🔸 Scenario 2 – Liquidity Sweep & Rejection (Technical short)

Required conditions:

Price sweeps 1.79–1.80

Appears: Volume spike, But weak candle close / rejection

OI: Rising faster than price, Or holding high despite price stalling

Logic:

Late longs get trapped

Short is not a trend reversal, but a pullback short within uptrend

Trade idea:

Entry: after 1H rejection candle

SL: above the high of rejection candle

TP:

TP1: 1.712

TP2: 1.652

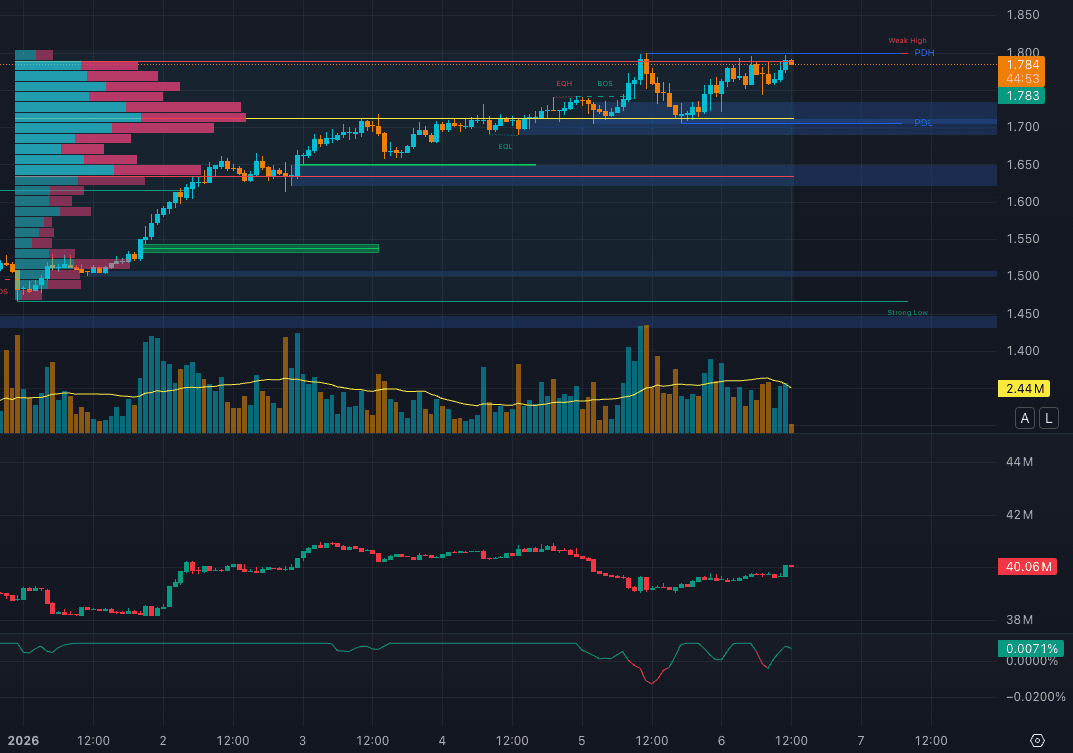

🔹 Market Structure

Primary structure:

HTF & 1H trend remains UP STRUCTURE

Clear bullish BOS previously occurred, breaking old highs and continuing to form valid Higher Highs and Higher Lows

Current status:

Price is sideways–compressing just below the Weak High / PDH zone

No bearish CHoCH or BOS on 1H yet

👉 Structure remains intact. This is consolidation below resistance, not a reversal.

🔹 Key Price Zones

Resistance / Supply: ~1.79 – 1.80 (weak highs, PDH, sell-side liquidity)

Mid / Magnet zone: ~1.69 - 1.71 (PDL, POC, Important Higher Low)

Support / Demand: ~1.61 – 1.65 (H1 demand + VAL)

Strong structural low: ~1.47 - 1.50

🔹 Volume & Volume Profile

Volume (Time-based)

Volume hasn't exploded as price approaches 1.79–1.80

Bullish candles: Medium bodies, No strong follow-through

Have not had: Sell climax, Panic selling

👉 This indicates: No strong distribution yet. Market is awaiting liquidity activation

Volume Profile

POC sits lower than current price

Price is currently above Value Area High and trading in premium zone

👉 Longing here doesn't offer attractive RR. But shorting also lacks clear edge without rejection.

🔹 OI & Funding Rate

Open Interest (OI)

OI moving sideways → slightly increasing

No strong short build-up during sideways movement, nor obvious long FOMO

👉 Meaning: Capital is waiting for a break. Neither side is all-in.

Funding Rate

Slight positive funding (~ +0.007%)

This level is not excessive, Not high enough to call longs overcrowded

👉 Current funding is NOT a signal to short against trend. However, if it continues rising while price doesn't → warning that market is in distribution phase.

🔹 Trade Scenarios

🔸 Scenario 1 – Break & Acceptance (Priority with trend)

Conditions:

1H close above 1.80

Volume expansion

OI rising with price

Logic:

Liquidity above Weak High gets swept

Capital accepts higher prices

Trade idea:

Entry: break and pullback to retest 1.78–1.79

SL: below 1.75

TP:

TP1: 1.85

TP2: 1.90+

🔸 Scenario 2 – Liquidity Sweep & Rejection (Technical short)

Required conditions:

Price sweeps 1.79–1.80

Appears: Volume spike, But weak candle close / rejection

OI: Rising faster than price, Or holding high despite price stalling

Logic:

Late longs get trapped

Short is not a trend reversal, but a pullback short within uptrend

Trade idea:

Entry: after 1H rejection candle

SL: above the high of rejection candle

TP:

TP1: 1.712

TP2: 1.652

In Short

1H structure remains bullish

Price compressing below Weak High → decision zone

Current situation:

Don't FOMO long

Don't blind short without rejection

👉 This is a "wait for confirmation" phase, not an aggressive entry phase.

#trading #TradingSignal #futures

✍️ Written by @CryptoTradeSmart

Crypto Insights | Trading Perspectives

⚠️ DISCLAIMER:

NOT financial advice. Perpetuals trading is high risk - you can lose your entire capital. This is my personal setup for educational purposes only. Always DYOR, use strict risk management, and never risk more than you can afford to lose. You are solely responsible for your decisions.

Trade safe! 🎯