus on execution.

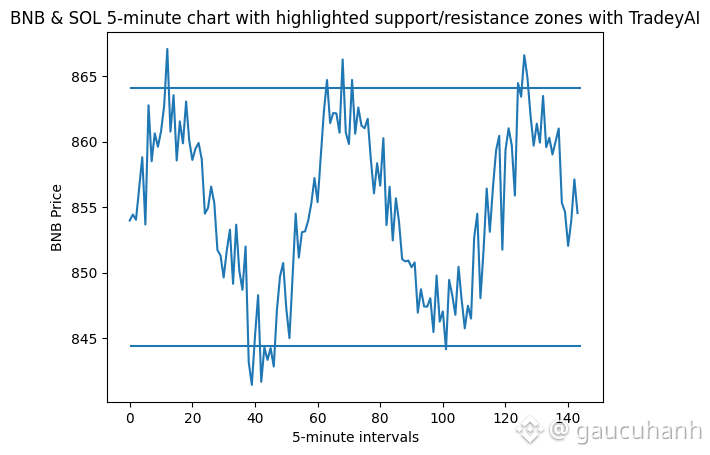

BNB Intraday Behavior

BNB often trades within well-defined intraday ranges. When price approaches support, TradeyAI helps traders anticipate possible bounces rather than reacting late. During resistance tests, AI signals can help avoid emotional overtrading.

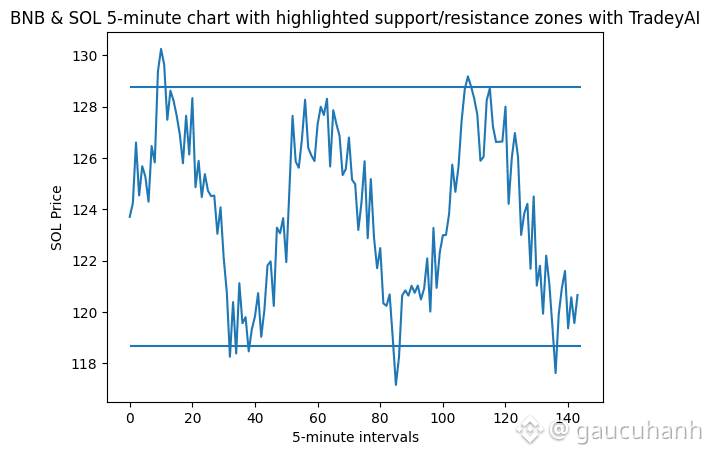

SOL Intraday Behavior

SOL is known for fast, sharp intraday moves. Breakouts often occur quickly, leaving little time for manual confirmation. TradeyAI’s real-time tracking helps traders prepare for these moments before volatility expands.

Why AI Matters for Support and Resistance

Human traders may draw different levels on the same chart. AI, however, applies consistent logic across timeframes, helping traders:

Maintain discipline

Reduce overtrading

Improve entry precision

Same chart. Different discipline. AI removes subjective bias.

Another often overlooked advantage of AI-identified levels is consistency under pressure. In fast intraday markets, traders frequently redraw levels, second-guess their analysis, or hesitate at execution. TradeyAI removes that friction by applying the same rules regardless of volatility. When price reaches a zone, the decision framework is already defined. This allows traders to focus on timing and risk management instead of reanalyzing the chart — a critical edge when trading assets as fast-moving as BNB and SOL.

Conclusion

Support and resistance remain essential — but AI-powered interpretation gives traders a measurable edge. For BNB and SOL intraday trading, TradeyAI helps transform raw price data into actionable insights.

BNB & SOL 5-minute chart showing TradeyAI-identified support and resistance zones, helping intraday traders anticipate reactions instead of chasing price.

BNB & SOL 5-minute chart showing TradeyAI-identified support and resistance zones, helping intraday traders anticipate reactions instead of chasing price.

Do you rely more on manual levels or AI-assisted analysis when trading BNB & SOL?

Let’s compare approaches 👇