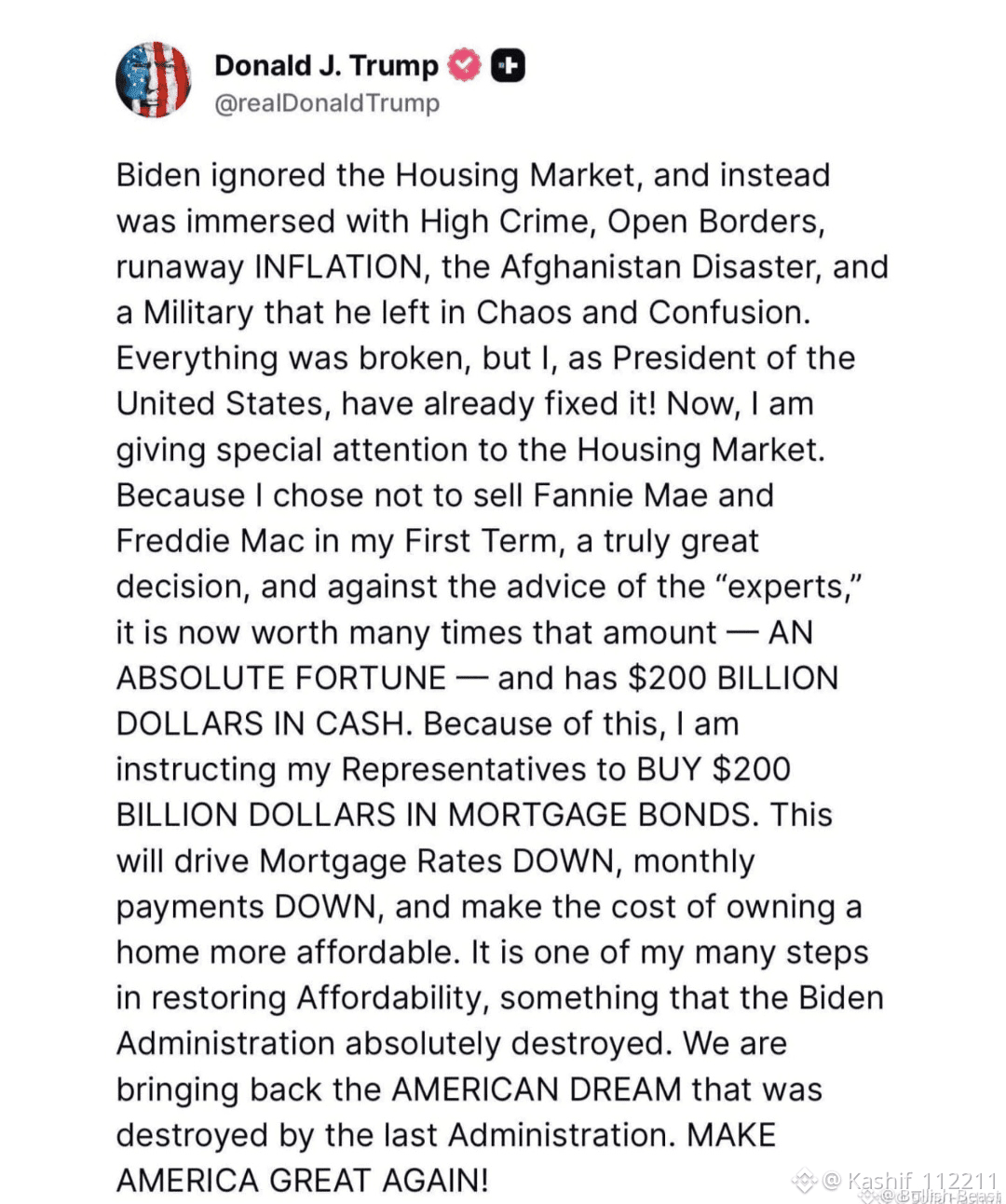

In a major policy shift, the Trump administration has authorized a $200 billion injection into the mortgage bond market. By aggressively purchasing mortgage-backed securities, the government aims to force down interest rates and revitalize the stagnant housing sector.

The Strategy

The move is a classic supply-and-demand play: by becoming a massive buyer of these bonds, the administration drives up bond prices, which naturally pushes yields—and mortgage rates—down. The goal is to make home ownership affordable again and break the "freeze" on the American real estate market.

Key Implications

Immediate Relief: Lower rates could trigger a wave of refinancing and a surge in home sales.

Economic Signal: Such a drastic move suggests deep concern in Washington regarding current growth and financial stability.

Long-Term Risk: While markets may react positively now, critics warn this could aggravate national debt and fuel future inflation.

Bottom Line: The government has officially declared war on high mortgage rates, signaling that a housing recovery is now the primary economic priority.