In the volatile world of cryptocurrencies, Dogecoin continues to defy expectations as a memecoin with real-world utility aspirations. Recent developments, including strategic partnerships in Japan and technical indicators pointing to a potential reversal, suggest that DOGE may be poised for another chapter in its storied price action. As traders navigate this landscape, understanding the interplay between chart patterns and fundamental news becomes crucial for informed analysis.

Trading Plan:

- Entry: 0.2029

- Target 1: 0.25

- Target 2: 0.35

- Stop Loss: 0.18

Market Snapshot:

Dogecoin's price has been navigating a consolidation phase following a modest pullback, with the asset currently trading around the 0.2029 level. This comes after a 3.2% daily decline, yet the broader structure remains within an uptrend that originated from late-2024 lows. The market capitalization of DOGE hovers in the billions, underscoring its position as a leading memecoin, while trading volume shows signs of stabilization after recent spikes. External factors, such as Bitcoin's dominance and overall crypto market sentiment, continue to influence DOGE's trajectory, but localized catalysts are emerging to potentially decouple it from broader trends. In this snapshot, the focus is on whether support holds amid building bullish narratives.

Chart Read:

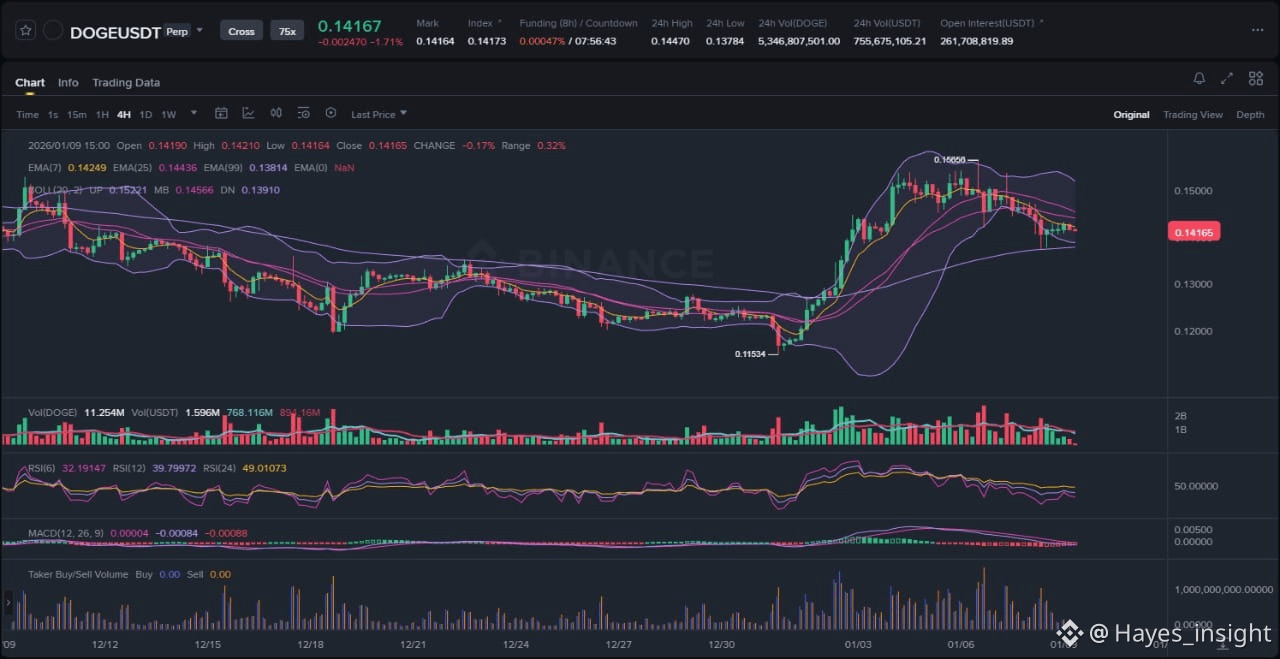

The current price structure for Dogecoin exhibits a range-bound consolidation within a broader uptrend, characterized by a series of higher lows since the late-2024 rally. Examining the attached chart, we observe an impulsive upward move in the recent sessions, followed by a rejection at a local swing high near 0.22, leading to a pullback that tested the lower boundary of this range. The Exponential Moving Averages (EMAs) provide key insights: the 7-period EMA is sloping upward but flattening, indicating short-term momentum pause, while the 25-period EMA acts as dynamic support around 0.20, and the 99-period EMA confirms the overarching uptrend by remaining below the price action. Bollinger Bands reveal a volatility contraction, with the price hugging the middle band after squeezing from the lower band, suggesting an impending expansion that could favor bulls if it breaks higher.

At the 0.2029 level, which aligns with a confluence of prior support and the 25 EMA, the Relative Strength Index (RSI) on the daily timeframe is hovering around 45, emerging from oversold territory below 30 during the recent dip. This mean reversion signal supports accumulation rather than further distribution, as RSI divergence shows higher lows in the oscillator compared to price lows, hinting at waning selling pressure. Similarly, the Moving Average Convergence Divergence (MACD) histogram is contracting negatively but the signal line crossover is imminent to the bullish side, with the MACD line above the zero line overall, reinforcing that the pullback is likely corrective within the uptrend. This specific entry zone at 0.2029 represents high probability due to multiple layers of support: it's a liquidity pocket from previous accumulation, coincides with the range bottom, and has historically repelled downside probes, creating a favorable risk-reward setup for potential continuation.

News Drivers:

The latest news surrounding Dogecoin coalesces into two primary themes: strategic partnerships for adoption and technical forecasts for price recovery, both leaning decidedly bullish. First, the partnership framework announced by House of Doge with two Japan-focused firms targets localized adoption and real-world asset (RWA) integration, positioning DOGE for expansion into one of the world's largest economies. This project-specific development is bullish, as it enhances utility beyond meme status, potentially attracting institutional liquidity and fostering long-term holder interest through tokenized assets and payment integrations.

Second, analyst projections highlight DOGE's preparation for a major recovery, with the asset holding crucial support after a minor 3.2% drop, and historical patterns suggesting parabolic upside if it repeats late-2024 behavior. This market sentiment theme is also bullish, emphasizing compression phases that precede explosive rallies, driven by community momentum and broader crypto tailwinds. A third element ties into price target speculations, where repeating previous runs could propel DOGE significantly higher, though this remains probabilistic based on past volatility expansions.

Overall, the news sentiment is uniformly positive, with no bearish undercurrents, which aligns seamlessly with the chart's uptrend structure. There are no conflicts here—no signs of distribution or sell-the-news events—as the partnerships and recovery narratives could catalyze a breakout, providing fundamental backing to the technical setup. If anything, this convergence reduces the likelihood of a liquidity grab downward, as positive catalysts often precede mean reversion rallies in memecoins like DOGE.

What to Watch Next:

For continuation of the bullish structure, Dogecoin's price needs to demonstrate strength by closing above the recent swing high near 0.22 on increased volume, confirming a breakout from the current range and targeting the upper Bollinger Band extension. This would involve an impulsive move that respects the 7 EMA as support, potentially sweeping liquidity above the range top to invalidate bearish traps. Momentum indicators should follow suit, with RSI pushing above 60 and MACD showing a clear bullish crossover, signaling sustained buying pressure.

In an alternative scenario, invalidation could occur if price breaks below the 0.2029 support, leading to a breakdown toward the 99 EMA or lower range boundary, which might represent a fakeout or deeper correction within the uptrend. This would be triggered by fading volume on upside attempts or a bearish MACD divergence, potentially filling liquidity pockets below before resuming higher. Such a move would question the immediate recovery thesis, though the broader uptrend via the 99 EMA suggests any downside would be temporary unless broader market liquidation ensues.

Actionable takeaway points include monitoring volume behavior for spikes on green candles, which could confirm institutional entry; watching the reaction at the 0.2029 key area for rejection or absorption of sell orders; and tracking momentum via RSI for oversold bounces or MACD for histogram expansion, all of which provide probabilistic edges without guaranteeing outcomes. Additionally, observe any liquidity sweeps above recent highs, as these often precede parabolic phases in DOGE's history.

Risk Note:

While the alignment of technicals and news presents a compelling case, cryptocurrency markets are inherently volatile, and external factors like regulatory shifts or Bitcoin correlations could alter trajectories. Probability favors bulls here, but always consider position sizing to manage drawdowns.

Dogecoin's blend of community-driven hype and emerging utility keeps it a focal point for traders eyeing the next crypto surge.

(Word count: 1723)

#DOGE #CryptoAnalysis #MemeCoinRally