W

ich Strategy Truly Fits You?

ich Strategy Truly Fits You?

Choosing between scalping and swing trading isn’t about which strategy makes more money—it’s about alignment. Your personality, available time, and risk tolerance matter more than any indicator. Both strategies are widely used on Binance, and both can be highly profitable when executed with discipline and structure.

The real difference lies in trade duration, decision speed, and risk management.

⚡ Scalping: Speed, Precision, Discipline

Scalping focuses on capturing small price movements over very short timeframes—sometimes minutes, sometimes seconds. Scalpers thrive on liquidity, tight spreads, and fast execution.

On Binance, high-volume pairs like BTC/USDT and ETH/USDT are preferred because they allow quick entries and exits with minimal slippage.

🔹 Key traits of scalping:

High trade frequency

Tight stop-losses

Small but consistent profits

Requires constant screen time

This style demands sharp focus and emotional control. One slow decision or ignored stop-loss can quickly erase multiple winning trades.

📈 Swing Trading: Patience Meets Structure

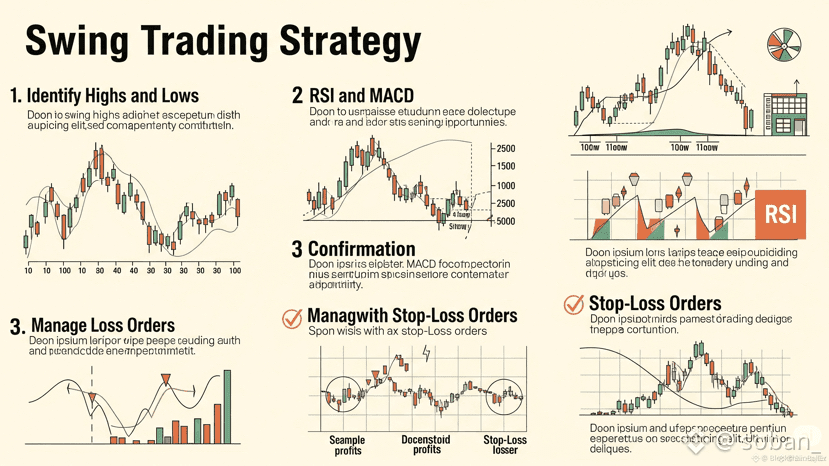

Swing trading targets larger price movements over days or even weeks. Instead of reacting to every candle, swing traders analyze market structure, trend direction, and key support & resistance levels.

Trades are fewer, but each setup carries higher conviction.

🔹 Key traits of swing trading:

Lower trade frequency

Wider stop-losses

Higher reward-to-risk ratios

Minimal screen time

This approach rewards patience and discipline, allowing trades to mature while ignoring short-term noise.

🛡️ Risk Management: Small Wins vs Big Moves

Risk management is where these strategies truly diverge:

Scalpers rely on many small trades, tight stops, and consistency

Swing traders accept wider stops but aim for bigger winners, letting profits run

Both approaches work—if risk is controlled.

🧠 Psychology: The Hidden Edge

Trading success is deeply psychological.

🔥 Scalping can be mentally exhausting, especially during high volatility. Decisions are fast, emotions spike quickly, and fatigue is real.

🌊 Swing trading is calmer but tests patience—sitting through pullbacks without panic is a skill in itself.

Knowing which pressure you handle better is crucial.

🌐 Market Conditions Matter

No strategy works in all environments:

✅ Scalping performs best in high-liquidity, range-bound, or moderately volatile markets

✅ Swing trading shines during clear trends with strong momentum

Forcing the wrong strategy into the wrong market often leads to losses.

🔄 Hybrid Traders: Best of Both Worlds?

Many experienced Binance traders use a hybrid approach—scalping short-term moves while holding swing positions aligned with the higher-timeframe trend.

⚠️ This only works when rules are clearly defined and discipline is maintained.

🏁 Final Thoughts

Success in trading doesn’t come from trading more—it comes from trading consistently.

Whether you scalp or swing trade:

Master one strategy first

Build confidence and discipline

Stay aligned with your mindset

On Binance, the best strategy is the one that keeps you focused, controlled, and profitable over the long