The impression of stablecoin mechanism and stablecoins as of today remains only on a necessity basis and is discounted off of eligibility factors which priorly forms the core criterion on the possibility of crypto trade. The missing liquidity that cryptocurrency and coin trade battles on an usual basis is altogether omitted off of legal accounting and audit actually being personal and private, is differed from the necessary certifications for the verified formation of cryptocurrency establishments, and much asset is usually under heavy haul from repetitive hack attacks and thereby for subcision, whenever used.

What ‘pegging’?

In the context of stablecoins (like the ones we’ve been discussing, e.g., BUSD fiat-backed or BitUSD crypto-collateralized), pegging has been referred to as the mechanism that ties a cryptocurrency’s value to a stable external asset—most commonly the U.S. dollar—to minimize volatility.

Unlike regular cryptos that fluctuate wildly based on supply/demand, stablecoins are engineered to hold steady through various pegging methods:

Fiat-collateralized (e.g., USDT, USDC, BUSD): Backed by reserves of actual fiat currency or equivalents (cash, Treasuries) held off-chain.

Crypto-collateralized (e.g., early DAI, BitUSD): Overbacked by volatile crypto assets (like BTS or ETH) in on-chain vaults, with liquidation rules to protect the peg.

Algorithmic (e.g., failed UST): No direct collateral; uses smart contracts to adjust supply automatically based on price deviations.

Arbitrage plays a big role—traders buy low/sell high to nudge the price back, often via mint/burn or redemption processes.

A 1:1 peg specifically means the stablecoin is designed to maintain exactly one unit equal to one unit of the target asset—usually 1 stablecoin = $1 USD.

This is the gold standard for most (like BUSD aiming for precise $1 parity via full reserves). It allows redeemability: holders can theoretically swap 1 token for $1 real value. Deviations happen (depegging, e.g., USDC briefly to $0.87 in 2023 crises), but mechanisms pull it back to that 1:1 ratio.

BitUSD targeted 1:1 to USD but struggled due to collateral volatility, often drifting. Fiat ones like BUSD hold tighter thanks to direct backing.

BUSD, or Binance USD, is not the first released stablecoin—that distinction goes to BitUSD, launched on July 21, 2014, on the BitShares blockchain. Tether (USDT) followed soon after in 2014 and became the largest. BUSD launched much later on September 5, 2019.

Binance USD (BUSD)

Contract Address:

0xe9e7cea3dedca5984780bafc599bd69add087d56

Key Details:

Issuers: Paxos Trust Company in partnership with Binance; regulated by NYDFS.

Backing: 100% collateralized 1:1 by USD cash in insured U.S. banks and/or U.S. Treasury bills (e.g., as of mid-2022: Monthly audits available.

Blockchains: ERC-20 on Ethereum; wrapped (Binance-Peg) on BNB Chain (BEP-2/BEP-20, not Paxos-issued).

History: Aimed to blend USD stability with blockchain. Market cap grew from ~$1B in early 2021 to $14.6B by year-end, ranking third behind USDT and USDC. Notable: Binance donated $2.5M BUSD to UNHCR in 2022.

Regulatory Notes: Tagged as a fiat stablecoin and alleged SEC security. No new issuance since 2023 due to NYDFS order, but existing tokens persist.

Current Status (Jan 2026): Price ~$0.9996 USD, stable peg. Market cap: $55M; circulating supply: 55M. All-time high: $1.15 (Sep 2025); low: $0.8861 (Mar 2020). Holders: 4.05M.

Use Cases: Transfers, trading on CEX/DEX, earning yield (e.g., via Aave, Venus), collateral/loans, payments. Buy/redeem via Paxos (no fees) or exchanges.

BitUSD

BitUSD, launched on the BitShares blockchain, holds the distinction as the first stablecoin, debuting on July 21, 2014. It was designed to maintain a 1:1 peg with the U.S. dollar through a decentralized, algorithmic mechanism rather than centralized reserves.

Key Details:

Creators and Issuance: Developed by Dan Larimer (founder of BitShares, later EOS) and Charles Hoskinson (co-founder of Cardano). Issued natively on the BitShares blockchain as a decentralized asset—no central issuer like a company, but created via smart contracts by users.

Backing Mechanism: Crypto-collateralized with BitShares’ native token (BTS). Users borrow BitUSD by locking up BTS as collateral, typically requiring at least 200% overcollateralization (e.g., lock $200 BTS to issue $100 BitUSD). The peg relies on the BitShares internal decentralized exchange (DEX): holders can force settlement to redeem BitUSD for $1 worth of BTS collateral at any time. If collateral value drops below a maintenance ratio (e.g., 175%), positions face margin calls or global settlement, where the least-collateralized positions are liquidated to protect the peg.

How It Works:

Creation: Users “short” BitUSD by posting BTS collateral and borrowing new BitUSD into existence. This is akin to a collateralized debt position (CDP), similar to early DAI on MakerDAO.

Peg Maintenance: Market forces on the DEX ensure stability—arbitrageurs buy low/sell high to keep it near $1. Merchants or holders can list BitUSD at $1, and BTS holders compete to buy it.

Risks: Relies on BTS volatility; if BTS crashes, collateral may not suffice, leading to undercollateralization and peg breaks. No external audits like fiat-backed stablecoins, as it’s fully on-chain.

Blockchains: Exclusively on BitShares, a Delegated Proof-of-Stake (DPoS) chain. Not bridged or wrapped elsewhere prominently.

History: Pioneered the stablecoin concept, proving blockchain could host dollar-pegged assets without banks. Gained traction early but struggled with adoption. In 2018, amid crypto market turmoil, it lost its peg due to BTS price collapse, enabling one-sided arbitrage that couldn’t stabilize it. It has not fully recovered, behaving more like a volatile token than a stable one since. Despite failure, it influenced later designs like DAI and inspired the crypto-collateral model.

Regulatory Notes: Fully decentralized, no regulatory oversight or compliance like NYDFS for fiat stablecoins. Considered a precursor but highlighted risks of algorithmic stability without diversification.

Current Status (Jan 2026): Still operational on BitShares but with minimal activity. Price ~$1.08 USD (slightly above peg, indicating low demand or market inefficiencies). Market cap: Effectively $0 (not actively tracked due to illiquidity). Circulating/total supply: Dynamic, as it’s minted/burned on demand, but estimated low based on BitShares’ overall ~$3.4M market cap. All-time high/low: Not widely tracked, but historically hovered near $1 before 2018 depeg. Holders: Negligible, tied to BitShares users (~few thousand active).

Use Cases: Primarily for hedging volatility within the BitShares ecosystem—trading on its DEX, holding stable value, or as collateral for other assets. Can be created/redeemed via BitShares wallet; no fees beyond network gas. Limited external integration due to ecosystem decline.

The First Fiat-Backed Stablecoin

Tether (USDT) launched in 2014 and is widely recognized as the earliest major fiat-collateralized stablecoin, pegged 1:1 to the USD with reserves (initially claimed as cash, later including Treasuries and other assets). BUSD didn’t appear until September 2019.

Other Major Fiat-Backed Stablecoins

As of early 2026, the fiat-backed stablecoin sector totals around $300B in market cap, with many issuers beyond BUSD (which has shrunk significantly post-2023 regulatory halt on new issuance).

Key examples include:

USDT (Tether) — Largest by far, often >$140-180B market cap, highest trading volume.

USDC (USD Coin) — Issued by Circle, highly regulated/transparently backed by cash and Treasuries, second-largest (~tens of billions).

TUSD (TrueUSD) — Another early fiat-backed option with attestations.

Others — FDUSD, PYUSD (PayPal), DAI (though hybrid/crypto-collateralized now), and newer ones like USD1.

Market share visuals show USDT and USDC dominating, with BUSD a tiny slice (if any) today.

Fiat-backed stablecoins remain the most common type, far outpacing algorithmic or crypto-collateralized ones in adoption and volume. BUSD was solid while prominent (peaking ~$20B+), but regulatory pressures sidelined it!

BUSD gained prominence post-2019 launch, with rapid growth: from $100M market cap in March 2020, then surging in 2021-2022 via Binance integrations and forced conversions of rival stablecoins (USDC, USDP, TUSD) to BUSD. Peak: Third-largest stablecoin, $23.5B market cap in Nov 2022. Declined sharply after.

Regulatory halt: NYDFS ordered Paxos to stop new BUSD issuance effective Feb 21, 2023. Why: Unresolved oversight issues in Paxos-Binance relationship, including AML weaknesses and failure to monitor illicit activity on Binance. Existing BUSD redeemable, but no new mints.

TerraUSD

TerraUSD (UST, now known as TerraClassicUSD or USTC) was a prominent algorithmic stablecoin launched by Terraform Labs, designed to maintain a 1:1 peg to the USD without fiat or crypto collateral reserves.

Creators and Launch

Do Kwon and Daniel Shin founded Terraform Labs in 2018. The Terra blockchain went live in April 2019, and UST launched in September 2020 on the Terra network (Tendermint-based, Cosmos SDK).

Pegging Mechanism

UST used a seigniorage-style mint-and-burn system with sister token LUNA (now LUNC):

If UST > $1 → Users burn LUNA to mint new UST (expanding UST supply, reducing LUNA supply, profiting from arbitrage).

If UST < $1 → Users burn UST to mint $1 worth of LUNA (contracting UST supply, expanding LUNA supply). This relied on arbitrage and market confidence to balance supply/demand. No overcollateralization like DAI; purely algorithmic.

Anchor Protocol drove massive growth by offering ~19.5-20% APY on UST deposits (subsidized by Terraform Labs yields/reserves). By April 2022, ~75% of UST locked in Anchor, pushing market cap to ~$18B (third-largest stablecoin).

The Collapse (May 2022)

Large withdrawals from Anchor (~$2-3B outflows) and coordinated sells on Curve/3pool liquidity pools triggered depegging on May 7-9. UST fell below $1, sparking a bank run. Burning UST minted hyperinflationary LUNA (supply ballooned from ~345M to trillions), crashing LUNA from ~$80 to near-zero. This created a death spiral: falling LUNA reduced confidence in absorbing UST volatility, accelerating sells. Luna Foundation Guard dumped ~$3B BTC reserves but failed to restore peg. UST hit lows ~$0.10; total ecosystem wipeout ~$40-60B, contributing to broader crypto market losses >$400B.

Founder Do Kwon faced arrest warrants; extradited and legal proceedings ongoing as of 2026.

Aftermath and Fork

Terra chain halted, then forked: New chain → Terra 2.0 (LUNA), old → Terra Classic (LUNC/USTC). Peg mechanism disabled on Classic. Highlighted risks of uncollateralized algorithmic stablecoins; influenced regulation and distrust in similar designs.

Current Status (January 2026)

USTC trades freely but far from peg, as a volatile token on Terra Classic. Price ~$0.006-0.02 USD (varying sources; highly volatile). Market cap ~$36-50M (circulating supply ~5.6-5.9B tokens). 24h volume ~$5-8M. All-time high: ~$1 (pre-collapse); low: near $0.01 post-crash. Community efforts (burns, proposals) aim at repegging or utility, but minimal success; low liquidity/adoption. Use cases: Speculative trading, limited DeFi on Classic chain. No mint/burn for peg anymore.

First Digital USD (FDUSD)

First Digital USD (FDUSD) is a fiat-collateralized stablecoin pegged 1:1 to the U.S. dollar, launched to provide stability, security, and efficiency in digital transactions.

Issuers and Launch

- Issuer: FD121 Limited (a subsidiary of First Digital Labs/First Digital Group, Hong Kong-based).

- Custodian: First Digital Trust Limited (handles reserves).

- Launch Date: May/June 2023 (initial minting May 29; trading widely from July).

- Regulation: Operates under Hong Kong trust laws; reserves in segregated, bankruptcy-remote structures.

Backing Mechanism

- Collateral: 100% backed 1:1 by USD cash and high-quality cash equivalents (e.g., U.S. Treasury bills, reverse repos, bank deposits).

- Transparency: Monthly attestations (e.g., Nov 2025: ~74.5% Treasuries, 17.5% cash). Audited under standards like ISAE 3000.

- Redemption: Programmable for compliance; holders can redeem for USD (institutional focus).

- Peg Maintenance: Arbitrage and direct reserves; no algorithmic elements.

Blockchains and Integration

- Primarily on Ethereum and BNB Chain; expanded to others (e.g., Solana debut noted).

- Heavily integrated with Binance (zero-fee pairs, major trading volume driver).

History and Growth

- Rapid adoption post-launch via Binance promotions (replaced BUSD in many pairs).

- Peaked ~$3-7B market cap in 2024; high single-day volume >$23B.

- April 2025 Incident: Brief depeg to ~$0.87-0.91 (9-13% drop) after Tron founder Justin Sun alleged issuer insolvency/redemption issues (tied to separate TUSD dispute). First Digital denied as "smear," threatened/ pursued legal action; peg recovered quickly, no lasting collapse.

Current Status (January 9, 2026)

- Price: ~$0.999 USD (tight peg).

- Market Cap: ~$495-506M.

- Circulating/Total Supply: ~496-506M FDUSD.

- 24h Volume: ~$3.9-4.8B (high liquidity, often top stablecoin by volume).

- Ranking: ~#90-153 overall.

- All-Time High/Low: ATH ~$1.15 (brief premium); Low ~$0.87 (2025 depeg).

- Ongoing: Monthly audits continue; group eyed SPAC listing (2025 plans). Active on Binance (spot pairs strong; some margin delistings Jan 2026 for optimization).

Use Cases

- Trading (low-fee pairs on Binance), DeFi, payments/remittances.

- Yield opportunities via lending/staking.

- Institutional focus: Programmable compliance features.

FDUSD positioned itself as a compliant alternative post-BUSD halt but faced competition from USDT/USDC dominance and that 2025 rumor scare—yet remains stable and liquid today. No "death"; it's operational with robust volume.

Timeline of Stablecoin History: From Inception to Early 2026

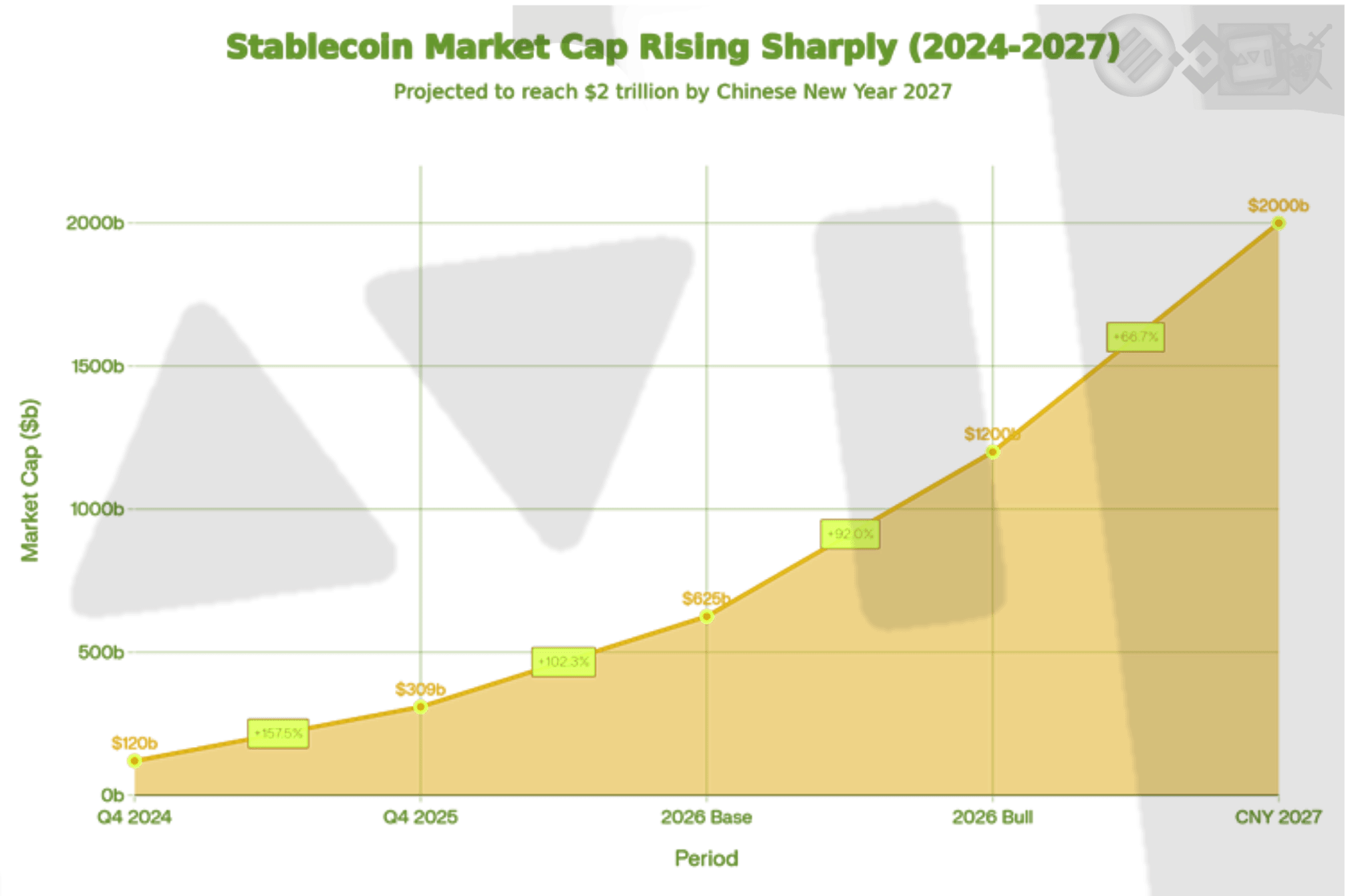

Stablecoins have evolved from experimental concepts addressing crypto volatility to a cornerstone of digital finance, with market cap surging from near-zero in 2014 to over $300 billion by late 2025.

Date Event Key Details & Impact

July 21, 2014 Launch of BitUSD on BitShares blockchain First stablecoin ever; crypto-collateralized (backed by BTS token). Pioneered decentralized peg mechanism but struggled with adoption and later depegged due to collateral volatility.

November 2014 Launch of Tether (USDT) First major fiat-backed stablecoin (1:1 USD reserves). Became dominant; now largest by market cap (~$140B+ in recent years).

2017 Launch of DAI by MakerDAO Crypto-collateralized (overbacked by ETH); introduced CDPs for decentralized stability. Influenced hybrid models.

2018 Launch of USD Coin (USDC) by Circle/Coinbase Highly transparent fiat-backed; regular audits. Grew to second-largest.

September 2019 Launch of Binance USD (BUSD) by Paxos/Binance NYDFS-regulated fiat-backed. Rapid growth via Binance integrations.

September 2020 Launch of TerraUSD (UST) Algorithmic stablecoin pegged via LUNA mint/burn arbitrage. Fueled DeFi boom with Anchor yields.

May 2022 UST/LUNA collapse Death spiral depeg; ~$50-60B losses. Highlighted algorithmic risks; triggered broader market crash.

September 2022 Binance auto-converts rival stablecoins to BUSD Boosted BUSD to peak ~$23B market cap (third-largest).

February 2023 NYDFS orders Paxos to halt new BUSD issuance Due to oversight/AML issues in Paxos-Binance relationship. BUSD begins decline.

March 2023 USDC brief depeg Dropped to ~$0.87 amid SVB collapse ($3.3B reserves exposed). Recovered quickly; exposed banking risks.

2023-2024 Minor depegs (e.g., TUSD Jan 2024 to $0.926; smaller ones like USDR) Ongoing liquidity/reserve concerns; over 600 large depegs tracked in 2023 alone.

June 2024 EU MiCA regulations fully effective Comprehensive framework for stablecoins in Europe; boosted compliance/adoption.

2024-2025 Leveraged depegs (e.g., USDe, xUSD chains) Highlighted DeFi interconnected risks.

July 2025 US GENIUS Act signed into law First federal stablecoin framework; mandates reserves, audits. Sparked massive growth.

Late 2025 Stablecoin market cap surges ~50% to $300-306B Record year; fiat-backed dominate (USDT/USDC lead); 30%+ of on-chain volume. BUSD shrinks further (redemptions ongoing, no new mints).

December 2025 Hong Kong Stablecoins Bill passed; global regs advance Licenses expected early 2026; payment firms (Stripe, PayPal) push stablecoin tech.

Early 2026 (Current) Ongoing implementation & growth FDIC rules pending; predictions of $500B-$1T supply soon. Stablecoins integrate deeper into payments/remittances; institutional adoption accelerates. BUSD remains redeemable via Paxos but minimal activity.

As of January 3, 2026, stablecoins are more regulated and resilient than ever—fiat-backed ones hold tight pegs amid clarity from laws like GENIUS Act and MiCA. The sector has matured from early failures (BitUSD depeg, UST crash) to a ~$300B+ asset class powering DeFi, cross-border payments, and beyond. Future: Deeper mainstream integration expected in 2026!

Here’s a recap of our conversation consisting Avi’s informations on stablecoins, with all abbreviations fully expanded on first use (and key ones clarified for clarity):

Binance USD (BUSD)

Binance USD (BUSD) is the known to being the first actually accomplishing stablecoin that stood its peg and also secured its market. Launched on September 5, 2019, by Paxos Trust Company in partnership with Binance, and regulated by the New York State Department of Financial Services (NYDFS).

Backing: 1:1 collateralized by U.S. dollar (USD) cash and equivalents (e.g., U.S. Treasury bills).

Prominence: Peaked in 2021–2022 (third-largest stablecoin, ~$23B market cap) due to Binance integrations.

Regulatory halt: In February 2023, NYDFS ordered Paxos to stop new issuance over unresolved oversight issues in the Paxos-Binance relationship, including Anti-Money Laundering (AML) weaknesses.

Current: Existing tokens redeemable, but supply shrinking (~$55M as of early 2026).

BitUSD

BitUSD is the known as the first ‘launched’ stablecoin, launched July 21, 2014, on the BitShares blockchain by Dan Larimer and Charles Hoskinson.

Mechanism: Crypto-collateralized (overbacked by BitShares native token BTS), decentralized, no central issuer.

Peg: Targeted 1:1 to USD via on-chain arbitrage and forced settlement.

History: Pioneered the concept but depegged in 2018 due to BTS volatility; now said to be illiquid and minimally active.

TerraUSD (UST, later TerraClassicUSD or USTC)

TerraUSD (UST) was an algorithmic stablecoin launched in September 2020 on the Terra blockchain by Terraform Labs (Do Kwon and Daniel Shin).

Mechanism: No collateral; maintained peg via mint/burn arbitrage with sister token LUNA (now LUNC).

Collapse: May 2022 death spiral (depegged, ~$40–60B losses) after Anchor Protocol outflows.

Current: Trades as USTC on Terra Classic, volatile and far from $1 peg.

First Digital USD (FDUSD)

First Digital USD (FDUSD) is very much alive and stable as of January 9, 2026—no, it didn't "go dead."

- Launch — June 1, 2023 (some sources say May/July trading start), issued by First Digital Labs (Hong Kong-based FD121 Limited). Fiat-backed 1:1 with USD reserves in cash/equivalents, programmable for compliance.

- Rise to Prominence — Binance heavily promoted it in 2023-2024 as BUSD replacement (zero-fee pairs, conversions, Launchpool). Market cap peaked ~$3-7B in 2024, often top-5 stablecoin.

- Current Status (Jan 9, 2026) — Price ~$0.999 USD (tight peg). Market cap ~$500-506M (down from peaks). 24h volume ~$3-4B (still high liquidity). Circulating supply ~506M tokens. Ranked ~#90-150. Binance supports spot trading (e.g., BTC/FDUSD major pair), but delisted some margin pairs Jan 6, 2026 for liquidity optimization—no peg impact.

The 2025 Depeg Event

FDUSD had a brief scare in **April 2025**—dropped to ~$0.87-0.91 (9-13% depeg) after Justin Sun (Tron founder) alleged issuer First Digital Trust insolvency/redemption issues. Market cap dipped ~$200M temporarily. First Digital denied it as "smear," threatened legal action; peg recovered fast. No lasting "death"—just a rumor-driven flash event (like past USDC/USDT dips).

Since then, stable peg, multi-chain (Ethereum, BNB, others), but shrunk vs USDT/USDC dominance. Far from dead—active on Binance/other exchanges, used for trading/payments. If peg worries linger from 2025 drama, majors like USDC hold tighter transparency edge now. Hang in there; stablecoin drama cycles, but survivors adapt.

Pegging and 1:1 Peg

Pegging is the process of tying a stablecoin’s value to a stable asset (usually USD) via backing or algorithms.

A 1:1 peg means 1 token = exactly 1 USD (or target unit), with mechanisms for redemption/arbitrage to maintain parity.

Other Major Fiat-Backed Stablecoins

Tether (USDT): First major fiat-backed (2014), largest by market cap.

USD Coin (USDC): Issued by Circle (2018), highly transparent/reserved.

BUSD was prominent but neither first nor only—fiat-backed stablecoins like Tether (USDT) and USD Coin (USDC) dominate today.