Key insights

Ethereum and Solana are currently some of the strongest crypto options for investors aside from Bitcoin.

Other options like Chainlink and Ondo Finance are also benefiting from institutional demand

Sui now stands out as a fast-growing challenger among mid-cap tokens

The crypto market is moving far beyond Bitcoin as investors continue to search for stronger growth ahead of 2026.

Bitcoin still leads as a reserve asset. However, attention has turned toward other networks that support apps, payments and real-world finance.

Here are five cryptocurrencies beyond Bitcoin that Indian investors are considering as the next cycle approaches.

Ethereum

Ethereum continues to be the most important blockchain outside Bitcoin. The network is still the smart contract hub and powers most of the world’s decentralized finance.

Developers still choose Ethereum more than any other chain.

Late 2025 was a period of growth for Ethereum, despite the liquidity fragmentation across Layer 2 networks earlier in the year. The Pectra upgrade helped reduce this issue by improving the user experience.

Because of this upgrade, Ethereum now appeals to more investors seeking yield. The ETF market now offers yield-bearing holdings for Ethereum as well, and its steady yield of 3.5% has now changed how Ethereum fits into portfolios.

Tokenized finance has also been a good booster for Ethereum. Firms like BlackRock and Franklin Templeton now use Ethereum for on-chain fund settlement, and this use case strengthens ETH as more than a mere speculative asset.

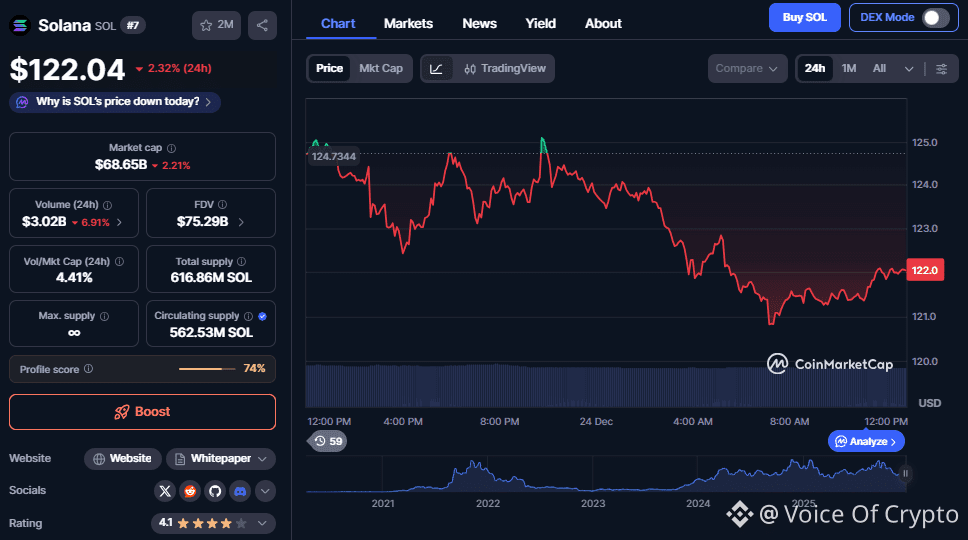

Solana

Solana is similar, yet so different from Ethereum. The network offers speed and low fees, with transactions that cost fractions of a cent.

This alone makes Solana great for everyday use.

Retail traders favour Solana for payments, trading and on-chain apps. The Firedancer upgrade earlier this year also improved performance further, and the network now handles massive transaction loads.

Meanwhile, stablecoin usage continues to grow on Solana, and payment providers are now integrating directly with the network. This trend has pushed Solana closer to real-world commerce, with AI agents also relying on Solana.

In summary, Solana stands as the consumer side of crypto beyond Bitcoin, and its activity volume keeps growing as new users arrive.

Chainlink

Chainlink’s role in the DeFi space is less visible than Ethereum’s, but this infrastructure network matters deeply.

This is because Chainlink’s oracles allow blockchains to access real-world data, and financial institutions rely on this connection. Chainlink makes it easier for data to move safely between private systems and public chains.

The network’s Cross-Chain Interoperability Protocol supports this need, and CCIP enables secure messaging between blockchains. It even performed successful trials with SWIFT and DTCC this year.

This progress places Chainlink at the centre of financial blockchain adoption, as banks are more about secure communication than which blockchain wins.

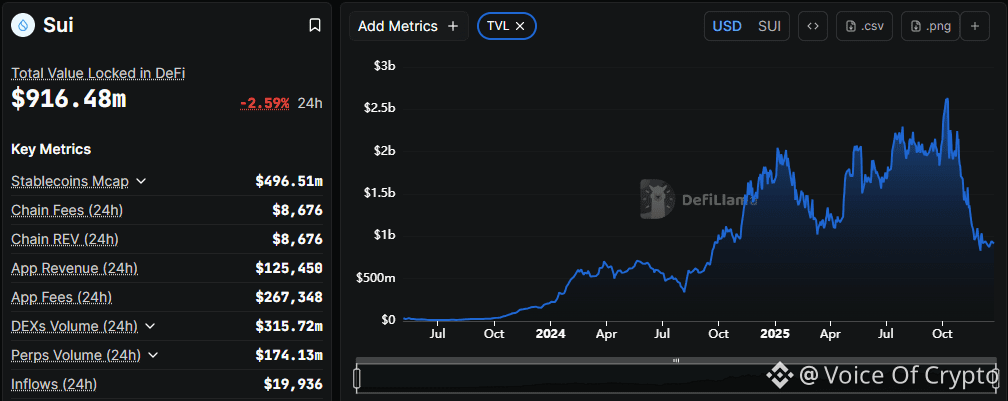

Sui

Sui entered the scene later than Ethereum or Solana, and growth has been fast.

The network uses the Move programming language and was designed by former Meta engineers. Its object-based system is different from account-based models, and this structure is perfect for complex apps.

Gaming and dynamic NFTs perform well on Sui, which means that objects can change state without heavy computation. This feature appeals to developers and are responsible for the network’s strong strong TVL.

Capital inflows into the Sui network increased lately, and its Total Value Locked rose past several Layer 2 networks. This trend indicates developer confidence and could translate into price movement.

Ondo Finance

Ondo Finance focuses on tokenized real-world assets. The project converts traditional instruments into blockchain tokens, and US Treasury Bills are part of its core offering.

These assets generate yield while remaining liquid, which means that crypto users can access them without banks.

Decentralized organizations value this feature, as treasury management benefits from predictable returns, and ondo supports this demand.

Institutional alignment also sets Ondo apart, as partnerships involve regulated custodians and issuers. This structure is very appealing to large firms entering crypto.

As interest rates change, on-chain yield grows more attractive, and ondo bridges traditional finance with decentralized systems.

Portfolio Balance Matters Beyond Bitcoin

In all, diversification is very important, and when choosing an investment strategy, investors should make sure that each asset serves a role.

Ethereum supports yield and settlement, while Solana handles speed and retail volume. Chainlink connects data, Sui offers growth, and Ondo links real assets.

Risk levels are also important to consider, as large-cap tokens bring stability and mid-cap options offer growth.

Overall, investors should note that this cycle is controlled mostly by institutional interest, and firms prefer assets with clear use cases.

Because of this, infrastructure now matters more than speculation.